The June 2023 Toronto real estate numbers are in so it’s time to take a deep dive into what they really mean, rather than reporting them without any context, as most do. It’s always a good idea to read beyond the headlines because the numbers always show the real picture.

I’m sure you’re familiar with my monthly reports where I dig into what the numbers mean and what’s happening in the market. My background is based in numbers (I was the head of finance for a big Toronto ad agency prior to real estate), so my approach to the market is very numbers-focused.

What you may not know (but hopefully you do) is that I help many clients buy and sell real estate on a daily basis. I am the Founder and Lead Broker of Toronto Realty Boutique and I specialize in listing homes and condos, representing buyers of all budgets, and I also do a lot of work in the Toronto pre-construction market.

So, if you’re thinking about buying or selling and want a Broker that can not only represent you better than anyone else but who can also sort through the numbers and help you make the best move, don’t hesitate to contact me anytime.

Now let’s get into the June numbers.

The Latest Interest Rate Announcement

The Bank of Canada announced today, July 12th, that they have increased interest rates yet again, by 25 basis points, bringing the overnight rate to 5%.

Many are surprised by this latest hike – I mean, they just did this at their June meeting, so why again now? Many believe this is a way to double down on moving in the right direction, rather than things jumping out of control again.

At the end of the day, it’s easier to increase now and err on the side of caution, knowing they can cut rates at any time, rather than doing too little in the near term.

Analysts believe this will be the final hike of the cycle, but there is still the risk of additional hikes in the future if necessary, to battle stubborn inflation.

But inflation is currently sitting at 3.4%, a far cry from one year ago when they were sitting at 8.1% in June 2022. This gives me hope that this will indeed be the final hike of the cycle and that rates will now normalize at this level, if not drop. But don’t expect that drop this year – it will be a while until we see that type of announcement.

The Overall Toronto Real Estate Market

Let’s look at the main headlines when it comes to the June 2023 Toronto real estate numbers. You’re reading that everything is UP!! Hooray, right? Well, not so fast. I’ve got a warning for you about what you’re going to see in the headlines coming up in the next few months.

Last year in June 2022, we saw the third interest rate hike in a row – 25 basis points in March, 50 basis points in April, and 50 basis points in June. At this point, the market was coming to a screeching halt.

All of the pre-approvals that buyers had in hand with the ultra-low rate were expiring or used, and many adopted the wait-and-see attitude of what’s going to happen with rates. I don’t have to tell you how slow it was last summer and now we’re seeing the other side of that particular coin.

So when we start seeing the year-over-year numbers soar, don’t forget what happened in the market one year ago. I’m willing to bet that the media is going to forget and when we start seeing the headlines later this summer that home prices are going up year over year by double-digits, remember reading this warning.

Don’t get caught up in the hype – remember to look at what’s being reported versus what’s actually happening. It’s going to be an interesting time in real estate, but don’t think the market is getting out of control.

It will be important to look at the month-over-month trends to see what’s really happening. And proof of that is in the June 2023 numbers. Let’s examine each segment in the Toronto market.

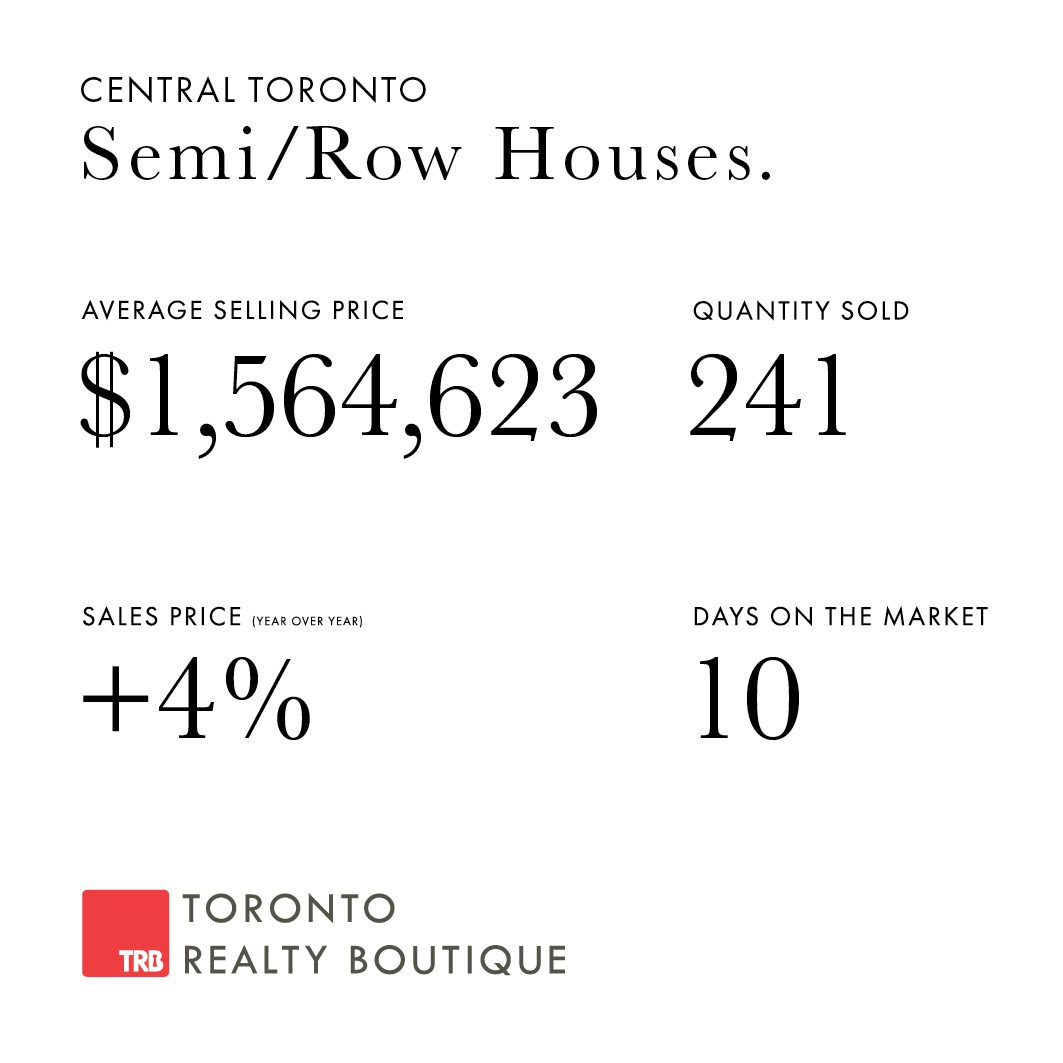

June 2023 Toronto Real Estate: Semi-Detached and Row Homes

I always like to start things off by looking at some additional numbers that aren’t widely reported to help give a bit more context to my analysis.

The year-over-year quantity sold is up 18.1%

Year-over-year new listings are down 19.7%

The year-over-year days on the market are down from 11 days to 10 days

Year over year price is up just over 4%

Month-over-month prices are up 1.1%

I’m going to say this once again, but this segment of the market is always the first to show any kind of reaction to rate hikes as they’re the most rate sensitive. So a big win here within this segment is that although the news of the rate hike came into play, we still saw solid activity with buyers.

The quantity sold is up, the days on the market are down, and pricing is up both month-over-month (most important here) and year-over-year. So what’s to come?

With the news of this latest rate hike in July, coupled with the typically slow summer season, I predict we won’t see the same next month. But I do believe we’re going to see another increase in the year-over-year pricing, because of all that I stated about the market in 2022.

Let’s get this straight – buyers are still buying, and sellers are still listing. But it’s going to be an interesting time to interpret the numbers to determine what’s really going on.

My Advice for Buyers: work with a mortgage broker that can assist in getting you into the right mortgage term that works for you. You’ll want to be able to buy now because it’s an excellent time in the market, but you’ll want to refinance in the future to take advantage of the lower rates that will be coming in the next year or two.

There are always ways to make the market work for you – you just need the best team working for you to make it happen. Because who wants to live their life based on rates – there is always a way.

Advice for Sellers: I’m going to be really honest here – wait until the fall market to list. Spend the summer making your home look incredible – paint, do small improvements, up your landscaping game – make your home stand out from the others.

Pricing is on an upward trend and with no Bank of Canada meeting in August, you’ll be positioning yourself for the prime selling season this fall.

Toronto Condos

Let’s start again by looking at some of the stats I examine that aren’t widely reported.

The year-over-year quantity sold is up 13.8%

Year-over-year new listings are up 2.6%

The year-over-year days on the market are up from 14 days to 19 days

Year over year price is up just over 2%

Month-over-month prices are down 2%

The surprising stat here is the small decrease in pricing month over month. It’s very small – only by 2%, but nevertheless, it’s the first time we’ve seen this in a few months so it’s something I’ll be keeping my eye on.

When we look at month-over-month quantity sold, we’re sitting at about 17.1% less than in May 2023. This drop in demand is likely the reason for this small drop in pricing.

Once again, we’re starting to see the year-over-year pricing creep up, and I’m going to bet we’ll continue to see that in the condo segment for the rest of this year. But if the numbers start to increase by double-digits, which they likely will, just remember what I said before about what we went through this time last year.

The July stats will be a good indicator of what’s to come, and I don’t think the latest rate increase will have an impact. Buyers in this segment will always be active because it’s the busiest of them all. First-time buyers, downsizers, investors, city lovers, and even students. It’s one of the best places for your money regardless of what category you fall into.

Advice for Buyers: the summer months are always a good time to buy in the condo segment. But I would advise buying now, as soon as possible. With the school semester starting in September, the condo market will soon be busy with competition as students (well, their parents) look for places to live for the upcoming year.

You’ll have less competition now than you will in August, making your experience a positive one.

Advice for Sellers: if you’re thinking of selling, August is the perfect time. With the influx of students looking for a home for the next few years, it’s going to be a busy time – it always is during the few weeks before school starts. And although days on the market are trending upwards, it’s wise to hold on your pricing if you’re priced well. This is not the time to be holding back offers in the condo market.

Have a bit of patience and you’ll be rewarded with a good sale.

June 2023 Toronto Real Estate: Detached Homes

Let’s start again by looking at the numbers I use that aren’t widely reported.

The year-over-year quantity sold is up 3.61%

Year-over-year new listings are down 17%

The year-over-year days on the market are up from 11 days to 13 days

Year over year price is up 5%

Month-over-month prices are down 5.3%

The detached homes market is typically fuelled by buyers that are upsizing and the month-over-month trends have been both up and down this year so far. When we see that new listings are down 17% year over year, it does indicate that things are slow within this segment.

Many that are in a detached home typically sell to go into a larger detached home or into a new neighbourhood. With limited listings on the market, many may simply be just sitting tight until more inventory becomes available.

Which makes sense – if you’re in a good place and don’t need to sell, why start looking for a new home to move into? Why pick something you don’t love? Days on the market are also up to nearly two weeks, which shows that buyers are taking their time and not jumping at the first chance they get.

We see here yet again, that the year-over-year price is up by 5%, again reminding us to look at where we were last year at this time. Things were starting to get pretty slow in this segment, so watch for the year-over-year numbers to start to creep up over the next few months.

But let’s keep looking at that month-over-month trend – I’m not sure what the summer months will hold, but with cottage country in full bloom and the travel season in full swing, I’m predicting a typically quiet summer before the busy fall selling season that begins the Tuesday after Labour Day.

Advice for Buyers: take advantage of the quiet in the market. This means there is very little competition in the market so you really should be out looking. I’ve seen some pretty incredible detached homes in some of the best neighbourhoods that are fairly priced. These should be selling so don’t think there is better to come in the fall. With more inventory and selection comes lots of competition – so take that into consideration when mapping out your buying strategy.

Advice for Sellers: with such low inventory on the market, now is actually an incredible time to list. It may take a little longer – no overnight offers to be expected, but if you’re priced right, you’re going to see showings and an offer. Stick with your market price and you’ll be happy you did. It will be a low-stress situation and not the pressure of so much competition that could be building up with the fall selling season.

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the June 2023 Toronto real estate numbers you have or about the Toronto market in general.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.