The February 2025 Toronto Real Estate numbers are in so it’s time to take a deep dive into what they really mean.

As we near the end of the first quarter of 2025, I’ve been getting a lot of questions from my clients about what’s really going on in the Toronto market.

Headlines continue to deceive, and the real picture is often ignored. So, I’m here to help you understand the numbers behind the facts so you can see for yourself what’s trending.

Each month I give my clients a truthful analysis of the numbers, how the market is performing and what they can expect in the coming months.

So if you’re a homeowner, thinking of buying or selling, or are an investor looking at the market, this report is for you.

March 2025 Bank of Canada Interest Rate Announcement

The Bank of Canada did not meet in February but on March 12th, they met and announced a further cut to rates by 0.25%.

Inflation is relatively low, and the economy has been slowing, so my prediction of further cuts has been correct thus far. But how far will the cuts go in 2025? Many economists believe we’ll get to a 2.5% rate—perhaps even lower—by year’s end.

If tariffs stick around and weaken the economy, the Bank of Canada may have to cut even more aggressively than they once planned.

The Overall Toronto Market in February

When looking at our start to 2025, the trend of “let’s wait and see” continues to churn for would-be buyers. We’re seeing a dip across all three market segments in the number of transactions compared to this time last year, yet listings continue to rise.

Nearly all buyers are waiting to sell their current home, before making offers on new homes, with the exception of those First-Time Buyers who are in a prime position in today’s market.

Now continues to be one of the best times to buy in Toronto in recent memory – there’s the combination of inventory of many beautiful homes, lowering interest rates and no-pressure buying that has many paying attention and watching to see what will happen next.

Let’s take a look at each market segment in Toronto to see how February performed when it comes to the numbers.

Detached Toronto Homes – February 2025

I’ve also included some stats below that I like to look at in addition to the above.

New Listings were up, year over year in January by 8.35%

The Quantity Sold year over year was down by 11.39%

The average price of a detached home year over year was up by 15%

Days on the market, year over year were down from 24 days to 15 days

As of the end of Feb there was just under 3.5 months of inventory on the market

OK so whenever I see a massive number like pricing is UP 15% year-over-year, I stop dead in my tracks and ask what the hell is really going on here. Obviously something doesn’t add up.

And since we’re looking at detached homes, we must examine the luxury market and the impact it had on the February numbers. I consider the luxury market any detached home over $4 Million. So let’s see what really happened.

In February 2025, there were 16 homes over $4 Million that sold, including four homes over $11 Million and one home over $27 Million. This of course is going to skew the numbers as these 16 sales accounted for one-third of the volume of detached homes sold in February.

Let’s back these out and see what we get.

The average price of detached homes under $4 Million sold in February would then be $1,961,403.00.

Doing the same exercise for 2024, and comparing the average price then of $1,988,401.00, we see the average price for Detached Homes in Toronto down 1.36% – essentially flat. NOT up by 15%.

The big lesson here is if it sounds too good to be true, it usually is and requires further digging. But a flat number year-over-year is actually a good sign for a February market. Many are waiting for the Spring season to kick off, so I predict things will be changing soon.

Another positive to note is the dramatic decrease in Days on the Market – buyers are becoming more decisive as we sit in a nicely balanced market with 3.5 months of inventory currently available.

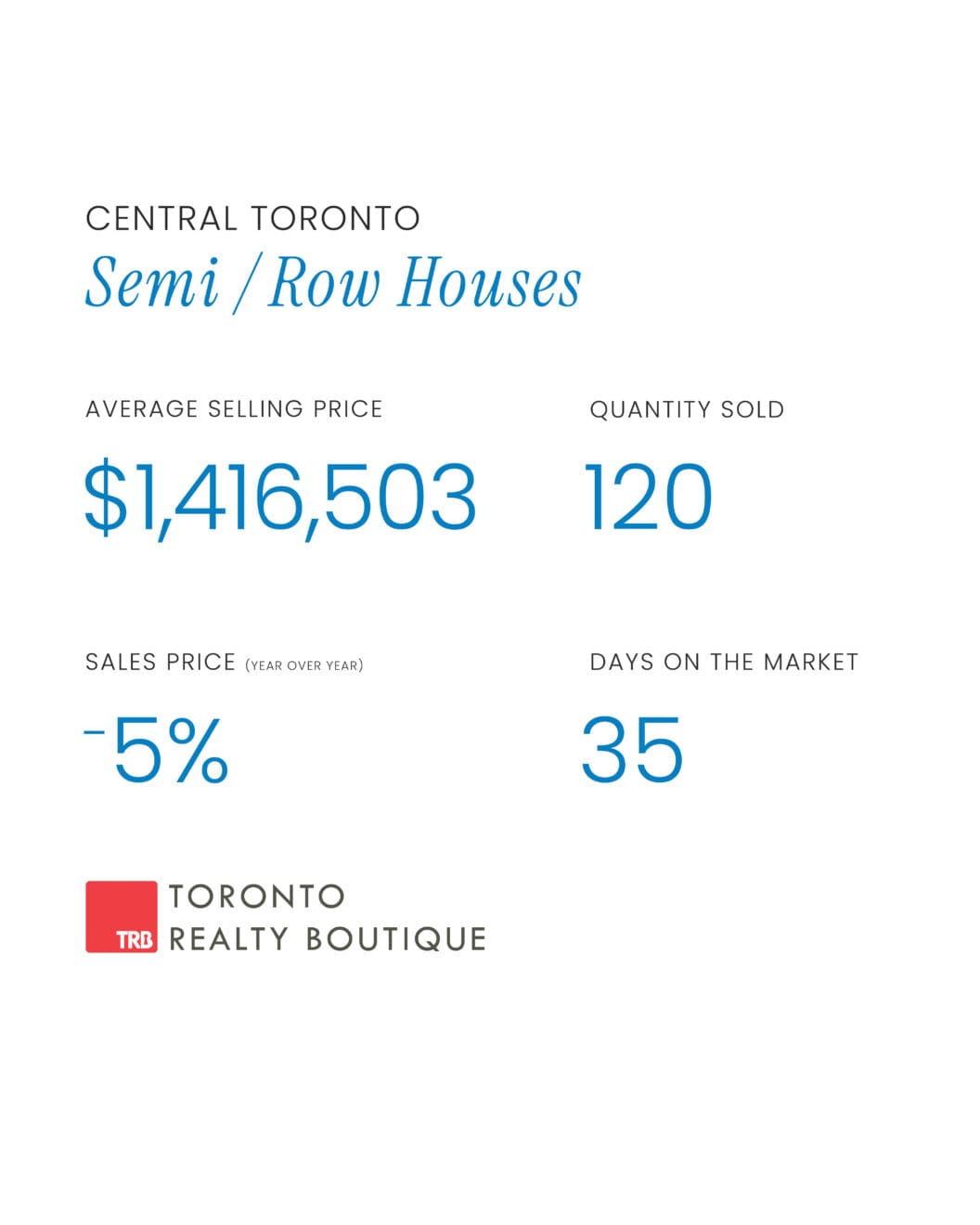

Semi-Detached & Row Homes – February 2025

New Listings were up, year-over-year in February by 10.13%

The Quantity Sold year-over-year was down by 9.77%

The average price of a semi-detached home-year-over year was down by 5%

Days on the market, year-over-year were up from 22 days to 35 days

As of the end of Feb, there was just under 1.5 months of inventory on the market

The big question I’m getting about this segment is around that 1.5 months of inventory and how that relates to pricing being down. 1.5 months of inventory typically means we’re sitting in a seller’s market but something is off here. Let’s dive in.

When I looked deeper into what’s happening with all of these listings, I saw a massive trend within this segment. Many sellers are pulling their listings and pausing the sale, as they wait for the predicted busy spring market to start. Rather than sitting on the market with days ticking away, they’re taking a break with plans to relist in the coming months.

This explains the ups and downs in the numbers and how they’re being presented at face value.

A big indicator of segment performance here is Days on the Market, which are up significantly. This shows that buyers are indeed taking their time and continue to be patient with their offers on homes they love.

For sellers, we see that they are motivated and willing to negotiate considering the dip in year-over-year pricing. Again, another proof point that now is the time to buy.

February 2025 Toronto Real Estate – Toronto Condos

New Listings were up, year-over-year in February by 2%

The Quantity Sold year-over-year was down by 13.3%

The average price of a condo year-over-year was up by 2%

Days on the market, year-over-year were unchanged at 27 days

As of the end of February, there was just over 5 months of inventory on the market

One of the key factors I’m looking at within the condo market is how many months of inventory we’re sitting at. In January we had just under 8 months of inventory available, putting us firmly in a buyer’s market.

But now we’re sitting at just over 5 months of inventory as we finished out February. That’s a significant drop. So what’s really happening?

Many sellers in this segment are pulling their listings. And not for the same reasons as in the semi and row-home segment. Many condo sellers are deciding to stay put for a while and ride out the influx of inventory. Many investors have decided the same – keep their condos and current tenants and not compete for the few buyers that are out there.

To further illustrate this point, pricing is stable with the 2% increase, the number of new listings is only slightly up, and days on the market are completely flat year-over-year.

So, we’re currently in a market where both buyers and sellers are holding firm for what they want and will remain this way for some time. If sellers don’t get their price, they won’t sell, and if buyers don’t get their offer accepted, they’ll wait as well.

I see this as a positive for both buyers and sellers showing stability on both sides – no one is fire selling and buyers are not paying inflated prices due to the lack of availability.

Working with TRB

Now besides crunching all of these numbers for my clients – you may or may not know (but hopefully you do) that I help many clients buy and sell real estate daily. I am the Founder and Lead Broker of Toronto Realty Boutique and I specialize in listing homes and condos, representing buyers of all budgets, I also do a lot of work in the Toronto pre-construction market.

You can check out some of my featured listings that are currently active here:

Toronto Realty Boutique Listings – Homes & Condos for Sale

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the February 2025 Toronto real estate numbers you have or about the Toronto market in general.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.