As I waited for the June 2022 Toronto real estate stats to come in, I knew, just like most in the industry that it would be a big one. Just like earlier in the year when numbers were skyrocketing, we waited each month to see how huge the numbers were.

Well, we did the same this month but for the opposite reason. With the hike in interest rates once again, chaos continued, and the sky is falling attitude can be felt radiating from the headlines. Buyers, sellers, and investors are likely feeling all kinds of emotions, from one end of the spectrum to the other.

But let me tell you one thing – real estate doesn’t stop. Homes are bought and sold each day of the year without question. And the biggest reminder is that none of us are in this to day trade properties like the stock market. I said this before, but real estate is a multi-year investment – typically 5 years or more.

And if we’re being really, really honest with ourselves, we all know deep down inside that the market we saw earlier this year was in no way sustainable. The increases were pricing too many buyers out of the market and it was obviously too much to handle for all sides.

So, when we look at this from a reality point of view, what’s happening now is the market is slowing – not stopping. We needed this, and I know that’s not a popular opinion.

Buyers can buy and sellers can sell. Investors can invest. Renters can rent. Sounds pretty nice, right? Right??

Let’s take a look at the Toronto numbers in each of the key market segments to give you some insight into what’s really happening. Your first hint: Welcome to the Buyer’s Market.

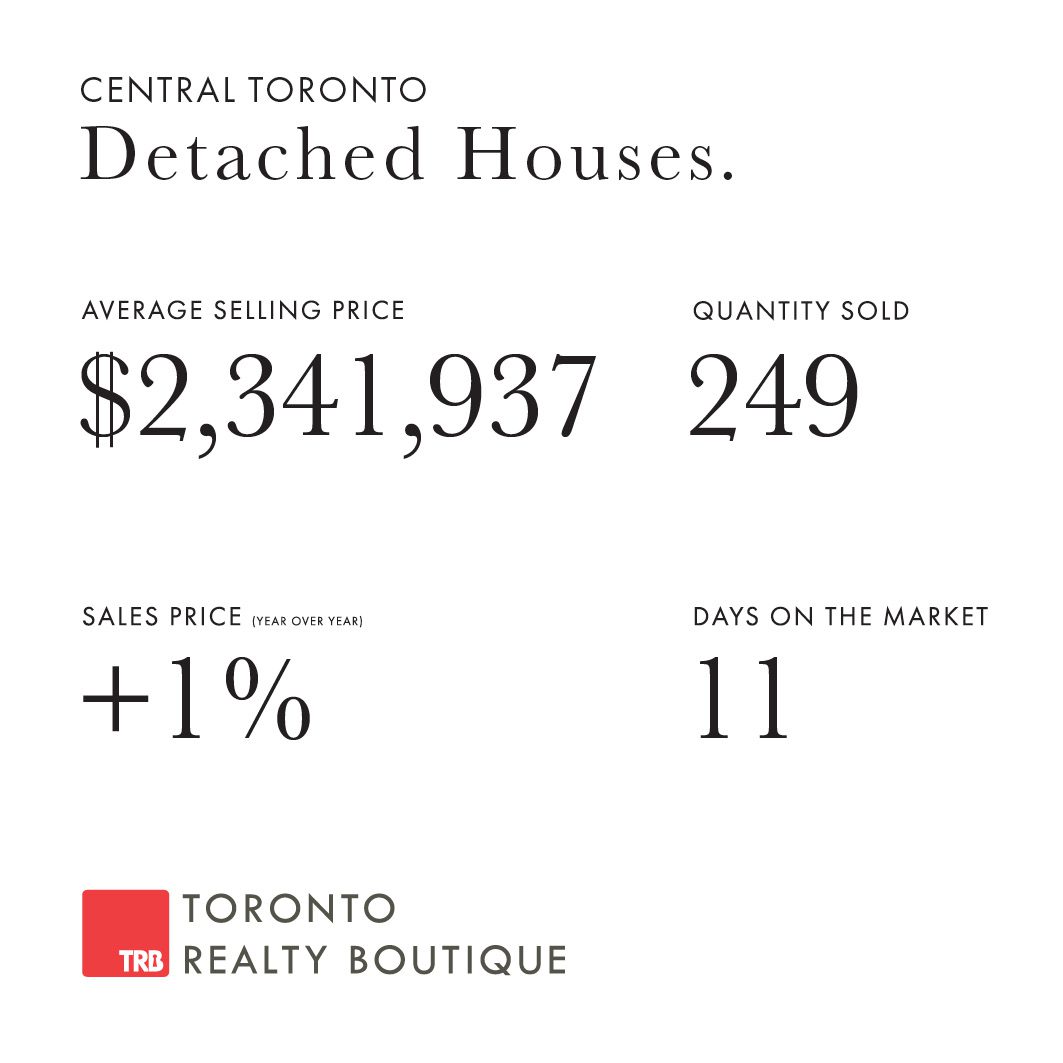

June 2022 Toronto Real Estate Numbers: Detached Homes

The detached homes segment of the market is slowly starting to show slight cracks from market pressure. With the rising interest rates, buyers are starting to pull back and sellers are missing offer dates. But who is really holding back offers in this market anyway?

The detached homes segment of the market is slowly starting to show slight cracks from market pressure. With the rising interest rates, buyers are starting to pull back and sellers are missing offer dates. But who is really holding back offers in this market anyway?

I’m going to keep saying this as a reminder, we’re not trading real estate day by day or even year by year. But when we look at the numbers, these two key indicators of market performance allow us to examine the trends more closely. This is incredibly helpful for buyers, sellers and investors.

During this time of year, we historically see the biggest price increases and the lowest amount of inventory due to a very active warm month trading season. But this year, prices are only up 1% from the same time one year ago, and inventory is also up.

To add to that, prices are down 12% month over month. What does that mean? I’ll say it again – welcome to the buyers’ market.

A buyers’ market is traditionally very short-lived, so here’s my advice for both buyers and sellers looking in the detached home market.

Advice for Buyers: if you’re in the market to buy right now, you are in the driver’s seat. Take advantage of it and make your move. Don’t wait. I repeat – DON’T WAIT. Traditionally buyers’ markets don’t last that long so get going! Don’t get caught up in the “let’s wait and see what happens” situation. There is so much inventory right now and many sellers have already purchased, so if you see something you like, go ahead and grab it.

Advice for Sellers: Wait. WAIT!!! If you’re in a situation where you don’t need to sell, my recommendation is to enjoy your summer, make some improvements, take a vacation (although stay away from Pearson…trust me), and have a relaxing break. This low won’t last long and before soon enough, you’ll be getting that For Sale sign on your lawn. The Fall market is just around the corner.

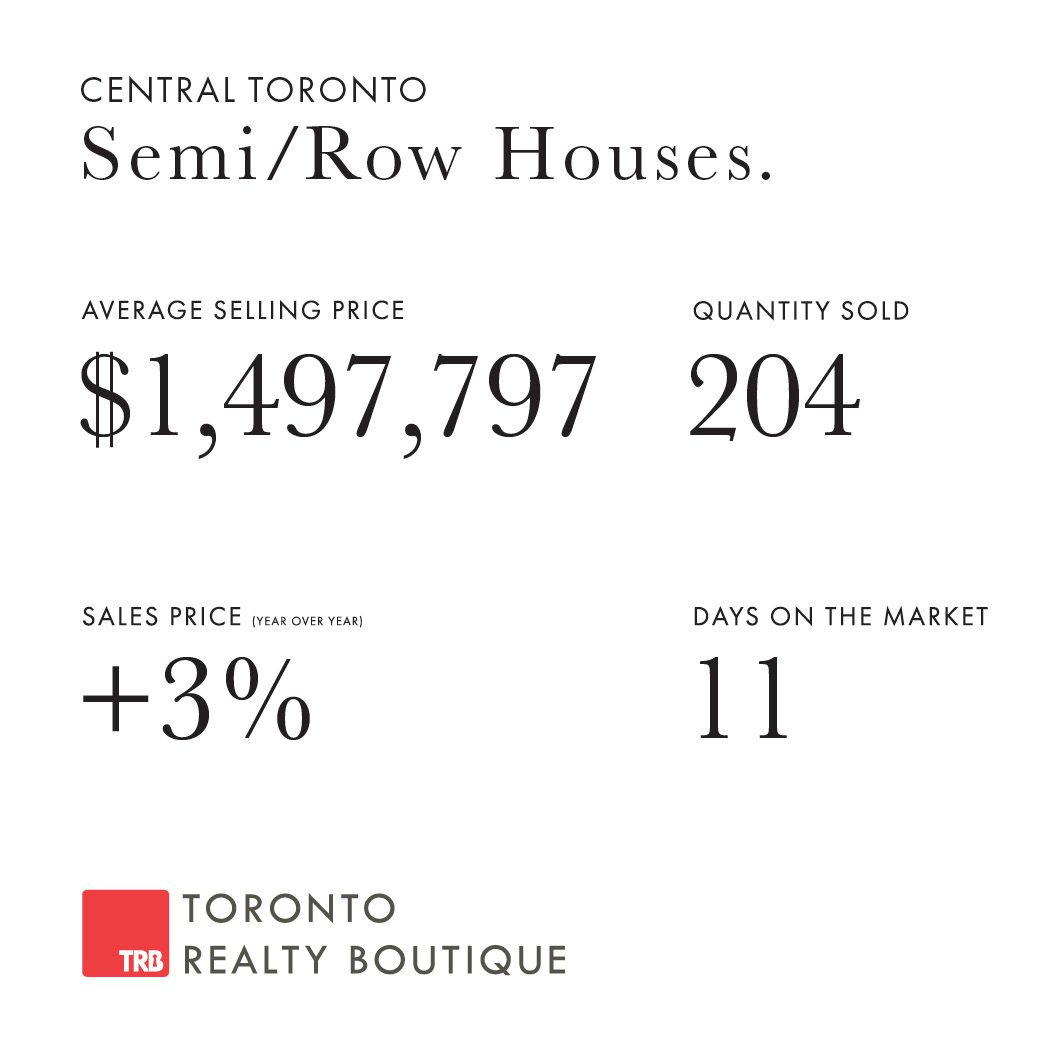

June 2022 Toronto Real Estate Numbers: Semi-Detached & Row Homes

The semi-detached and row home segment was one of the first to feel the impact of the interest rate hikes, earlier this year. Even the slightest rumour of a rate hike hits this segment first and fastest because buyers are typically the most sensitive here.

The semi-detached and row home segment was one of the first to feel the impact of the interest rate hikes, earlier this year. Even the slightest rumour of a rate hike hits this segment first and fastest because buyers are typically the most sensitive here.

Going from a condo to a semi-detached usually pushes buyers to their max so even the slightest swing can have an impact.

But we’re starting to see signs of stability here – perhaps the first one hit is the first one to rise up – we saw a 3% increase from this time last year and an identical year-over-year increase to May 2022.

Month over month we continue to see a decline, but that decline is slowing – only a 4% drop from last month.

The number of new listings is down over 21%, proving many sellers are pausing, as they should. The number of sold properties is also down 20%, showing a halt in this segment again, because of how sensitive they are to the interest rate hikes.

Advice for Buyers: the buyer’s market is quickly coming to an end – it’s still a buyer’s market at this moment, but it’s not lasting long – the trends tell us that. If you’re waiting to see what happens, well…it has happened and is almost over. Don’t get yourself in a position of regret – get out there and get something quickly.

Many buyers are buying now because their pre-approvals they got before the rate hike are quickly running out of time and are about to expire. This is going to create some urgency in the market and what does that do? It puts a quick end to the elusive buyer’s market. Get out there and get looking – now is your time.

Advice for Sellers: Now is the time to sell. If you’re listed on the market, keep it there. If you’re thinking about listing, do it. These buyers who are on the hunt will soon run out of time. Price your home right and you’ll see the offer you want.

Toronto Condo Market: June 2022

The condo segment of the market is the most affordable segment of the Toronto housing market – it’s usually the entry point for any buyer looking to purchase their first home.

The condo segment of the market is the most affordable segment of the Toronto housing market – it’s usually the entry point for any buyer looking to purchase their first home.

But this month, we’re seeing the biggest drop in demand within this segment. With sold transactions down 37% from the same time last year and inventory up, we are starting the see price stability in a sector of the market that usually sees double-digit increases month after month.

Prices are up 4% from the same time last year, and essentially flat month over month. The buying rush that happened last year with buyers getting in before rates went up and the price increases that came with that demand is behind us now.

We are now in a more balanced condo market with listings being on the market for a typical 14 days, multiple offers are a thing of the past and both sellers & buyers are being more realistic about listing and making offers.

Advice for Buyers: stop renting and get into the market now. The rental market is skyrocketing (more on that below), so stop paying someone else’s mortgage and put money into your own pocket.

Inventory is up so you have plenty of options to choose from, and prices are stable so you will not overpay. Don’t count on getting a “deal” as most sellers are not desperate, but now is your time!!

Advice for Sellers: with a stable market you’re going to get fair market value for your condo. Price your condo right, make those small improvements and you will see a high number of showings, and the right offer will come through.

BUT – before you list, look into holding and renting your condo out. Take out equity if you need to buy and look to get a good tenant in. With the rental market climbing, this may be a very good option for you to start your real estate empire.

A Note on the Rental Market

I usually don’t include the Toronto rental market in my analysis but this month I just had to because it’s getting pretty crazy. Some rentals are up and taken within 24 hours. Some are seeing insane multiple offers – just today one of my colleagues saw a condo with clients, and within 60 minutes it had 5 offers.

And I’m not talking about the below $2,000.00/month rentals – this is all of them. Even those asking $3k+ / month.

So, if you’re an investor – don’t fret. Things are looking GOOD.

But this is also why I’m telling those looking at rentals to seriously consider buying. A buyer’s market + skyrocketing rents are only putting you in a better position to finally get into the market.

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch with you right away. I’d be happy to answer any questions about the June 2022 Toronto real estate numbers you have or about the Toronto market in general and share my insights on what’s to come later this year.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.