The January 2023 Toronto real estate numbers are in so it’s time to take a deep dive into what they really mean, versus what is simply reported without any context. How does that happen anyway?

Each month I take a look at what’s fueling the numbers and what trends we should be watching. Let’s take a look.

The Overall January Market

The first thing I did when I saw the market stats for January was look back at 2022 – what was happening then?

And January 2022 was a good example of how artificially inflated the prices were due to buyers buying out of fear. That FOMO (fear of missing out) was real during the first part of 2022, and the numbers then supported that. There were rumblings of rates possibly going up and buyers were reacting. It was indeed one of the craziest starts of the year anyone in the market has seen.

There was no “Spring Market” – January 2022 started and didn’t stop. Until it did. I always say that real estate isn’t traded month over month or even year over year, so for this month’s analysis, I took a step back beyond one year to see what’s really happening and where the trends are pointing to.

Last year the headlines were screaming about how “crazy” the market was and this year, at the same time of year, they’re saying the exact same thing – it’s just a different sentiment – the other side of the coin if you will.

I actually looked back at my January 2022 report and this was an exact quote I used:

“Holy Sh*t the numbers are skyrocketing.”

Change the word from skyrocketing to something more relevant today, and the sentiment remains the same. As I said, the flip side of the coin.

Now before we get into each market segment, let’s talk about the reality of the market. I’m not going to be one of those agents that doesn’t acknowledge what’s happening – it’s with full honesty I can say:

- Prices are down

- The number of transactions is down

- The number of new listings is down

- Days on the market are higher than I’ve ever seen

Let’s examine each market segment in more detail to see what’s happening and where things are headed.

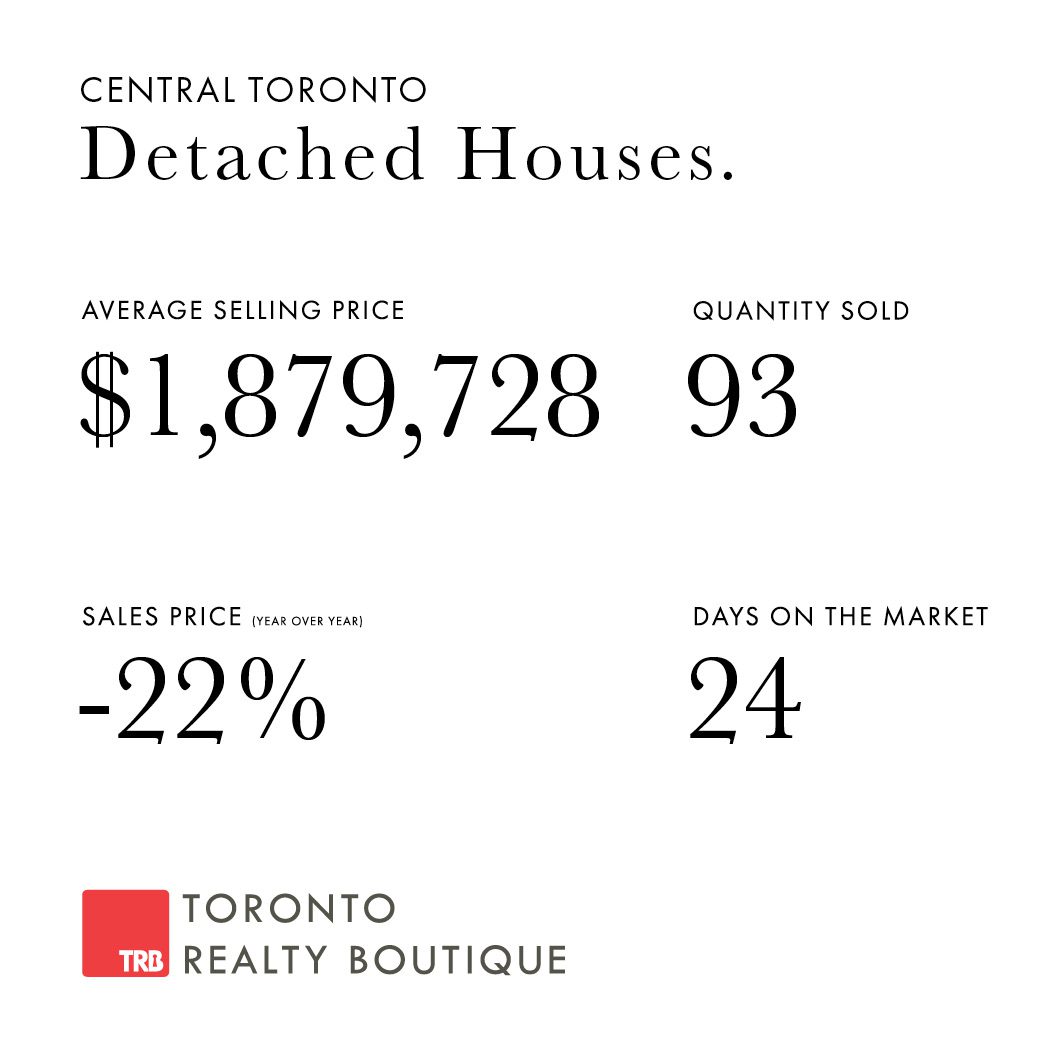

January 2023 Toronto Real Estate: Detached Homes

First, we should examine some of the numbers that aren’t usually reported widely.

The year-over-year quantity sold is down 36.7%

Year over year new listings are down 12%

The year-over-year days on market are up from 18 days to 24 days

So, the first thing to note is the correlation between new listings and the number of transactions, year over year, is disproportionate. Supply is outpacing demand and we’ll continue to see downward pressure on pricing until buyers get back into the market.

So, the first thing to note is the correlation between new listings and the number of transactions, year over year, is disproportionate. Supply is outpacing demand and we’ll continue to see downward pressure on pricing until buyers get back into the market.

The big number in the stats is the year-over-year pricing being down 22%. But again, this is where I want to remove the January 2022 inflated pricing and look at what was happening in 2021.

Let’s face it, those who purchased at home at the height of the market in January 2022, are likely not selling right now. If you’re one of the few that are, you’re likely in a situation that is forcing you to sell – if you’re in this boat, get yourself a good Broker that can explain the many options you have out there – one that is totally honest, and not saying well I guess you have to sell.

OK, let’s get back to it. If we compare pricing from January 2021 to January 2023, removing the inflated numbers of 2022 we have the following:

- January 2021 Detached Home average price = $2,048,331.00

- January 2023 Detached Home average price = $1,879,728.00

This makes today’s detached homes valued at 8% lower than in 2021. This is a lot more digestible than 22%, right?

Some will say this isn’t the right way to look at the numbers, but we have to be able to remove a “crazy year” in order to look at the trends. This in no way changes the hand we have in front of us – it just allows us to examine the bigger picture in order to look at all sides of the story.

My Advice for Sellers: If you’re considering selling, it has never been more important to have the full financial picture of your home and what it’s worth. You need to be looking at what you bought it for and what you’re going to sell it for.

Your reason for selling is also the key factor in determining your next move. If you’re selling to make a lateral move into a new neighbourhood, I’d say wait. But if you’re looking to sell to purchase a bigger home and up-size, now is the time. The money you’re going to miss out on by selling now will not outweigh the value of getting a bigger/better home for less, with little to no competition and pressure on your purchase.

My Advice for Buyers: If you’re looking to buy and are worried about interest rates, I’d recommend a 1-year term mortgage. This is pretty normal right now based on what my colleagues in the mortgage industry are seeing – you’re getting into a new home for less and will probably get more for your money. Don’t let this short-term pain deter you from the market. There are major opportunities out there and a trusted mortgage agent can help you look at the entire picture, both short-term and long-term.

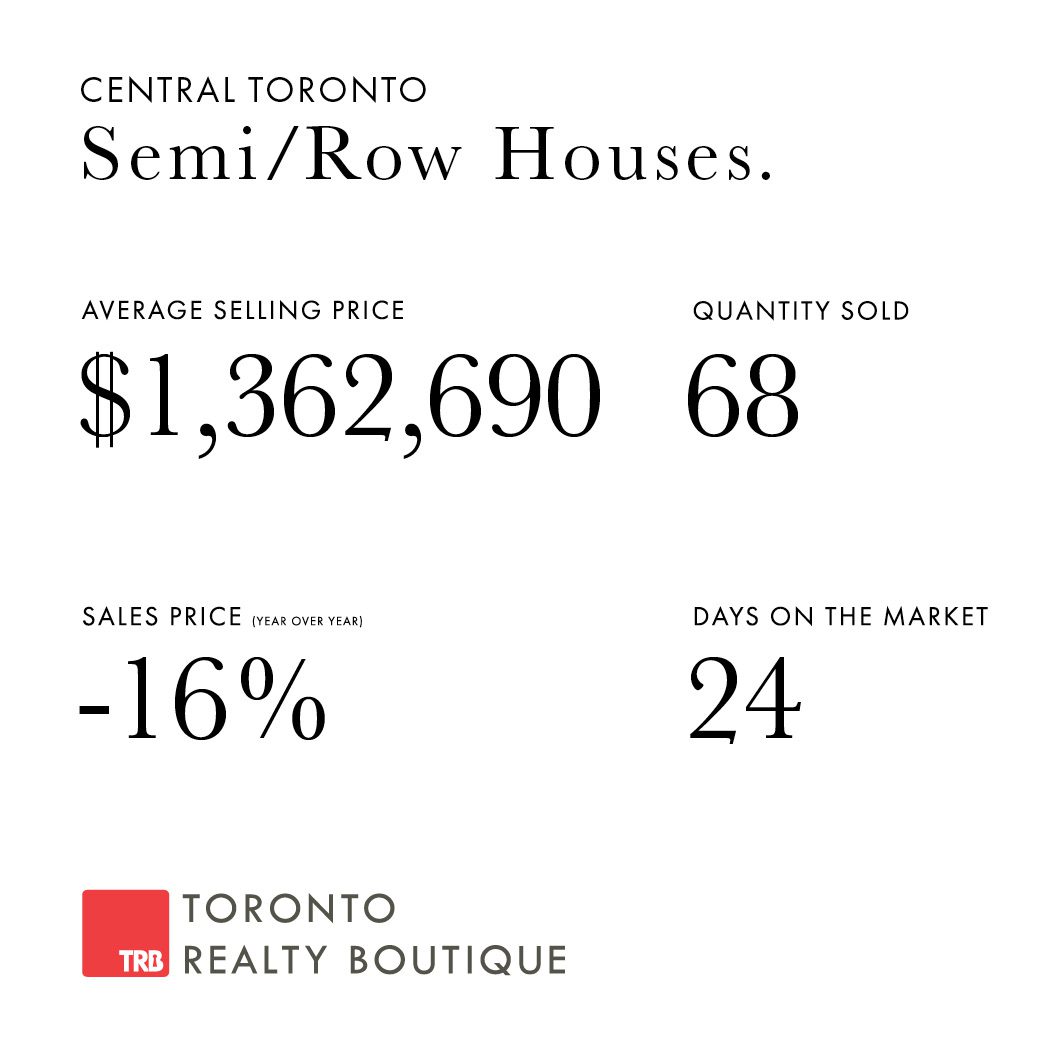

January 2023 Toronto Real Estate:: Semi-Detached and Row Homes

Let’s start with some of the numbers that aren’t usually reported widely.

The year-over-year quantity sold is down 37.5%

Year over year new listings are up 0.55% (we’ll call this even)

The year-over-year days on market are up from 18 days to 24 days

A few things to note with the numbers in this segment which is pretty interesting to look at. The year-over-year new listings is essentially identical to 2022. But the issue is, demand has dropped significantly, therefore the pressure on pricing continues to have a huge impact on the year-over-year numbers.

A few things to note with the numbers in this segment which is pretty interesting to look at. The year-over-year new listings is essentially identical to 2022. But the issue is, demand has dropped significantly, therefore the pressure on pricing continues to have a huge impact on the year-over-year numbers.

But with that said, when we remove 2022 from the equation as we did for detached homes, we see the following:

- January 2021 Semi/Row Home average price = $1,415,760.00

- January 2023 Semi/Row Home average price = $1,362,690.00

This means that the average price of a semi/row home in 2023 is down 3.7% in comparison to 2021.

I always say that buyers within this segment are the most rate sensitive, and the numbers this month further prove this. The majority of people who own within this segment have been there for a while – likely many, many years.

I believe this is the driving force behind the number of listings remaining consistent even with the pricing drops we’re seeing. Owners know that they are making good money on their semi/row home versus what they paid for it and are now looking for opportunities to cash in on that and take advantage of the lower detached home prices should they be moving up.

These sellers are the buyers within the detached homes segment that are winning on the buy, which is how you actually win in Real Estate.

My Advice for Sellers: the only sellers that should be considering listing right now are the one’s looking to get into the detached homes market. If you’ve been in your semi for several years and have always pictured living in a detached home, now is the time. If you just got into your home within the last 12 months, I’d recommend holding off – the market will be back – and you have time on your side. Enjoy the home you love and don’t fret about what you paid for it. I promise that when you’re ready to make a move in a few years, you’ll be up from what you paid and will be happy with your decisions.

My Advice for Buyers: Inventory levels are the same right now as they were last year at the peak of the market. You have just as much selection now as you did then, but you’re buying without the pressure and 24-hour timeline that we saw last year. Get out there and look, and if you find something you love, don’t be afraid to pull the trigger – especially with the lower pricing we’re seeing in today’s market.

Toronto Condos

Here are some of the numbers that aren’t usually reported widely:

The year-over-year quantity sold is down 60.8%

Year over year new listings are down 0.26% (we’ll call this even)

The year-over-year days on market are up from 16 days to 31 days…almost DOUBLE

There is one major takeaway with the condo numbers in the January Toronto Real Estate numbers that must be pointed out here. The year-over-year new listings number is essentially identical to 2022 when the market was crazy. But when we look at demand, it has dropped significantly. Yet, there is NO pressure on pricing as the condo segment is only down only 3% year over year.

There is one major takeaway with the condo numbers in the January Toronto Real Estate numbers that must be pointed out here. The year-over-year new listings number is essentially identical to 2022 when the market was crazy. But when we look at demand, it has dropped significantly. Yet, there is NO pressure on pricing as the condo segment is only down only 3% year over year.

So, let’s go ahead and repeat what we did with detached homes and semi/row homes, by removing 2022 from the trend equation to see where we’re at.

- January 2021 Condo average price = $684,552.00

- January 2023 Condo average price = $804,972.00

This means that the average price of a condo in 2023 is UP 17.6% in comparison to 2021.

The condo segment in Toronto is more of its own market. What we see in detached and semi/row homes typically never translates over to the condo segment, and the numbers in January 2023 proved that yet again.

The condo segment is a collection of every buyer in the market – first-timers, investors, up-sizers, downsizers, and end-users of all kinds. With a pool of buyers that broad and wide, sensitivity to interest rates, inflation, and the overall economic cycle has very little impact on a decrease in pricing.

I’m still standing behind the fact that the Toronto condo market is the best place for your money if you’re looking to get started as a buyer or an investor.

My Advice for Sellers: if you’re considering selling, it’s always a good time because the market is strong. But with that said, examine what your long-term goals are – do you really need to sell? Is it possible for you to take equity out of your condo, make the next purchase you need to make, get a tenant, become a landlord and hold your properties?

I tell every condo owner I know to try and make it work. It doesn’t always fit into the bigger plan right away, so if you need to sell, sell with confidence. Price your condo right and wait for the buyer – it’s taking longer as proven with the days on the market, but pricing is holding so you’ll get what your condo is worth.

My Advice for Buyers: it’s honestly a great time to buy in the condo market. Inventory levels are keeping the same pace as they did in 2022, so you have a lot to choose from. But you can take your time and find the right condo that works for your goals.

I also recommend having a plan – look at what you can do with your current savings and how you can leverage what you have to get into the market as an investor. If you’re looking for a safe place to put your money, the condo market is it. The proof is in the numbers.

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the January 2023 Toronto real estate numbers you have or about the Toronto market in general.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.