The December 2021 Toronto Real Estate numbers came in just as we thought they would. When looking at the month-over-month numbers, December showed that Detached homes were down, semi and row homes were down and condo numbers were down. Expected? Yes. Surprising? No. Let’s take a look at why.

December 2021 Toronto Real Estate Numbers: Detached Homes

I’ve said this before and I’m going to double down on this statement again after looking at the December numbers. One of the biggest drivers of the near-historical highs of the average selling price of detached homes is due to the trading in the luxury market. The number of luxury homes bought and sold in 2021 is astronomical and this is what’s making those numbers skyrocket. It’s not typical, but it was definitely the trend in 2021.

I’ve said this before and I’m going to double down on this statement again after looking at the December numbers. One of the biggest drivers of the near-historical highs of the average selling price of detached homes is due to the trading in the luxury market. The number of luxury homes bought and sold in 2021 is astronomical and this is what’s making those numbers skyrocket. It’s not typical, but it was definitely the trend in 2021.

Historically, December, January, and August are the slowest times of the year for detached home sales. In December, it’s impossible to entertain, decorate for the holidays and keep your family in the festive spirit when you have showings and the house needs to look immaculate for buyers. Many families leave for warmer climates and put off selling to the late winter or spring market. So all around, it’s just a slow month for real estate in this segment year over year.

We saw this proven true in the December 2021 numbers with the number of transactions down by nearly 48% from November – this is a major contribution to what we’re seeing in the “down” figures. Let’s keep our eye on January and February because I predict things are going to pick right back up in the detached market and those numbers are going to keep going up.

December 2021 Toronto Real Estate Numbers: Semi & Row Homes

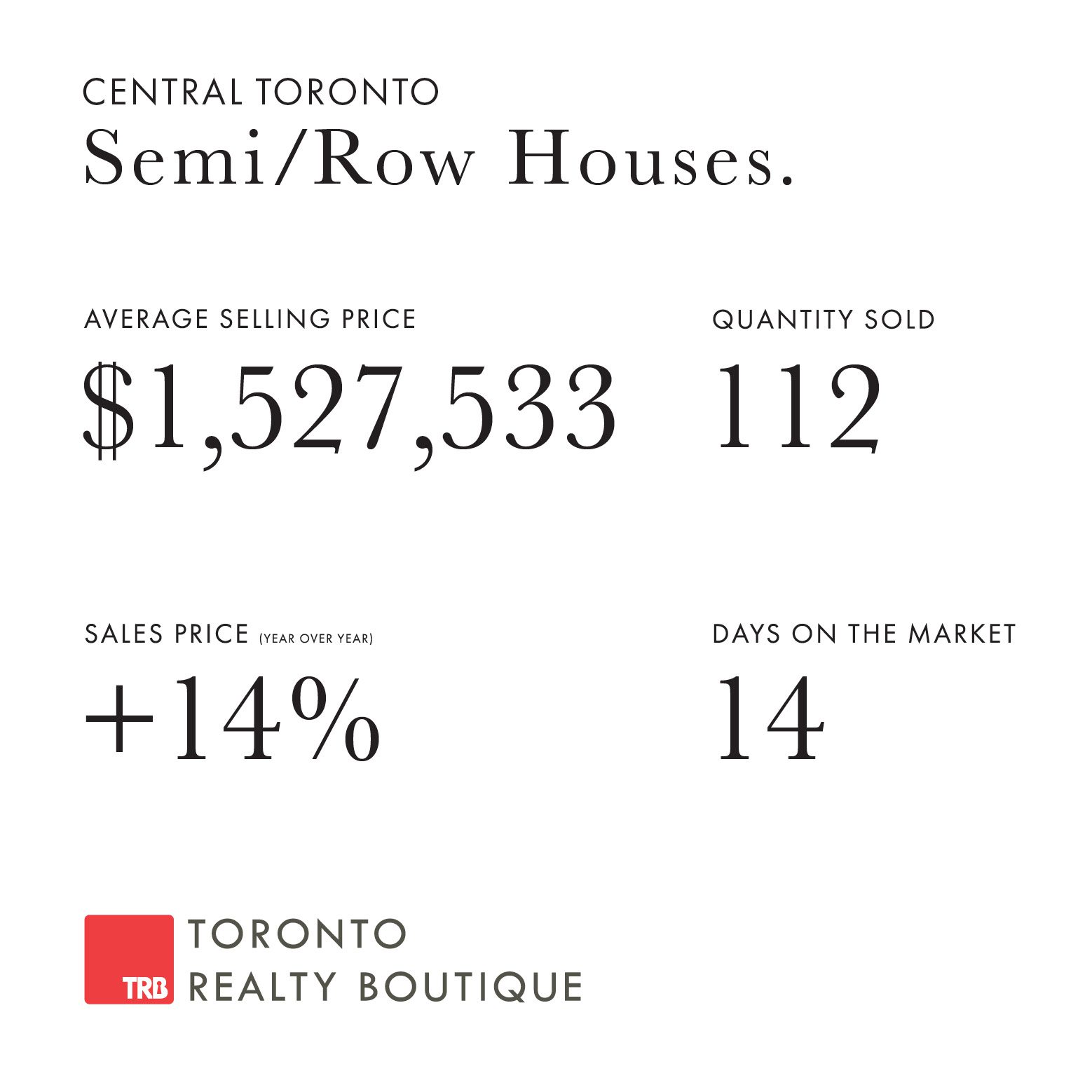

Once again, we’re seeing the impact of the December selling season and the seasonality of this particular month. Trends we saw in the Detached market are very similar in the semi and row home market. The number of transactions fell to less than 50% of the previous month so regardless of what pricing says, this is the key indicator to examine in December before looking at pricing to get a real picture.

Once again, we’re seeing the impact of the December selling season and the seasonality of this particular month. Trends we saw in the Detached market are very similar in the semi and row home market. The number of transactions fell to less than 50% of the previous month so regardless of what pricing says, this is the key indicator to examine in December before looking at pricing to get a real picture.

Demand is always high in a city like Toronto where supply has consistently been low, which has seen semi and row home prices take a roller coaster ride this year. But we are ending the year up 14% from December 2021, so if you want a real taste of market performance, look at the year-over-year numbers. It’s apples-to-apples – holidays happen every year so this is a good indication of market and segment health.

Semi and row homeowners should be thrilled to see the numbers climb at a steady and dependable rate, and buyers are happy because they’re not seeing the average price skyrocket like in the detached market – however, skewed it may be.

The December 2021 Toronto Condo Market

The Toronto Condo Market is very different when it comes to seasonality and selling during the traditionally slower months. Because it simply has no impact. We see that in the December numbers where sales and demand remain strong.

The Toronto Condo Market is very different when it comes to seasonality and selling during the traditionally slower months. Because it simply has no impact. We see that in the December numbers where sales and demand remain strong.

A good example is a listing I had at 78 Tecumseth Street. Our client was slightly hesitant about listing in December but with the right strategy and timing in place, combined with a very hot market, this 2-bedroom + den, 2-bathroom sub-penthouse with parking sold in four days for a record price per square foot in the building and well over the asking price. In fact, it sold for more than $115,000.00 MORE than the last identical suite just a couple of months prior.

The condo market is the only segment that showed consistent and sustainable price growth throughout the entire year, ending 2021 at 18% higher than December 2021. Again, apples to apples to see the full picture and I can say with confidence that the condo market is going nowhere but up.

If you’d like to discuss buying or selling, simply fill out the form below or call/text me anytime – 416-999-1240. I’m happy to help you take a look at the specific numbers in your neighbourhood and come up with a tailored plan that works for you.

~Romey Halabi, Founder & Lead Broker, Toronto Realty Boutique

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.