The July 2023 Toronto real estate numbers are in so it’s time to take a deep dive into what they really mean, rather than reporting them without any context, as most do. It’s always a good idea to read beyond the headlines, because the numbers always show the real picture.

I’m sure you’re familiar with my monthly reports where I dig into what the numbers mean and what’s happening in the market. My background is based in numbers (I was the head of finance for a big Toronto ad agency prior to real estate), so my approach to the market is very numbers-focused.

What you may not know (but hopefully you do) is that I help many clients buy and sell real estate on a daily basis. I am the Founder and Lead Broker of Toronto Realty Boutique and I specialize in listing homes and condos, representing buyers of all budgets, and I also do a lot of work in the Toronto pre-construction market.

So, if you’re thinking about buying or selling and want a Broker that can not only represent you better than anyone else but who can also sort through the numbers and help you make the best move, don’t hesitate to contact me anytime.

Now let’s get into the July numbers.

Overall Market Sentiment

I like to start with what’s happening with the overall market and how many are feeling about Toronto Real Estate in July. Topics like rate hikes, the rental market, pre-construction investing, and the summer slowdown are all being discussed frequently. Buyers, sellers, and investors have a lot of questions. Here are some I’m getting from my clients:

Will Rates Go Up Again?

My thoughts: while no one has a crystal ball, but based on how inflation continues to drop, I would say another rate hike in the near future is unlikely. But, if we do see one, there is no way it’s going to be more than by .25%. The strategy of raising rates to lower inflation is working – at this time last year inflation was sitting at 7.6%, and as of June 2023, inflation was sitting at 2.8%. Although it went up slightly as announced on August 15th, I still don’t see that as being significant enough for the Bank of Canada to react immediately.

Is it a Good Time to Start Investing in Real Estate?

I always look at it like this – historically, rents are going up and the likelihood of them going down significantly is zero. Rates have gone up, yes, but they will come down. The short-term pain of a larger carrying costs is worth buying at today’s pricing, rather than the pricing of tomorrow. Now is a great time to buy – no bidding wars, plenty of investor-friendly inventory and a reliable condo market here in Toronto. I always tell my clients you make money on the buy, not the sell. (Hint – look at some of the amazing Assignment Sales out there right now)

What’s Really Happening with Pre-Construction in Toronto?

Many of my clients saw headlines this week saying that pre-construction developers have dropped prices for the first time in 10 years. This made me shake my head and wonder where that stat came from. There are a lot of projects out there, and it’s a challenge to sift through all of the options and know what the good ones are (that’s what your VIP Broker is for). Let’s just say that if a developer is dropping prices, you may want to think again about buying there.

I don’t know one developer I work with (and that’s a lot) that have even thought about price drops. And there are many projects coming this fall that are tremendous investments that will fly off the shelves. There is no better time to get into pre-construction than this fall with the few developers that are bringing exceptional buildings to the market for both investors and end-users.

Coming in September: Bellwoods House

Coming in October: Q Tower

Now let’s jump into the July 2023 Toronto Real Estate numbers.

Toronto Condos

Let’s start by looking at some of the stats I examine that aren’t widely reported.

The year-over-year quantity sold is sitting at 595, which is exactly the same number as this time last year.

Year-over year new listings are up 34.5%

The year-over-year days on the market are up from 20 days to 23 days

Year over year price is up 2%

One of the most interesting numbers within the Condo segment this month is the significant increase in new listings – a staggering rise of 34.5% compared to the previous year. In 2022, we have to remember that the major summer slowdown was upon us and many were holding to see what was going to happen to rates. Now, as we get into the middle of our summer this year, many are making moves.

One of the most interesting numbers within the Condo segment this month is the significant increase in new listings – a staggering rise of 34.5% compared to the previous year. In 2022, we have to remember that the major summer slowdown was upon us and many were holding to see what was going to happen to rates. Now, as we get into the middle of our summer this year, many are making moves.

But what’s causing this major increase in listings? Some headlines will lead you to believe all investors are dumping their suites and running away. Is there any truth to that? Perhaps – some are getting out of the game mainly because they made the wrong buying and financing decisions. But again, it’s all about the strategy and your big-picture plan when you’re an investor.

I don’t see many condo owners selling their suites to become renters. Rents are through the roof and the competition for 1-bedroom rentals is the fiercest it has ever been. 24-hour listings with 20+ offers – it’s happening, and condos are renting out for way over ask.

So, what’s driving the condo market – it’s the cycle of real estate. Many first-time buyers are looking to move out of their condos and up in the market. Lifestyle changes – marriages, children, new jobs, new locations – these type of life influences never stop and neither does the market.

Advice for Buyers: with the surge in inventory, now is the time to get out there and look. If you’re a first-time buyer and have your finances in order, your pre-approval in hand, and know your needs and wants, get out there and look! There is so much to choose from and you have time on your side.

Advice for Sellers: If your selling strategy is to list and make bigger moves in the market – do it. Get out there because now is the time to buy. But if you’re selling out of fear, don’t. Hold on and don’t let the headlines mess with your strategy. Get the facts, get the real numbers, and assess your situation for the next few months. You may be surprised at what you can hold on to rather than selling out of fear.

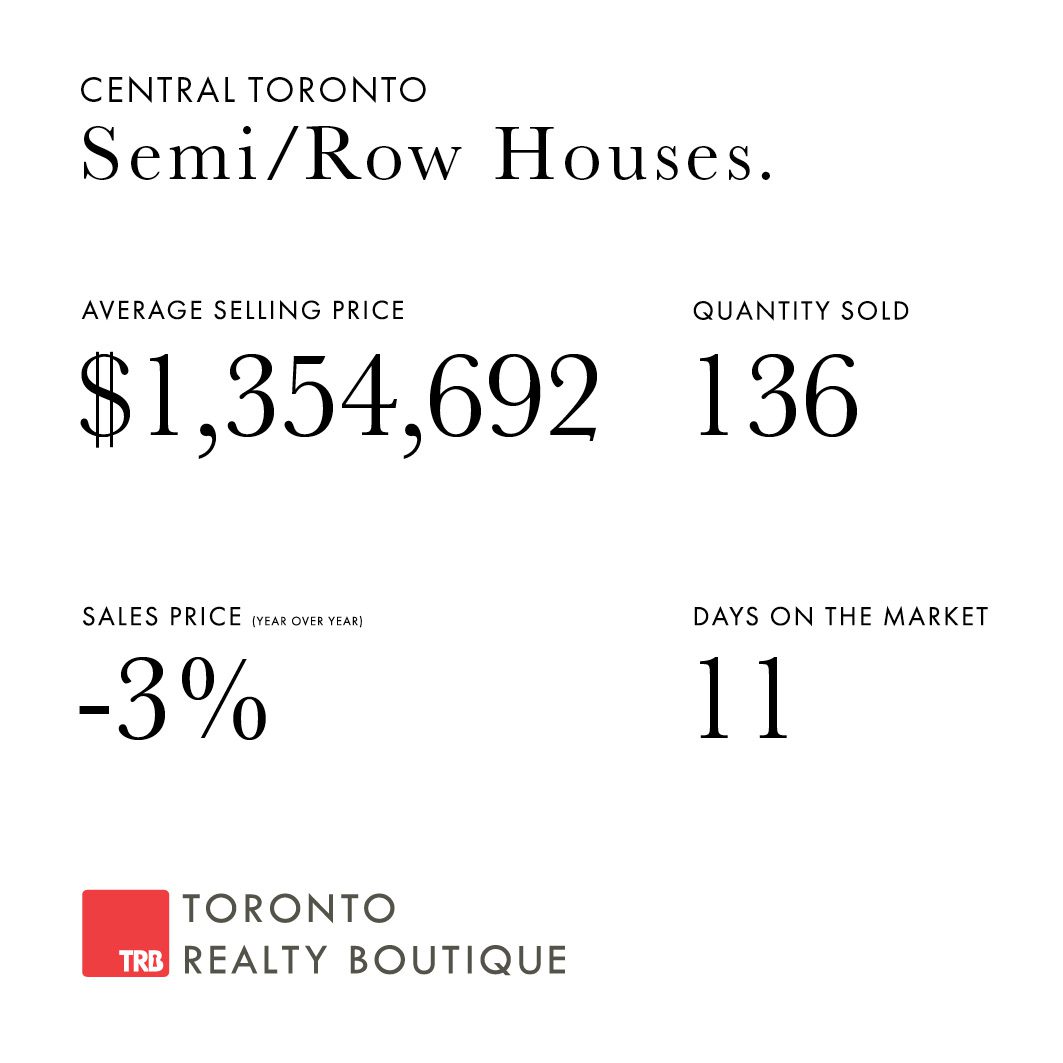

July 2023 Toronto Real Estate: Semi-Detached and Row Homes

Let’s look at some of the stats I examine that aren’t widely reported.

The year-over-year quantity sold is down 8.1%

Year-over-year new listings are up 17.8%

The year-over-year days on the market are down from 17 days to 11 days

Year over year price is down by 3%

The first thing we need to acknowledge here is that once again, we saw a rate hike and this highly rate-sensitive segment of the market was very quick to react.

The first thing we need to acknowledge here is that once again, we saw a rate hike and this highly rate-sensitive segment of the market was very quick to react.

We’re seeing slightly diminished demand, with a decrease of 8.1% in the quantity sold compared to the previous year. This decline suggests a level of cautiousness among potential buyers, obviously due to the most recent rate hike.

We see a pretty big number in the year-over-year listings, being up from 2022 by nearly 18%. What does this say to me? Sellers are sick of the waiting game and aren’t going to put life on pause any longer.

Remember – taking the next step in life isn’t dependent on the real estate market. Families grow, new jobs are accepted, and moving into a new home is sometimes a huge part of the equation. Why wait when you can adjust your strategy and keep moving onwards and upwards?

Another interesting number I wanted to look at is the days on the market. When these fluctuate by a day or two, I don’t really take notice, but this number has decreased by 6 days which means that buyers who are in the market right now, are moving a lot faster today than they were a year ago. This is promising for sellers who are priced well at market value and know the worth of their home.

Advice for Buyers: Inventory is increasing so get out there and look. You’re still in a very good position in the market right now so if you’re thinking of starting to look for a new home, now is a good time. August is typically a slow month in resale, so get out there and look at all of the inventory available. There will be a lot more competition in September and October so I recommend getting ahead of them now if you can.

Advice for Sellers: Homes that are priced right and positioned well are selling so don’t be shy to list now. The fall market promises to be a busy one, but that doesn’t mean you should wait – many others are waiting too, and if you think there are a lot of listings now, wait until September and October. By getting on the market now, you’re going to get those serious buyers that want to get into the market before the busy fall season when there will be a lot of competition for buyers’ eyes.

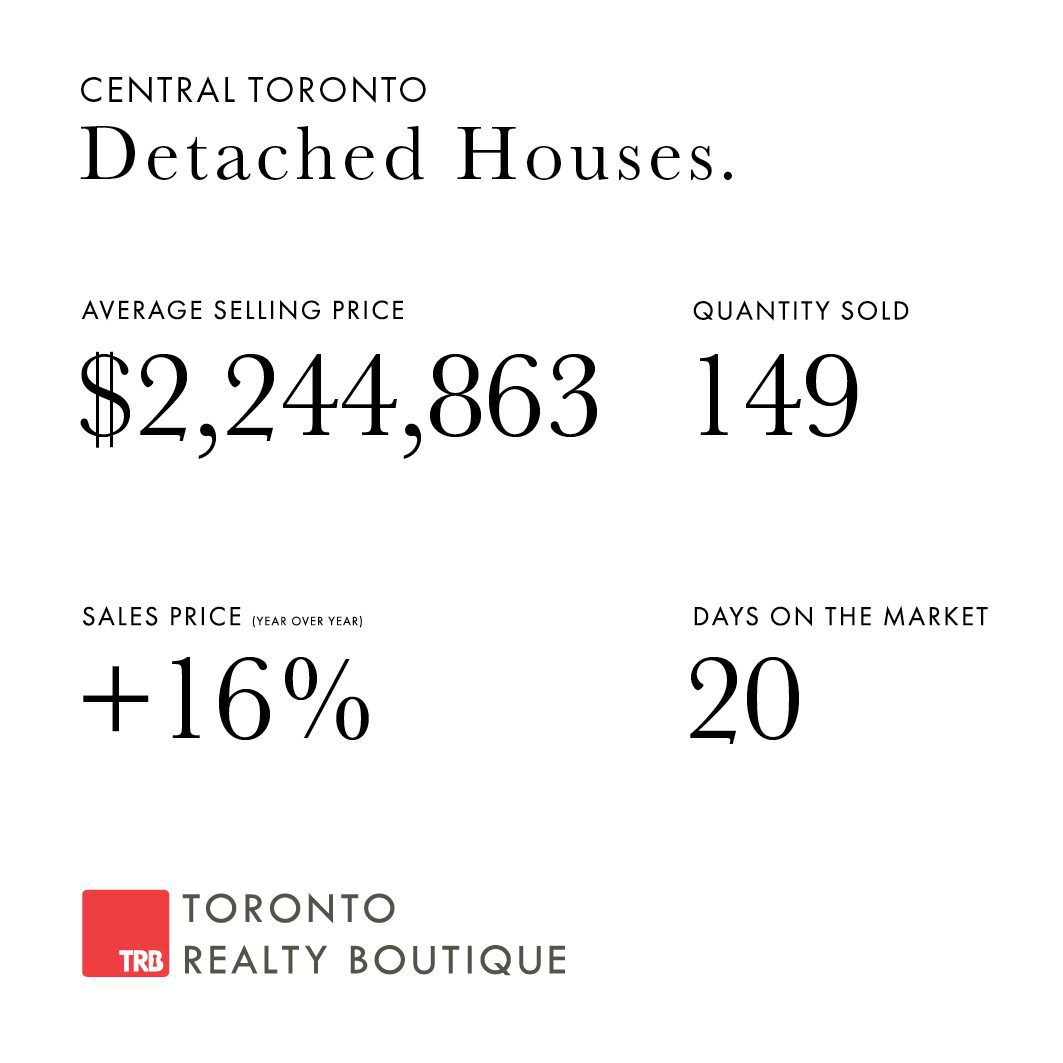

July 2023 Toronto Real Estate: Detached Homes

Let’s start again, by looking at some of the stats I examine that aren’t widely reported.

The year-over-year quantity sold is sitting at 149, which is exactly the same number as this time last year.

Year-over-year new listings are down 6.9%

The year-over-year days on the market are up from 16 days to 20 days

Year over year price is up 16%

Whenever I see a massive jump in the pricing year over year, especially within the detached homes segment, I stop and re-examine things with particular consideration for the luxury market.

Whenever I see a massive jump in the pricing year over year, especially within the detached homes segment, I stop and re-examine things with particular consideration for the luxury market.

Let’s take a look. When you back out the luxury market, which we will define as anything that has sold for over $4,000,000, the average price for July 2023 would be $1,870,432 with 7 homes over $4M, and the Average price for July 2022 backing out luxury is $1,845,145, with 17 homes over $4M

That makes the year-over-year increase only 1.37%.

Interesting what just a few homes at luxury prices can do to this segment, isn’t it? Let this be a reminder to really dig into the numbers when things don’t seem as they look.

So, the “average” detached home increase was 1.37%, which we can call flat. I took a second look when I saw that only 149 detached homes traded in July 2023. Doesn’t that seem really low?? It does to me.

What does this mean? We can combine a number of factors in this slowdown – summer months of school holidays, vacations, interest rates, buyers and sellers pausing until the fall – the perfect storm of a very quiet detached homes market.

I think the fall will be very busy in this segment, so we’ll have to wait and see what happens. Everyone is back into their routines, and instead of thinking about the cottage or vacations, buyers and sellers will likely be back into the game big time.

Advice for Buyers: If you find something you love right now, I recommend making a move. With the lack of competition and the number of days on the market trending up, you may find yourself in a very good position to make a solid offer that will be accepted.

Advice for Sellers: I recommend waiting until the fall market. Let’s see what happens with the number of days on the market in my next report to determine what the short-term trends are saying. With the lack of buyers out there right now, you don’t want to run the clock and give the impression of desperation when September rolls around. Sit tight but be ready.

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the July 2023 Toronto real estate numbers you have or about the Toronto market in general.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240