Renting versus buying – many young professionals face making this decision early on as they begin their first major job in a large city like Toronto. Purchasing a condo or house is one of the biggest decisions anyone can make in their life, and it’s both exciting and scary at the same time.

Renting may seem like the obvious option as your entryway into real estate – but many get stuck in thinking that they will ever only be able to rent. Saving for a down payment can seem overwhelming. Taking the time to move, selecting a neighbourhood or condo building and making this major life decision are no small task. But there are many advantages to home ownership that can be realized both quickly and in the long run.

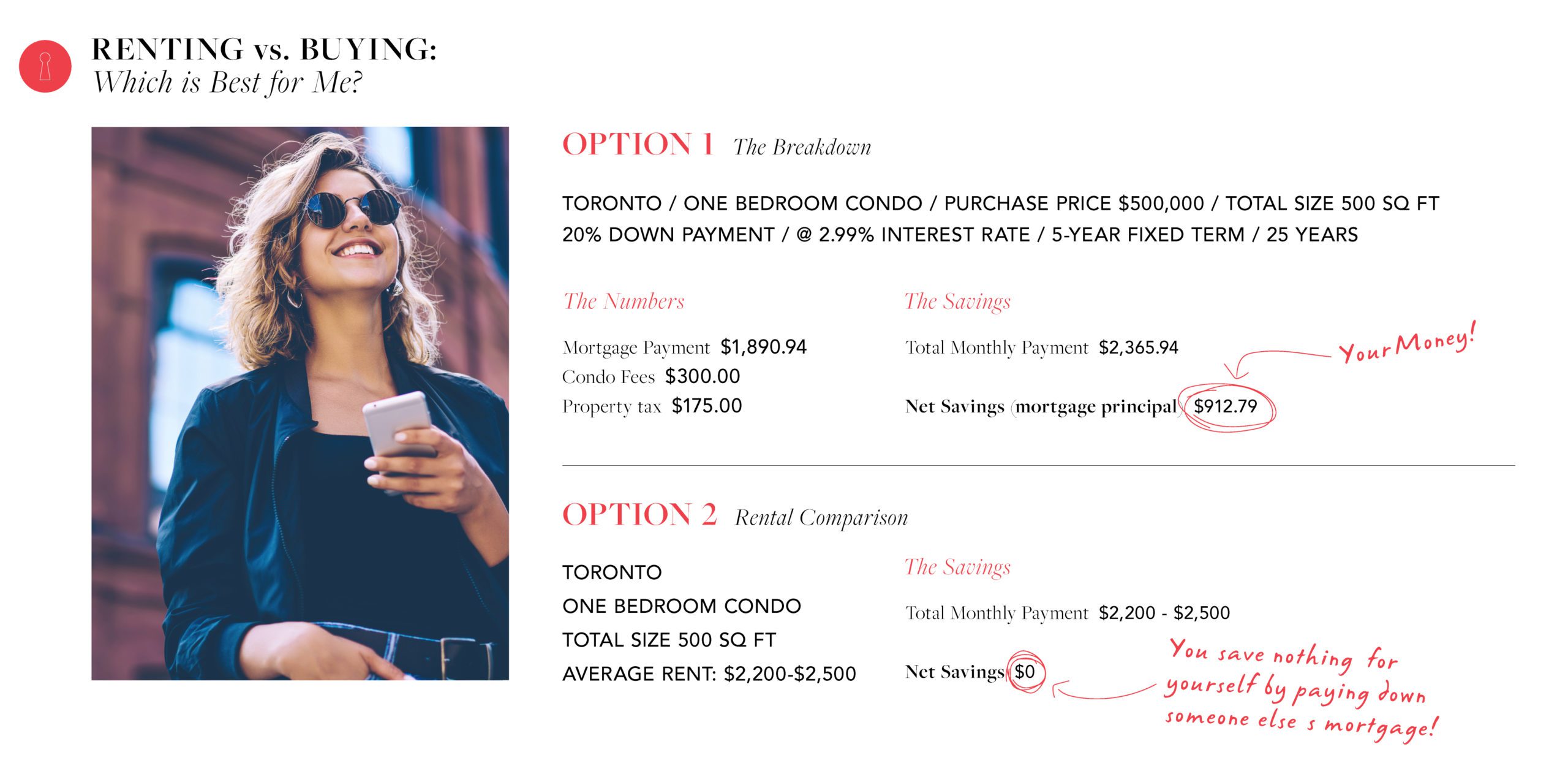

Renting versus Buying: The Numbers

Let’s get right to it. What’s the real difference between renting and owning on a monthly basis? This is one of the top questions we get asked by many first-time-buyers who are currently renting in Toronto. We wanted to share a quick analysis that we’ve put together to show you how comparable renting is to owning on a monthly basis.

Toronto One-Bedroom Condo Purchase Price (500 sqft)

with 20% down payment at 2.99% interest rate,

5-year term & 25-year amortization. $500,000

Mortgage Payment $1,890.94

Condo Fees $300.00

Property tax $175.00

Of this monthly payment of $2,365.94, you actually are putting $912.79 towards your principal mortgage payment (condo fees and property tax don’t go towards your own personal saving). What this means is you’re “saving” nearly $1,000.00/month as this money is going towards paying down your mortgage – it’s YOUR money.

When you sell and move into a bigger place, you’ll have all of this money saved as equity in your condo, PLUS the appreciation in value of your condo.

If you were to compare this to a rental, here’s what the numbers look like:

Average price of a one-bedroom, 500 square-foot condo in the general downtown Toronto area is approximately anywhere between $2200.00 and $2500.00 / month.

This may be slightly less than a mortgage payment, but you’re essentially throwing away any savings you could be putting towards your own mortgage / bank account. You’re spending your rent and not getting anything back. No appreciation in value and no savings by way of paying down your mortgage.

Down Payments

One of the things we’ve not gone into great detail about is the dreaded down payment required to purchase your first condo or house. This is usually the biggest hurdle renters and first-time-buyers face when considering the move to homeownership.

We wrote an in-depth blog post about saving for a down payment but doing this is the single most important thing to start thinking of now, if you want to buy your own condo or house. There are creative ways to start saving for a down payment – borrowing from family, taking on a side hustle or simply cracking down on weekly savings.

You can even think about buying a pre-construction condo with a friend and split the profits, so you can each buy your own home later on.

Things to Consider When Buying A Condo or House

Before you sign on the dotted line of your first purchase, make sure you do all of the necessary research. One of the biggest considerations is where to buy. Are you and East end or West end type of person. Do you want to be in the middle of the action like in King West, or do you prefer more of a community-feel like in Leslieville?

Choosing the right neighbourhood or condo building requires a lot of research. When you’re renting, it’s fairly simple to move once your lease is up if you don’t like your building or neighbourhood. Perhaps the type of neighbours in your condo building have changed, or your neighbourhood is undergoing some long-term construction.

When buying, spend a great deal of time looking into different areas of the city. Ask your realtor about upcoming projects in your top two neighbourhoods, and what the property values have looked like over the past couple of years.

Financial Success Through Real Estate

We’ve said it over and over again but getting into real estate through ownership early is the single most important thing you can do to set yourself up for future financial success. So if you’re debating between renting versus buying, owning your own condo or house, regardless of how small, is the first stepping stone to owning a bigger condo or house in the near future.

Think about savings and appreciation over three years. If you start ownership in your early 20’s, sell and buy again two more times, by your mid-30’s you’ll be living in a house on your favourite street, or a large condo in your favourite neighbourhood. So start now. Trust us.

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.