August 2024 Toronto Real Estate Market Update

We’re well into September and the fall Toronto Real Estate market is in full swing. And the August 2024 Market Stats are in so it’s time for my monthly deep dive into what’s really happening beyond all the misleading headlines out there. There is a lot of buzz about the market and the interest rate cut that took place – so let’s get into it.

Interest Rates

This is a hot topic right now, as we just saw the Bank of Canada cut rates again in September by 0.25%. Is this enough to get buyers off the sidelines? With rumours of two additional cuts coming this year, and one of those projected to be 0.5%, buyers are slowly starting to realize now is the time to get into the market.

There is a fine line between waiting for the right time, and that wait being too long, and I’m recommending to all of my buyer clients that the next couple of months is going to be the sweet spot in the market.

I know that the moment the September 4th rate announcement hit, there was a significant uptick in showings at all of my listings. And it has been busy since. It will be interesting to see how the next two announcements play out and if they’ll have the same impact on the market.

New Mortgage Rules

Finance Minister Chrystia Freeland today announced changes to some mortgage rules as part of an effort to make housing more affordable.

The federal government will increase the cap on insured mortgages to $1.5 million from $1 million, effective Dec. 15, which would allow more people to buy a house with a down payment below 20 percent.

Previously, Canadians who did not pay at least a fifth of the cost of the house as a down payment needed to take out mortgage insurance, but the insurance was available only for homes priced at $1 million or less. That limit is now $1.5 million.

In addition, purchasers will be able to take out loans for a 30-year period if they are first-time homebuyers or if someone is buying a newly built house, Freeland said. Earlier, the three-decade amortization period was limited to first-time buyers buying newly built houses.

The August numbers provided some interesting analysis, particularly in the Detached Homes segment – let’s take a look at what really happened, beyond what the numbers at a glance show.

Detached Homes

Before we jump in, let’s also look at some of the important numbers that aren’t typically reported monthly.

New Listings were down, year over year in August by 10.7%

The Quantity Sold year over year was up by 20.2%

The average price of a detached home year over year was up by 10%

Days on the market, year over year were up from 18 days to 31 days.

So let’s start by examining the big stat here – pricing is UP by 10%?! This gave me a reason to pause, as the numbers don’t play out, considering the average price was down in both the semi and condo segments. And I know the detached market isn’t moving that quickly since days on the market is now at 31 days – quite a high number for Toronto. So it was time to dig deeper.

I always say the Detached Homes market should be divided into two – the luxury market for homes above $4 Million, and those that are below that luxury price tag. Something must have been happening in the luxury market in August, and after some research, digging and analysis, I found this to be true.

There were 18 sales in August that were above that luxury $4 Million price tag, including one at $17 Million, one at $11.5 Million and one at $10.4 Million. That leaves 15 sales between $4 Million and $10 Million, with the majority of these over $5 Million. Seeing such a HUGE number of massive transactions, this of course is going to have an impact on the average price on this segment of the market.

These 18 transactions accounted for $121,604,000.00 in real estate trading, which is nearly 1/3 of the total transactions in this segment for August.

When I back out this number and compare year-over-year to August 2023, the average price of a Detached Home is $1,939,922. I then did the same for August 2023, and the average price then was $1,846,335.

This gives us an increase year-over-year of just 5.07%, not the whopping 10% the general numbers show. Still a nice increase, but no alarms are needed in this segment. We’re seeing stability and some nice slow growth.

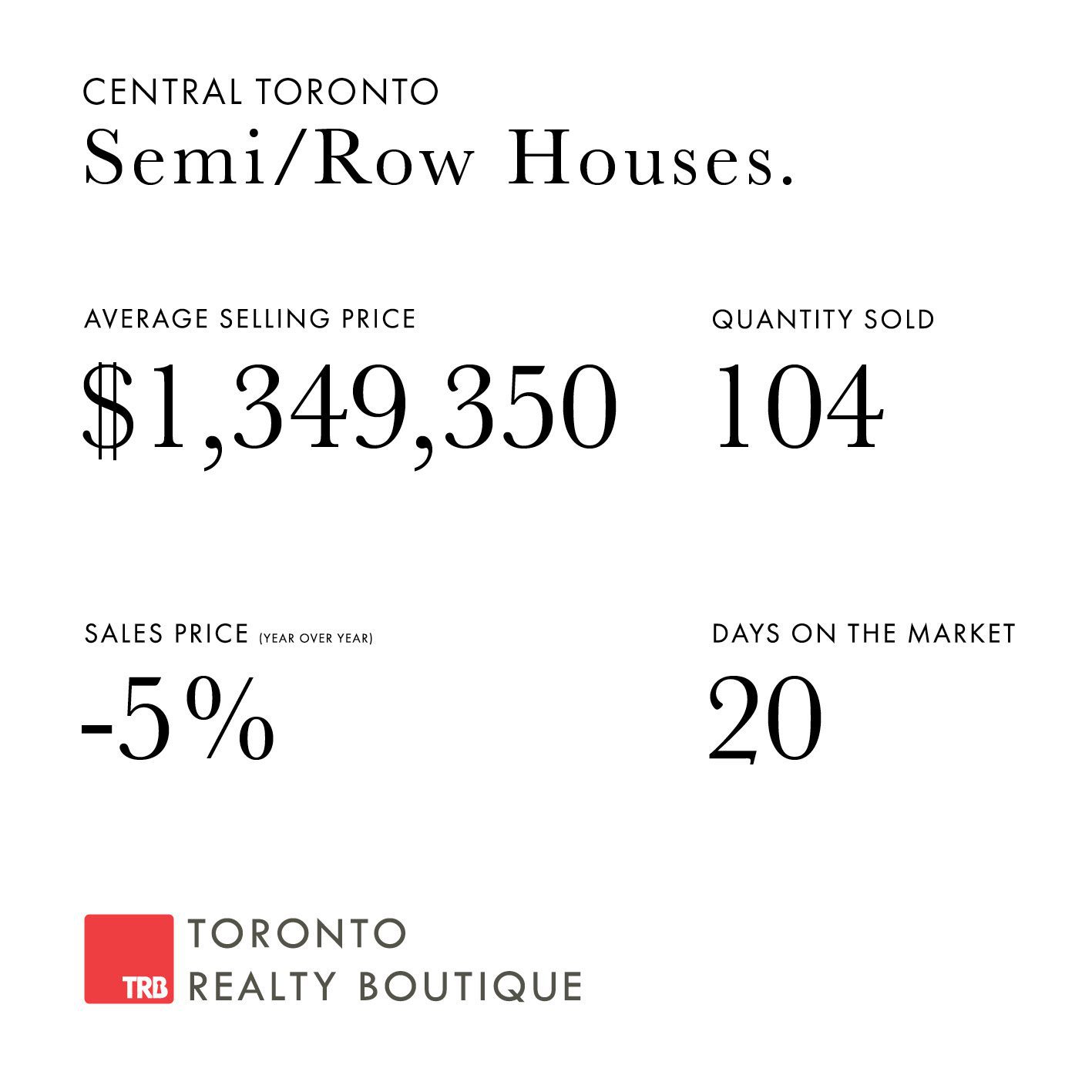

Semi-Detached & Rowhomes

New Listings were down, year over year in August by 17.1%

The Quantity Sold year over year was up by 16.1%

The average price of a detached home year over year was down by 5%

Days on the market, year over year were down from 22 days to 20 days.

The number of new listings is down in each segment, and with the 17.1% here in the semi and rowhome market, I honestly wasn’t surprised.

We’re all hearing about the record amount of travel happening, families spending more time at the cottage and simply enjoying a nice summer without the stress of listing a home.

I predict that we’ll see these numbers increase in September – I’m already seeing several of my clients eager to list their homes, saying “Now that summer is over…”. I hope buyers are ready as there is going to be a lot of inventory to choose from, and I have a feeling they’re going to start going quickly, impacting those days on the market – they’ll start to trickle down as winter approaches.

Toronto Condos

New Listings were down, year over year in August by 7.2%

The Quantity Sold year over year was down by 13.8%

The average price of a detached home year over year was down by 6%

Days on the market, year over year were up from 19 days to 26 days.

Overall in this segment, there were no surprises based on what we’ve seen in the past several months. We’ve seen a record number of new listings come on the condo market, so we were bound to see a slowdown – which we did at 7.2% year-over-year for new listings.

And naturally, we were going to see an increase in days on the market because of the sheer amount of inventory out there.

But like I’m saying to all of my condo-buying clients, now is the time! Remember when condos were being purchased with less than a day or two on the market? That wasn’t that long ago and buyers are truly in the driver’s seat right now. I’m even seeing many investor clients turn to the resale market instead of pre-construction because the opportunities are that good.

If you’re thinking about making a move into a condo, now is the time. Get ahead of the market now while you can. It’s easy to forget about the bidding wars of the past, but enjoying looking at all of the beautiful condos out there and taking your time making a decision is a luxury that won’t last that long.

And if you’re interested in checking out my latest listing – a loft-like 2-bedroom, 2-bathroom condo townhouse with parking, locker and direct street access, you can view it here: 293 Mutual Street – Just Listed today!

Working with TRB

Now besides crunching all of these numbers for my clients – you may or may not know (but hopefully you do) that I help many clients buy and sell real estate daily. I am the Founder and Lead Broker of Toronto Realty Boutique and I specialize in listing homes and condos, representing buyers of all budgets, I also do a lot of work in the Toronto pre-construction market.

You can check out some of my featured listings that are currently active here:

Toronto Realty Boutique Listings – Homes & Condos for Sale

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the May 2024 Toronto real estate numbers you have or about the Toronto market in general.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.