The April 2022 Toronto real estate numbers are in, so it’s time for my monthly deep dive into what they actually mean – not what the headlines want you to think.

It’s only May and the market has given us quite the ride in just a few short months – the media headlines are all over the place! Just a simple Google search as I write this gives me “The Market Has Cooled”, “The Market is RED HOT”, “The Market Has Stalled” and “The Market is Balanced” all at once. No wonder it’s so hard for people to sort out what the numbers mean – and that’s what I’m here to help with. Let’s take a look.

First, I wanted to give you a quick summary of the entire market before jumping into each segment.

April Market Numbers

According to TRREB, the average price decreased for the second time month over month, dropping by 3.5% from $1,299,984 in March to $1,254,436 in April. This has everything to do with the crazy hot market we saw earlier this year – the numbers are down from that time but when we examine what was happening before that, say in December, we’re still up 8.3%.

And when we look at Toronto-proper, the numbers are actually up 2% and the other surrounding districts are driving the decrease.

Year-over-year, the average home price is up 15%.

And this brings me to a very interesting take on the month-over-month analysis. Homeowners tend to purchase and hold for a minimum of 3-5 years. Sure, some are less, and some are more, but it’s very safe to say buying and selling real estate isn’t a month-to-month game. No one is buying one month to sell the next. So why look at month-over-month? Well, most use it to write crazy headlines about the market either being too hot or too cold, but what I use month-over-month analysis for is to help predict trends. And in order to predict a trend, you need to look at more than just one month over one month. Just some food for thought.

Another stat that is looking skewed to me is days on the market. This has become more apparent these past few months, as we were seeing crazy bidding wars on nearly every listing. But now, as those are coming to a screeching halt, the days on the market number becomes more questionable as we transition.

You see, many buyers listed during the month of April and as the tides changed a bit, they were missing their offer days. What impact does that have? Well when an offer day is missed, the listing is then taken down, and re-listed for an at-market list price and usually sells quickly, if priced right. This strategy restarts the days on the market clock, and therefore takes away the relevance and fundamentals of “days on the market”.

So, when we look at days on the market, it’s should be an indicator of how quickly inventory is being absorbed. But with this transition, it’s becoming less and less relevant as a key market indicator in all segments.

Just more food for thought as we dive into the monthly analysis.

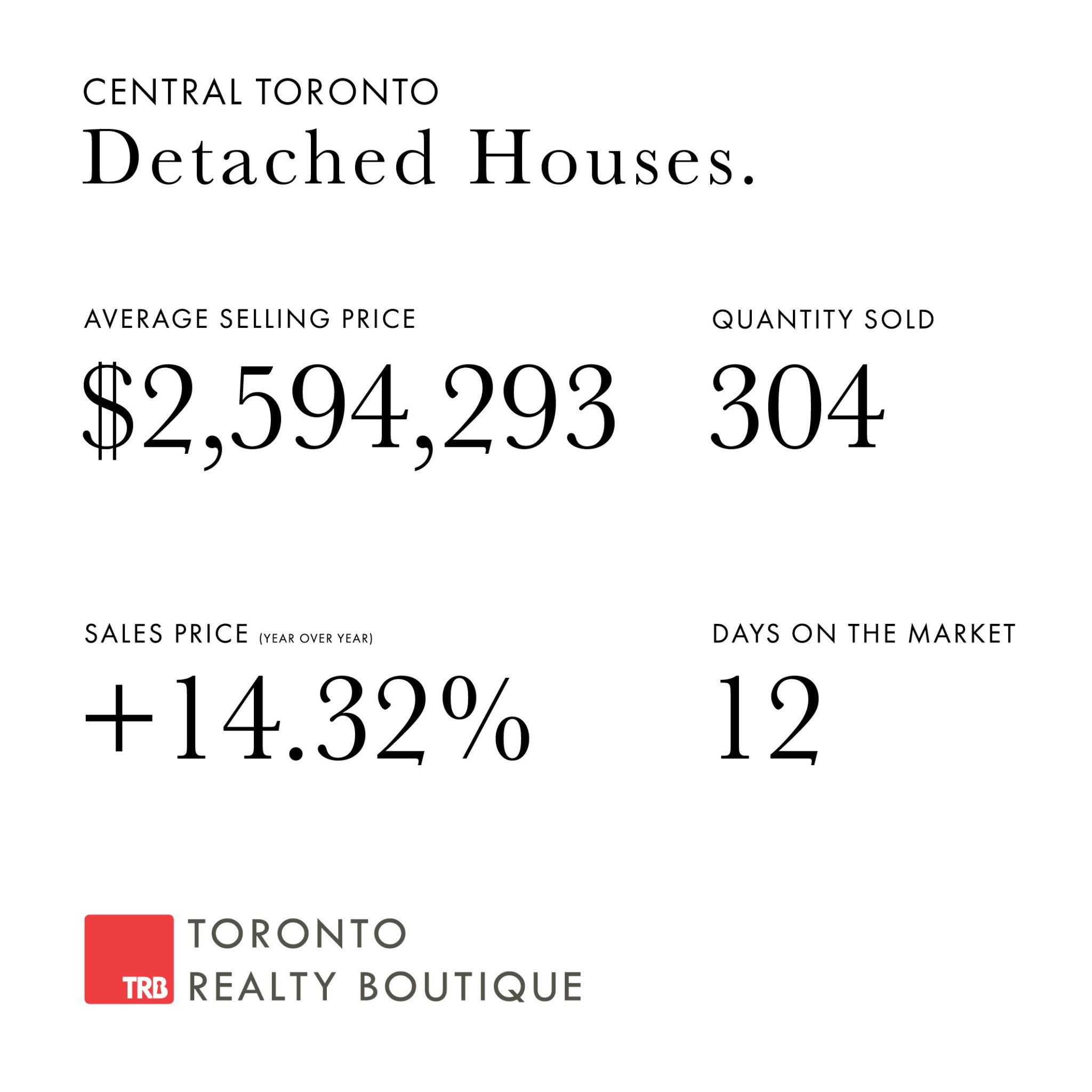

April 2022 Toronto Real Estate Numbers: Detached Homes

The detached homes market is stable and consistent, and with the April numbers, any detached homeowner, seller, or buyer should be confident with that statement.

The detached homes market is stable and consistent, and with the April numbers, any detached homeowner, seller, or buyer should be confident with that statement.

Although demand has slowed, prices year-over-year are up 14%, and month-over-month they are up 5%.

Since this segment of the market isn’t nearly as rate sensitive as the semi and condo market, it’s not heavily impacted by any rate hikes or threats of future rate hikes.

This segment of the market is showing signs of slowing after a very active first quarter of trading, but prices are holding steady with another small amount of growth from March. This is a good indication of a strong, stable segment.

My prediction for the summer? I’m willing to say that with the threat of more interest rate hikes, we’ll continue to see less trading than we did earlier this year. Many will adopt a wait-and-see attitude as there is no huge rush to get into the market.

Prices year-over-year are up 14%, and although the number of sold transactions is down 31%, this just further proves the point that this market segment is stable and holding value, even as demand and sold transactions are down.

My advice for buyers: don’t succumb to the headline pressures. If your plan is to buy now, then stick with it. If your plan is to wait until the fall, do that too. Stick with your strategy without any stress about what’s going to happen next.

With that said, I’d recommend pulling the trigger if you find a house you love. With the summer coming up and the return to a somewhat normal life, people will be enjoying life to the fullest and perhaps tabling listing for the time being.

My advice for sellers: don’t wait for too long to get your home listed. Many buyers take a pause during the summer months due to travel, cottages, kids camps – all the important life things that we’ve been held back from for the past two years. Now is the time. Also, think about your offer strategy and don’t get caught up in the hype of holding back and stressing over offer night. Too many listings are missing offer days, and as they say, you only have one chance at making a first impression.

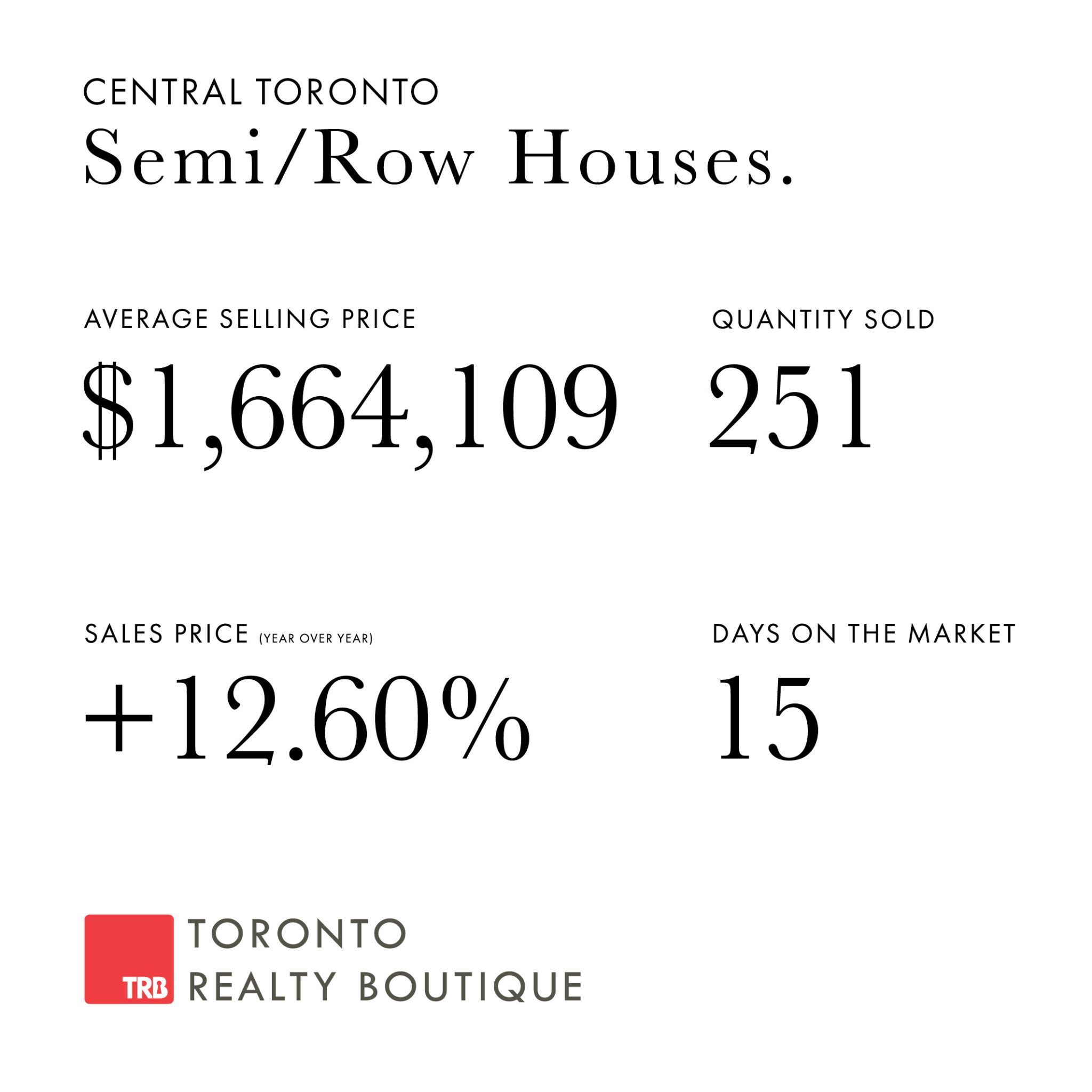

April 2022 Toronto Real Estate Numbers: Semi & Row Homes

I always say this segment of the Toronto real estate market is the most interest-rate sensitive and the April numbers prove just that.

I always say this segment of the Toronto real estate market is the most interest-rate sensitive and the April numbers prove just that.

The month-over-month average price is down 2.5% and although this isn’t a huge number, it’s something I will be keeping my eye on as we examine the trends. This could be the beginning of a downward trend coming within this particular segment.

Year over year numbers is also down – by 3%, adding an additional layer of proof to our point about a trend to definitely keep our eye on.

Many ask me why this segment is so sensitive to interest rate hikes, and here’s the reason. Buyers in this segment are usually upgrading from a condo to a semi due to an expanding family or lifestyle changes. Starting a family comes with plenty of costs associated with it that didn’t exist before – you’re adding in a new home, new day-to-day costs, and this all adds up, taking a portion out of your home buying budget.

Inflation also comes into play here – as food and gas prices go up, that home buying budget gets stretched even more.

My advice for buyers: buy now. Don’t wait – get into the market as quickly as possible because with the possible increase in interest rates coming again, your buying power is likely as strong as it can be in today’s market now.

My advice for sellers: I recommend listing as soon as possible. With the threat of future interest rate hikes coming, the buyer pool now is the largest it’s going to be for the next few months. Make your home shine and you’ll see results quickly.

Toronto Condo Market: April 2022

Looking at the Toronto condo numbers this month is kind of like being on a roller coaster. Here’s why:

Looking at the Toronto condo numbers this month is kind of like being on a roller coaster. Here’s why:

- Prices are up 2% month-over-month

- The number of transactions is down 31% month-over-month

- Prices year over year are up 12%

- The number of new listings month over month is down 6%

- The number of days on the market is up two days, from 10 to 12.

Let’s get off this ride and sort out what this all means.

The condo market in Toronto is a stable place to be – with pricing stability and the steady flow of new inventory, the condo market, month after month provides owners, investors, buyers, and sellers that confidence is to be had.

Bidding wars and offer nights with 10+ offers are quickly becoming obsolete, and sellers are lucky to have two offers to look at. I’ve experienced this personally with a client who just purchased a loft on King Street West. Offer night saw only two of us, and we came out on top with a solid deposit and a flexible closing date.

With this stable market, buyers don’t have to feel the pressure, and sellers don’t have to feel the stress of what will happen next. It’s a nice place to be.

With the trends we’re keeping an eye on in the semi-detached and row home market, another trend to add to the mix is keeping an eye on the demand for larger condos – 2-bed + den and larger, as buyers in the semi market realize lower buying power and need to look in the condo market for a new and/or bigger home.

Boutique, smaller buildings with these large floor plans will see demand hikes in the coming months.

My advice for buyers: don’t get caught up in the hype of an offer day or bidding war. A good strategy of waiting and seeing what happens on offer day could benefit you in the long run. Also, make your offer a good one and that doesn’t mean top-dollar or going beyond your budget. Beef up your deposit and be as flexible as possible on your closing – you’d be surprised at how far these two things can go with sellers.

My advice for sellers: holding back for an offer day could come back and bite you in the ass. Make your condo look amazing, do some small upgrades, give it a coat of fresh paint, stage it and let your condo shine and sell itself.

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch with you right away. I’d be happy to answer any questions about the March 2022 Toronto real estate numbers you have or about the Toronto market in general and share my insights on what’s to come later this year.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.