The August 2023 Toronto real estate numbers are in, so it’s time to take a deep dive into what they really mean, rather than leaning on the many misleading headlines that are out there. It’s always a good idea to read beyond the headlines because the numbers always show the real picture.

I’m sure you’re familiar with my monthly reports where I dig into what the numbers mean and what’s happening in the market. My background is based in numbers (I was the head of finance for a big Toronto ad agency prior to real estate), so my approach to the market is very numbers-focused.

What you may not know (but hopefully you do) is that I help many clients buy and sell real estate on a daily basis. I am the Founder and Lead Broker of Toronto Realty Boutique and I specialize in listing homes and condos, representing buyers of all budgets, and I also do a lot of work in the Toronto pre-construction market.

So, if you’re thinking about buying or selling and want a Broker that can not only represent you better than anyone else, but who can also sort through the numbers and help you make the best move, don’t hesitate to contact me anytime.

A Note on Interest Rates

At the September 7th Bank of Canada meeting, it was announced that rates would be held – no increases this month. This is after two months of raises by .25% in June and July respectively.

So with regard to rates, 2023 has looked like this to date:

January 25, 2023: rate went to 4.50%, with an increase of 0.25%

March 8, 2023: rate was held at 4.50%

April 12, 2023: rate was held at 4.50%

June 7, 2023: rate went to 4.75%, with an increase of 0.25%

July 12, 2023: rate went to 5.00%, with an increase of 0.25%

September 6, 2023: rate was held at 5.00%

October 25, 2023: scheduled announcement

December 6, 2023: scheduled announcement

What’s going to happen at the next two meetings? If I had to wager a bet, I’d say they’re going to hold rates at where they currently stand. Could I be wrong? Absolutely, but if we do see a raise, it’s not going to be any more than by 0.25%. I don’t see any big jumps coming anytime soon.

With this most recent hold, the Bank of Canada feels that the June & July increases did their job of steadying things and slowing down some potential explosive movement in the real estate market. They’re going to keep a close eye on the market to ensure it doesn’t get out of control quickly. A nice steady pace favours everyone – both buyers and sellers.

Overall Market Sentiment

Let me first start by saying that even in the hottest of markets in Toronto, August is typically slow. But there were some surprises that stuck out to me, that we’ll examine in the market segments.

Although the temperatures were soaring in the city, the same cannot be said about the market numbers. Two out of the three market segments showed a drop in year-over-year pricing and month over month, we saw drops in the same two segments.

The surprising segment performer in August? Semi-Detached and Row Homes. Let’s take a look at why.

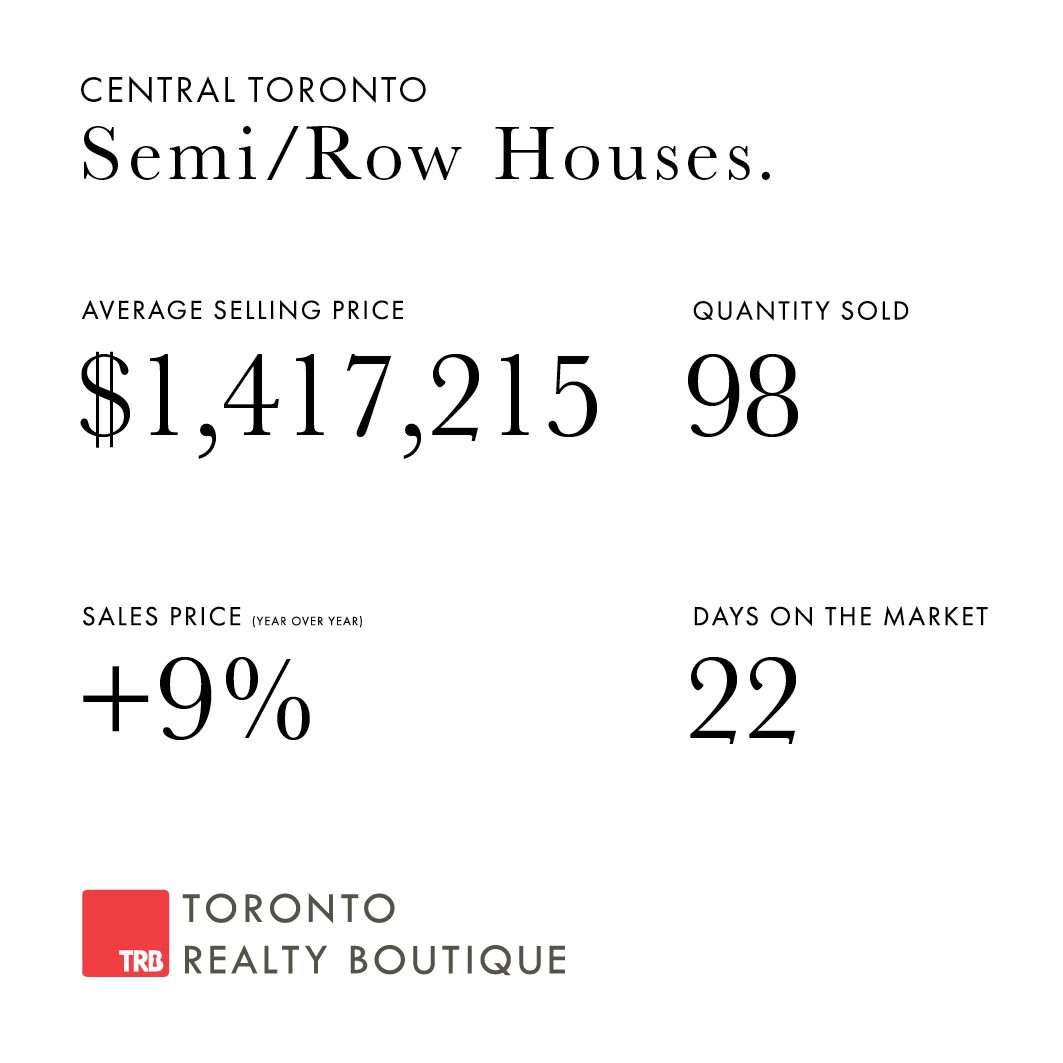

August 2023 Toronto Real Estate: Semi-Detached and Row Homes

Let’s begin with taking a look at some of the August 2023 Toronto real estate numbers that aren’t traditionally included in many reports yet do have importance in our analysis.

Quantity Sold – down 9.3%

New Listings – down 7.2%

Day on the Market is 22 days up from 13 days

Price increase year over year – up 9%

Many of these numbers made me look twice, but I have a good theory around why this segment outperformed the others in August.

Many of these numbers made me look twice, but I have a good theory around why this segment outperformed the others in August.

The key demographic for semi-detached owners is young families. Either moving from a condo into a semi or from their current semi to a new one, perhaps in a different neighbourhood…or school zone. Get where I’m going with this?

August was the perfect time to buy, get organized and settled before the school year begins. Let’s be honest, semi owners are pushing the limits – with payments, time, organization, and family – I know a lot of owners within this segment and this sums them up perfectly. They’ve got their shit together but it’s because they are organized.

August proved to be a very slow time – did you see how the number of days on the market went from 13 to 22? Yet, pricing is up by 9% year over year. This means that seller are holding on for their fair market value pricing because they simply must. And buyers are finding the right home and paying. It’s fair, simple and steady.

I have always said, this segment is the most rate-sensitive and when I look back at the behaviour of this market segment last year, my point is proven even further.

In June and July of last year, we saw a combined rate hike of 1.5%. That’s a huge number within just two months and this segment reacted – we saw a 9% drop in year-over-year pricing in August 2022.

This June and July, we saw a combined rate hike of just 0.5%. And this year we’re seeing a price increase of 9%. Literally the opposite of 2022 so it’s interesting to look at the behaviours of buyers and sellers with regard to rate hikes.

Advice for Buyers: Let’s be honest, every buyer is waiting for rates to come down to buy. It’s the honest truth. But we all know what happens when everyone is waiting to buy, right? Let’s say rates come down and the market is flooded with buyers.

Bidding wars and demand is going to force pricing way up. So sure, you’re paying more now because of rates, but that payment you’re making due to increased rates has nothing on the extra $200,000 you’re going to be paying for your home because the market is wild.

Buy now, get a one- or two-year mortgage, and set yourself up for long-term success. I can’t stress this enough – short-term pain for long-term gain is what you need to be looking at right now.

Advice for Sellers: If you’re looking to sell to move into your next home, the same advice as above applies. Look at your situation from a buyer’s perspective rather than a seller, IF that’s your strategy.

Also, you must have patience. We’re into September and things will start to pick up, yes, but there is still no market pressure on buyers. They’re in the driver’s seat. Price your home fairly and wait – remember in just one month, the average days on the market went from 13 days to 22 days. It will take some time, but the right buyer will come along and pay you fair market value for your home.

Toronto Condos

Again, here are the numbers I usually look at to aid in my monthly analysis that you may not see elsewhere.

Quantity Sold – down 2.1%

New Listings – up 28.7%

Day on the Market is 19 days down from 22 days

Price increase year over year – down 0.4%

Let’s start by looking at the one huge number here that is honestly, quite shocking. New listings in the condo segment are up, year over year, 28.7%. So what’s driving this? I think a number of factors.

Let’s start by looking at the one huge number here that is honestly, quite shocking. New listings in the condo segment are up, year over year, 28.7%. So what’s driving this? I think a number of factors.

First, many may go to investors dumping suites – I’ve seen the headlines and I’m going to call that the biggest pile of BS that I’ve heard. With the rental market soaring and the demand for suites at an all-time high, I have a hard time believing that investors are dumping suites.

In the condo rental market, it’s not uncommon for a 1-bedroom suite to be listed and have 20+ showings on the first day lined up, along with at least 5 offers on the table the same day. And these offers are from very good, qualified tenants.

It’s also August – the hottest rental month of the year. I’m willing to bet more leases are signed in August over any other month of the year. The reason? The 30,000 international university students coming into the city, and only 7,000 capacity for on-campus housing.

I think the huge number of listings in the condo segment is simple – they want to move up and out. Life doesn’t stop because of interest rates, and if you’re living in a condo, recently got married, found a life partner or started a family, the likelihood of you wanting your next home is high.

As this huge number of new listings gets sold, these sellers will in turn become buyers. This will be the start of some very busy activity within the market because once you turn from a seller to a buyer, the pressure is on. Let’s remember that in the months to come and keep an eye on what will happen.

Advice for Buyers: Inventory is up, and we’re currently still sitting in a buyer’s market, so take advantage. Buyers’ markets in Toronto don’t last very long. Again, examine what a one- or two-year mortgage will look like and plan for the future. Paying less now will be much more digestible than the price increases that could start happening very soon.

Advice for Sellers: My recommendation is to sell before you buy. With this kind of inventory on the market, it’s beneficial to take this strategy. You’ll relieve yourself of some of the selling pressure and still have plenty of inventory to look at once you have a firm sale in hand.

August 2023 Toronto Real Estate: Detached Homes

Let’s start once again by looking at some uncommon numbers for August.

Quantity Sold – down 15%

New Listings – up 8.2%

Day on the Market is 18 days down from 22 days.

Price increase year over year – down 8%

The detached market is typically where we see the biggest “summer slowdown”. Many are on holiday, with no thoughts around buying or selling. This is the trend year-over-year, so the quantity sold number being down by 15% isn’t a big surprise.

The detached market is typically where we see the biggest “summer slowdown”. Many are on holiday, with no thoughts around buying or selling. This is the trend year-over-year, so the quantity sold number being down by 15% isn’t a big surprise.

I decided to examine the luxury market within this segment again this month, as that 8% decrease in pricing year-over-year made me stop and wonder what was driving that.

When you back out the luxury market, which is typically homes $4 Million +, for Aug 2023 the average price is $1,846,356.00.

When you back out the luxury market for August 2022 the average price is $1,828,717.00.

So when we look at what we can call “the average” detached home, pricing actually went up 1% – essentially a flat market to 2022. Not the 8% drop that’s reported.

What’s to come in the detached market this fall? I expect some good activity, with pricing both month-over-month and year-over-year headed up. When I tell you staging companies are already booking into mid-October, that’s a sign of things to come.

Advice for Buyers: The upcoming fall market will see a lot more inventory. If you’re willing to be patient, you’ll have plenty of homes to consider. This buyer’s market is nearing its end, and as rates start to steady and even drop in 2024, the tide will change very quickly.

Advice for Sellers: Don’t let that 8% drop in pricing rattle you. In the detached market, comps in your neighbourhood speak volumes. Pick a broker that can interpret the numbers within your neighbourhood for you, so you have a full understanding of your comparable sales and your competition. It’s critical to price correctly to get a solid, fair market value offer that will give you the number that your home is worth.

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the August 2023 Toronto real estate numbers you have or about the Toronto market in general.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.