The May 2023 Toronto real estate numbers are in so it’s time to take a deep dive into what they really mean, rather than reporting them without any context, as most do. It’s always a good idea to read beyond the headlines because the numbers always show the real picture.

One question I received recently is why my stats vary slightly from the larger numbers reported widely. There is a good reason for that. I believe each district is different and performs differently in each market. For instance, combining Toronto with Peel or Durham doesn’t really make sense for my clients. My numbers focus on Toronto Central, so that’s what you’ll get from me.

I’m sure you’re familiar with my monthly reports where I dig into what the numbers mean and what’s happening in the market. My background is based on numbers (I was the head of finance for a big Toronto ad agency prior to real estate), so my approach to the market is very numbers-focused.

What you may not know (but hopefully you do) is that I help many clients buy and sell real estate on a daily basis. I am the Founder and Lead Broker of Toronto Realty Boutique and I specialize in listing homes and condos, representing buyers of all budgets, and I also do a lot of work in the Toronto pre-construction market.

In fact, I have an incredible condo listing that just hit the market this week – a stunning $2,450,000.00 condo at Waterworks Residences. Now this is one of the most popular buildings in Toronto but what makes this suite so special is that it looks like it’s straight out of an interior design magazine, and those CN Tower views?!

You can check it out here: Residence 1117 at Waterworks Condos – 505 Richmond Street West

So, if you’re thinking about buying or selling and want a Broker that can not only represent you better than anyone else, but who can also sort through the numbers and help you make the best move, don’t hesitate to contact me anytime.

Now let’s get into the May 2023 Toronto Real Estate numbers.

A Note About Interest Rates

First, I’d like to take a quick moment to discuss interest rates and what’s happening here. I’m sure you know, on June 7th the Bank of Canada raised its benchmark interest rate to 4.75%, an increase of a quarter-percentage point in its first hike since January.

Although not a significant raise, it’s significant in another way, and that is in the messaging from the Bank of Canada. A close eye is being kept on the real estate market, and this was a good strategy to take a little steam out of the current Spring market that was starting to pick up pace rather quickly.

The next Bank of Canada meeting is on July 12th so what can we expect? No one has a crystal ball, but I don’t expect another rate hike at this time. Since they held for two months and then implemented the smallest raise possible, I have a feeling they may want to wait and see what happens before making another move.

I do predict we’re going to see another hike at least one more time this year – it’s just a matter of when.

This brings me to one question I get nearly every single day as a real estate broker – is now a good time to buy a home? And you know what, no one thinks it is a good time. One of the big things that’s holding everyone back is interest rates and how high they seem. Many don’t remember the rates in the 80’s – we’re talking 18% – 20%, so remember – things can always go higher.

But the most important thing is once you wait until rates go down, the market is going to go wild. Everyone thinking about buying a home is going to be out there and prices are going to go through the roof once again. So pick your poison – high interest rates now that aren’t actually high, or inflated home prices once they come down.

It’s incredibly important to know the numbers and run different scenarios so you make the best choice for you and your current situation, as well as your long-term goals.

Toronto Condos

Let’s start by looking at some of the stats I examine that aren’t widely reported.

The year-over-year quantity sold is UP – 34.5%

The year-over-year quantity sold is UP – 34.5%

Year-over-year new listings are down 10.7%

The year-over-year days on market are up from 12 days to 18 days

Year over year price is up just over 0.5%

Month-over-month prices are up 2.8%

Let’s start with the big number here of quantity sold year over year being up nearly 40%. That’s a big one to pay attention to, and here’s why. This is the first time in 2023 we’re seeing the number of monthly transactions go up, instead of down, year-over-year.

In 2022, during the month of May, we were starting to see the slowdown due to the interest rate hikes, and now in May 2023, we’re starting to see the impact of two rate holds in a row – people are getting back into the market with a feeling of stability.

So now to further our quest for stability in the Condo market – because let’s be honest – a stable market is one that all buyers and sellers can rejoice in, let’s look at where we are at year to date when it comes to pricing. A good five-month picture will show where the trend is heading.

Year to date, condo prices are up an average of $76,758.00 or 9.5%. I’m liking how that looks and feels, and as a condo owner, you should too.

So, what’s to come? I have very high confidence in this segment of the market, so I see the trend continuing here. A nice steady climb for the rest of the year. Solid, dependable, trustworthy, stable – everything one wants to see in an investment.

Advice for Sellers: if you’re looking to sell to move up into a larger condo, a semi or detached home, don’t let the short-term pain of slightly higher rates deter you from selling and moving up. It’s better to be paying a higher rate for a short period of time, versus paying possibly $100k or more in a highly competitive market. And it’s coming.

Advice for Buyers: my biggest recommendation if you’re looking to get into the condo market is to seriously consider an Assignment Sale. I’ve never seen the Assignment market as it is now – people are selling at original pricing and there are some incredible deals out there. You’ll get an incredible price on a brand-new condo, and if you’re buying right, you can be moving in this summer or fall.

Not familiar with Assignment Sales? Check out my eBook on them here: Everything You Need to Know About Assignment Sales. As an expert who has done hundreds of Assignment Sales on both the buyer and seller sides, I promise this is a big opportunity that not many are looking at.

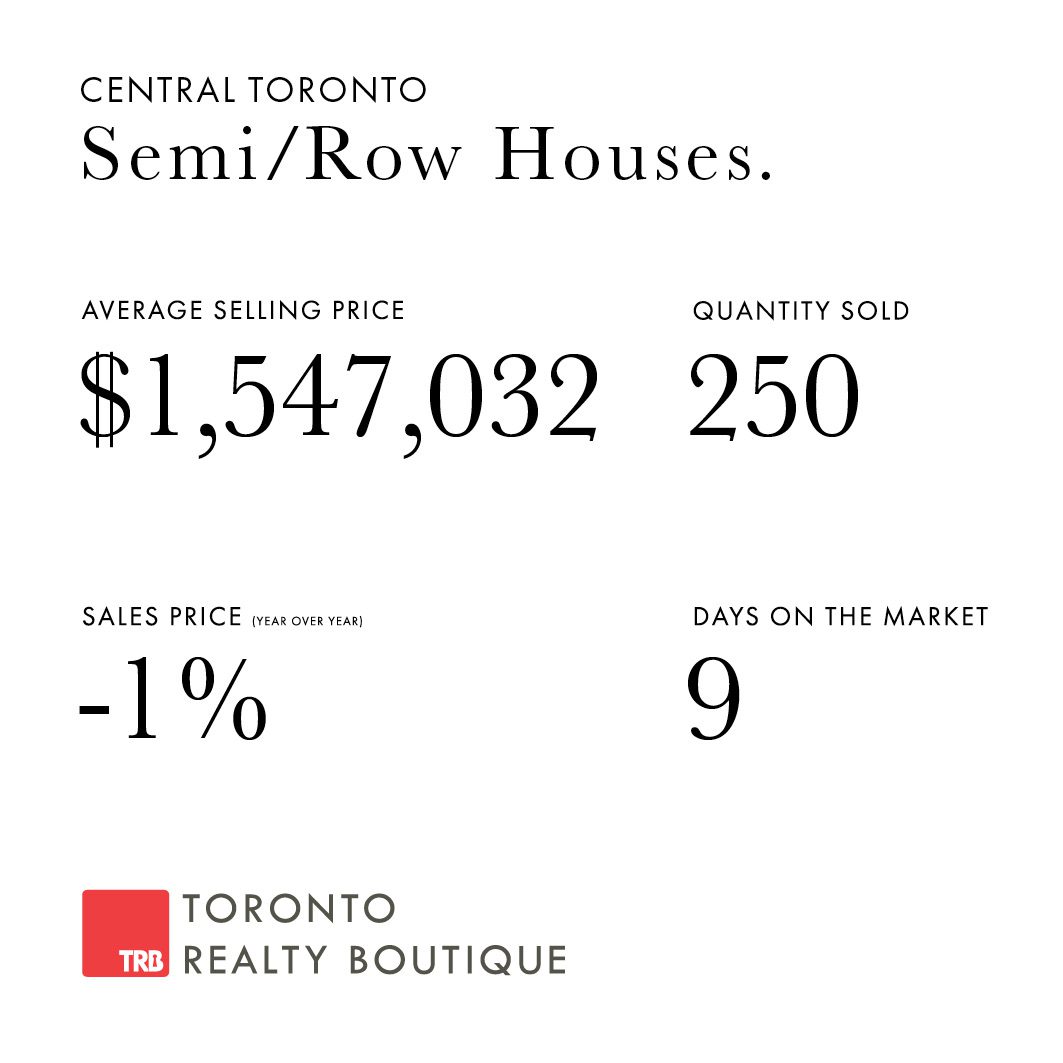

May 2023 Toronto Real Estate: Semi-Detached and Row Homes

Let’s start again with some of the unreported numbers that are important in our analysis.

The year-over-year quantity sold is down 2.3%

The year-over-year quantity sold is down 2.3%

Year over year new listings are down 39.4%

The year-over-year days on market are flat at 9 days

Year over year price is down 1%

Month-over-month prices are flat with a $3,349 increase

Being incredibly rate-sensitive, many buyers and sellers are in a holding pattern – wait and see what happens with rates. Perhaps the two-month hold wasn’t enough to bring confidence back, so many are keeping that pause button pressed.

Many of the key numbers here year-over-year are flat. So, is this really going to sway your decision to buy or sell? Most within this segment are moving up into bigger homes, usually due to an expanding family. So, you can only sit and wait for so long – rates can’t dictate your lifestyle forever.

I think many within this segment are going to lay low throughout the summer months and watch for the next few rate announcements before making a move. The fall market will be interesting, particularly here, because if things continue to hold or even go up slightly with .25% like in June, many buyers and sellers will become active.

We’ll see more and more listings come to the market and buyers will be picking them up. Because a year of waiting is going to be too long, and once the fall market is over, many will have to wait until the Spring to capitalize on a busy trading season.

Advice for Sellers: take advantage of the low inventory in the market right now. What’s being listed in the market right now is selling – just don’t expect bidding wars and 24-hour sales. Take your time, price your home right, and have patience. It will be worth it because there are buyers in the market looking for amazing homes. Make yours stand out and you’ll be pleased with the end result.

Advice for Buyers: this is a risky one, but I am leaning towards advising to buy before selling. Get yourself a long close and give yourself some time to sell. With the low inventory in the market right now, it is likely more challenging to find the perfect home than sell your current one. But again, you’ll need to prioritize finding the best new home for you over getting the highest price for your current home. There has to be a tradeoff, and when you’re in your new home you’ll be glad you took this risk.

May 2023 Toronto Real Estate: Detached Homes

Again, some of the numbers I look at are below:

The year-over-year quantity sold is UP 28.7%

The year-over-year quantity sold is UP 28.7%

Year over year new listings are down 6.8%

The year-over-year days on market are flat at 13 days

Year over year price is down 3%

Month-over-month prices are up 12.3%

Similar to the Condo market, this is the first time this year that the quantity sold year-over-year is UP. But one number that we need to look at within specifically this segment is the increase in the average price of a detached home in Toronto since January.

In just five months, the average detached home price has gone up by $707,925.00 or 37.7%. Yet, it’s still down year-over-year by 3%. That just goes to show how crazy the market was last year. Why? Last year at this time, the majority of buyers were counting down the days until their pre-approvals at ultra-low interest rates expired. It was the tail end of the feeding frenzy we experienced.

What’s to come this summer? June and July will be very interesting within this segment as we’ll see more listings and more transactions before things quiet down in August.

I’m personally seeing the luxury market take off again at a very rapid pace. Many are buying and selling $4 Million+ homes with ease. Many buyers want to move in and settle before heading off on holidays in August, and sellers are getting the price they’re looking for.

We’re not seeing 24-hour or same-day sales, but two weeks is a good indicator that things are under control and there is no panic buying to be had.

Advice for Sellers: buyers are more active now than they were last year at this time, or any time this year thus far. It’s a good time to be on the market, as the waiting is over. Buyers are out and active and making offers so don’t get left behind. Get listed before the summer months hit and the mass exodus of holiday travelers leaves the city.

Advice for Buyers: prices year-to-date have gone up steadily since January, BUT we’re still lower than last year. Get in now before the trend continues. I keep telling buyers to make an offer – we’re not going to see the month-over-month numbers go down, so each extra month you wait, you’re taking more out of your pocket. See something you love? Pull the trigger and enjoy the summer months in your new home.

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the May 2023 Toronto real estate numbers you have or about the Toronto market in general.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.