The October 2022 Toronto real estate numbers are in so it’s time for a deep dive into what they actually mean, instead of what the headlines are saying. Interest in the Toronto market continues to be at an all-time high among my clients. People just seem to want to talk about real estate.

The headlines continue to be all over the spectrum depending on the day. From “Could the Worst Be Over” to “A Cooling Market” to “Things are Heating Up in the Toronto Market”. Again, it’s no wonder some are confused and don’t know what any of this actually means.

Each month, I examine the Toronto numbers and give my honest insights based on my 13 years of experience on the ground working in the Toronto market, and my background in finance which helps me analyze the numbers unlike anyone else. I don’t just report them as many do. I examine the numbers to give you the facts that others are missing. Let’s take a look at October.

The Overall Toronto Market

When I looked at not only the October 2022 Toronto Real Estate numbers, but the trends over the last three months, I felt the need to hold on like I was riding a roller coaster. Up and down, up and down.

When the month-over-month numbers look like this, it’s usually because people are being reactive rather than proactive. Interest rates are up, the market is down. To buy or not to buy. Sell or not to sell. Listening to some “experts” is like watching the finals at Wimbledon – which side are we going with this month?

So, let’s take a step back. We know that 2021 was a record year in all market segments. We had inflated prices, bidding wars, bully offers and tough competition. So what did we think the market was going to look like in 2022? There was no way we would sustain that type of growth – I work in this industry and can tell you that type of growth and inflated pricing cannot and should not last. So here we are.

The market is slow but the trend is showing that it’s picking up in each segment. I’ve been saying this for a while but I’m going to say this again. NOW is the time to buy. Don’t be left behind when things start to pick up. And when you look at the trends, it’s slowly starting to happen. Are we going to see a massive jump in the next two months? Hell no. So you have time. But get on it. I promise.

One of my favourite takes on real estate is that you make money on the buy, not on the sell. So remember that as we sit in a very solid Buyer’s Market. It won’t last long.

Now let’s dive into each market segment – Condos, Semi-Detached & Row Homes, and Detached Homes to see what’s happening behind the usual market numbers and what’s driving the market right now in Toronto.

The Toronto Condo Market

Let’s take a look at some of the numbers that aren’t traditionally reported:

The average price is down 2% year over year

New listings are down 23.6% year over year Y

ear over year transactions are down 54.4%

Average days on the market is up 25%

3 out of the 4 key numbers I look at are down by big margins, but pricing is only down by 2%.

So, what does this mean? With the very hot rental market in Toronto right now, many sellers are rethinking their strategy. They’re choosing to take their condos off of the market and rent them out instead, simply because of the demand for rentals right now.

The average rental in Toronto is currently $500.00/month MORE than in October 2021.

This more than offsets any increases in interest owners may see – this is why there are a huge number of first-time investors flooding the market right now. They are delisting their condos, taking the equity out and redeploying it into either the pre-construction market or by picking up an additional condo suite to rent out.

Another interesting take on the average price of condos all comes down to perspective. I remember when the condo market was up 2% in recent months. The media and “industry experts” would talk about it as being a “flat month”. But it was still up 2%, right?

Right now, you would think the sky is falling by reading the headlines. Why are we not saying it’s a “flat month” in this case?

A 2% swing can happen just by having more high-end condos sold one year and not the next. It’s really a tiny variable that we should be looking at as flat, which is a GOOD thing because the condo market remains one of the most stable segments in the Toronto Real Estate market.

My Advice for Sellers: Look at the reason why you’re selling. If you are looking to upsize, NOW is the time to sell. You’re going to be getting a much better deal on the buying side so make your move now (remember – make your money on the buy!)

If you’re selling because of panic around rates going up or are nervous, don’t do it. Hold on. What are your other options? Sell for less and have to go into the sky-high rental market? Many renting 1-bedroom condos are paying more rent right now than the average mortgage payment. Hold tight.

If you’re sitting on your condo, have a meeting with a good mortgage broker to discuss your refinance options. You may be missing a big opportunity to get into the market as an investor by picking up a small suite and renting it out for more than what your payments might be. Have the conversation – it doesn’t hurt to ask.

My Advice for Buyers: Clean up your offers. Do the pre-work – you can, because you have time. Get the condo you want to offer on pre-approved by your bank, review the status certificate ahead of time. The cleaner the offer the more willing a seller will be to take slightly less, because it’s a done deal.

Two weeks ago, I submitted a clean offer for my clients on a King West condo – no conditions as their financing was done beforehand, and we had the status certificate reviewed ahead of time. Our offer was successful and was for below the asking price AND below the current market value – all because it was a clean offer. Before they move in, the condo will be worth more than they paid because of this strategy.

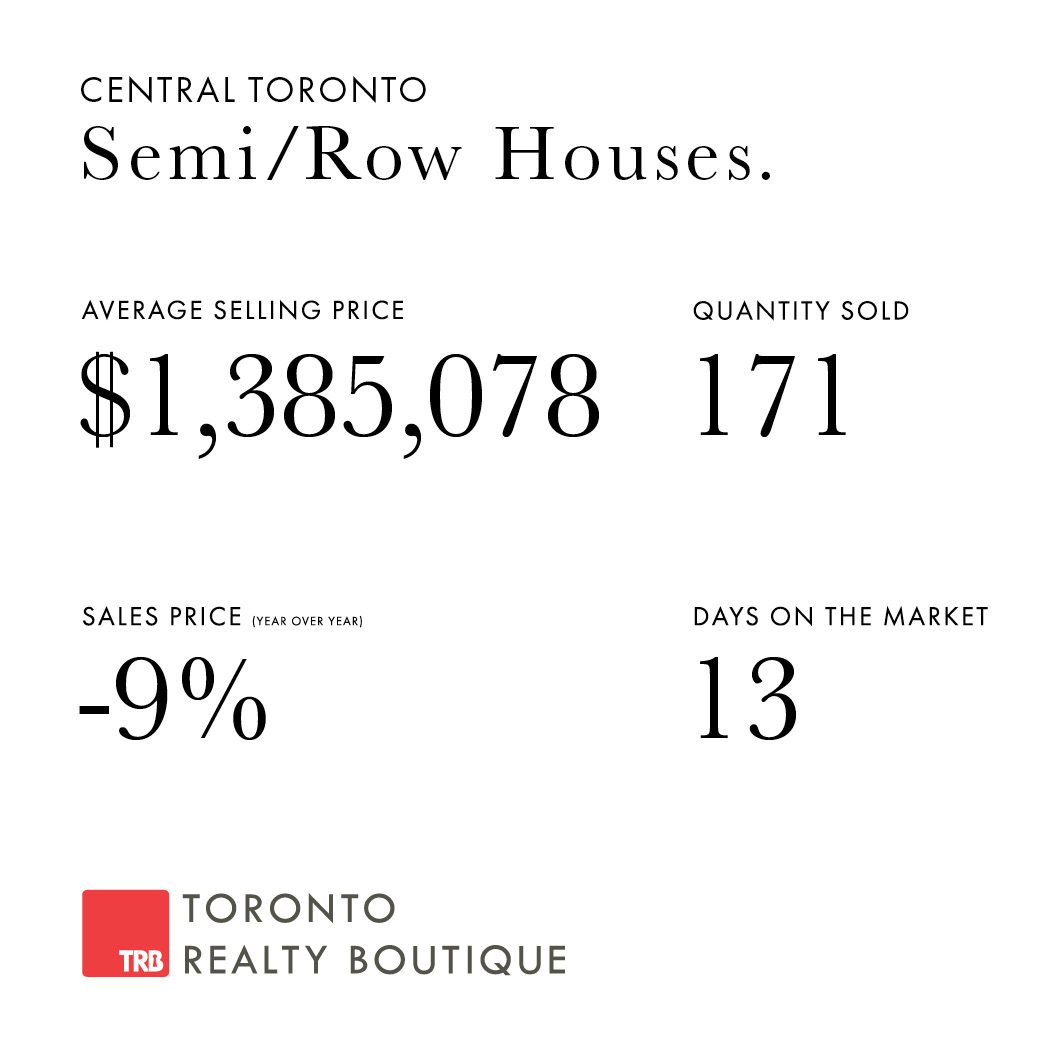

October 2022 Toronto Real Estate: Semi-Detached & Row Homes

Let’s start again with some of the numbers that you don’t traditionally see in news reports about the October 2022 Toronto Real Estate market.

The average price year over year is down 9%

The number of new listings is down 20% year over year

The number of transactions is down 42.8% year over year

Year over year number of days on the market is up 18%

When we look at the month-over-month number to add to our trend outlook, pricing in this segment is down 2.6%.

So let’s take a step back and investigate the 9% year-over-year decrease. We have to take into consideration that 2021 was a record year for not only this segment but this overall Toronto market. Pricing was through the roof and it was a marquee year for inflated real estate numbers and growth, both year over year and month over month.

So, let’s look at the variance between October 2020 and October 2022, removing the inflated prices of 2021. In the row home and semi-detached segment, pricing is up 7.5% in October 2022 from October 2020.

I don’t know many homeowners who bought in 2021 and are now selling after only a year of ownership. So, is there really a loss here? No. Always look at the long-term numbers because you need to have the real picture of what your finances and home values are sitting at.

Another item I’d like to investigate further in this segment is the days on the market number – this is something any buyer should be asking their broker to analyze during the buying and selling process. I do this for my clients and can show them that although the days on the market may say 7, a listing could have been put up and taken down two additional times over the last 30 days. It’s a bit flawed for the time being because this is becoming the norm in today’s listing market.

When we look at the 3-month trend for demand, we can see that it’s increasing – the pot is coming to a slow boil, particularly within this segment.

In August, 108 properties were traded within this segment In September 121 properties were traded In October, 171 were traded

My Advice for Sellers: if you’re thinking about making a move but are waiting until the spring, don’t. You need to get moving because waiting until the spring will run the risk of prices going up. Sure, you may get a bit more for your home, but you won’t have this freedom on the buying side that you do now. You’ll run the risk of competition, bidding wars and possibly getting less home for your money than you can now.

My Advice for Buyers: don’t always think that moving from a semi has to be to a detached home. If you have your eye on a favourite neighbourhood or a different school district or simply a slightly larger home with a bigger yard, now is an amazing time for a lateral move. Look at what semis are available – you may be able to get more home than what you have now for a very similar price tag. Consider it before the spring market.

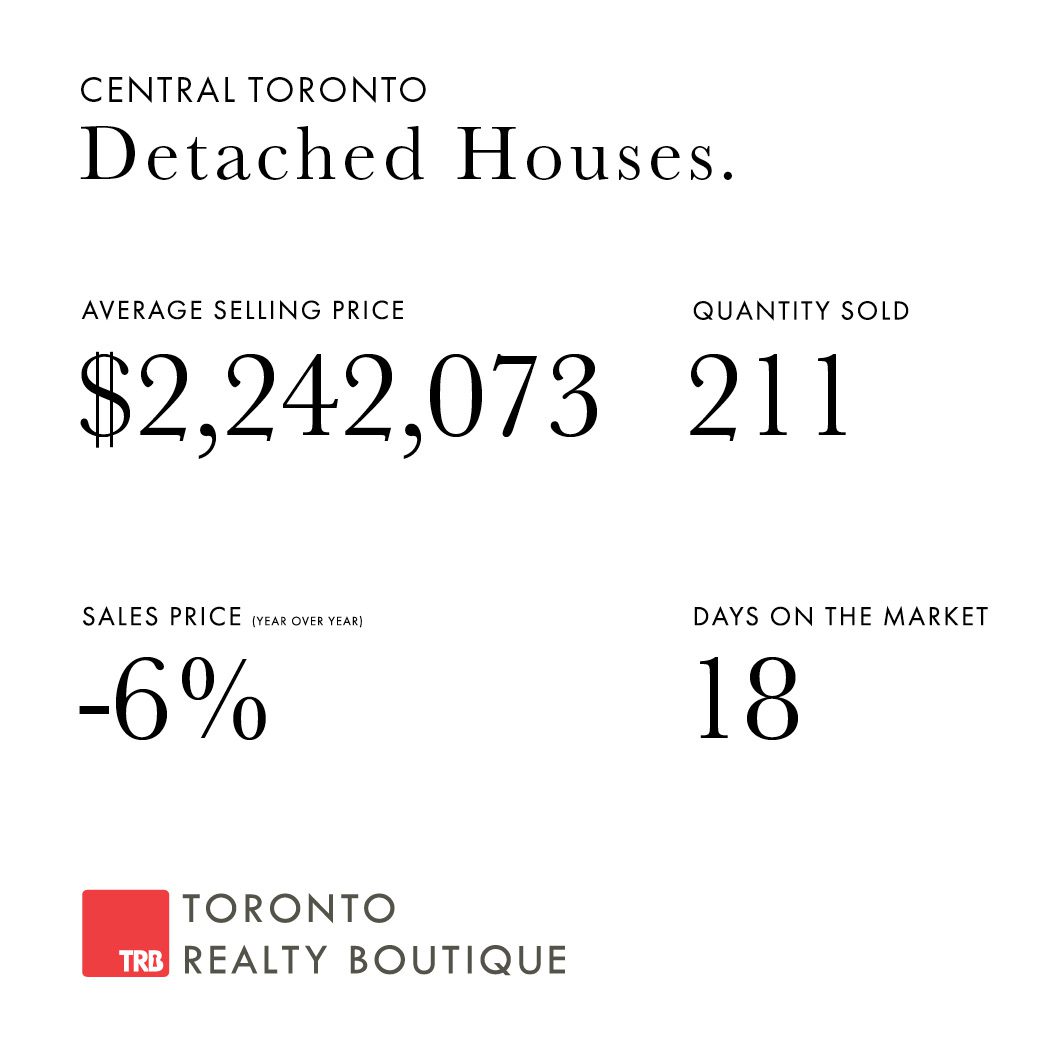

October 2022 Toronto Real Estate: Detached Homes

The October 2022 Toronto Real Estate detached homes market continues to be a very interesting segment of Toronto Real Estate. Let’s look at some of the numbers not usually reported.

The average price of a detached home in Toronto is down 6% year over year The number of new listings is down 8.9% year over year The number of transactions is down 40.4% year over year Year over year days on the market is up by 20%

I once again want to take a minute to look at the decrease in the average price year over year, while removing the 2021 numbers. The detached market in October 2021, saw a 19% increase in price y/y. This type of increase is NOT sustainable and is direct proof of what an anomaly 2021 was in Toronto Real Estate.

When we compare October 2022 to October 2020, the average price of a detached home is UP by 12%. It should be considered a crime to report these 2022 numbers without this analysis, when we had nearly a 20% increase year over year, last year. Do you remember the headlines then? I sure do. We’re seeing the other side of the coin here with the number’s narrative.

Last year the story was about pricing being too high, homes are unaffordable and this can’t continue.

Now, we have a sustainable growth projection over 2020 and yet the sky is falling? There has never been more proof that you need to really drill down into what is being reported before reacting.

Within the detached segment, it’s more important here than any other segment to look at the number’s neighbourhood by neighbourhood. As I said last month, the luxury market has a huge impact here so knowing the facts about where you are selling and where you want to buy are critical here.

The luxury market deserves some thought here when looking at the detached numbers so let’s take a look.

In October 2021, there were 40 sales over $4 Million (considered luxury market). In October 2022, there were 18 sales over $4 Million.

This significant drop in the number of transactions within the luxury market have a huge impact on the swing of the “average price” of a detached home. With those missing 22 sales, of course, the average price is going to go down. Just something to think about as you continue to examine the numbers here.

My Advice for Sellers: examine which segment of the detached market you’re sitting in. If you’re in the luxury market of $4 Million +, my advice is to hold off on listing until the spring. In February, reassess what the trends are saying and make decisions from there.

If you’re in the lower end of the detached market that’s around $1.5 Million, you may have a huge opportunity among those looking to get into the detached market. If you’re ready to sell, it might be wise to list. You may be surprised how many might act quickly to get into a new home before the holidays.

My Advice for Buyers: inventory levels year over year are nearly flat, which means there is a good amount of inventory on the market. Get out there and LOOK.

The trends show that the pot is coming to a slow boil in this segment as well, so don’t let it overflow before you can make a move.

In August, 140 properties were traded within this segment In September 164 properties were traded In October, 211 were traded

The Toronto Rental Market

Just a quick note about the October 2022 Toronto Real Estate rental market. The market continues to be the hottest out of all segments of Real Estate. But to be honest, we haven’t seen anything yet.

With the projected immigration numbers the government is providing, there will be more of a demand for rentals than ever before in the coming years.

The target for 2023 sits at 400,000 immigrants coming into Canada. Out of that number, 50% will be coming to Ontario, and 90% of that will be coming into Toronto. So approximately 180,000 people coming into the GTA next year alone.

Let’s also factor in foreign students, local students coming in from other parts of Canada, plus the current demand in the city, there is no way the supply will keep up with the demand. This will create more pressure on the rental market with bidding wars and rising rental prices.

And let’s not forget that as mentioned above, the average rental in Toronto is currently $500.00/month MORE than last year when rentals were trending at an average growth rate.

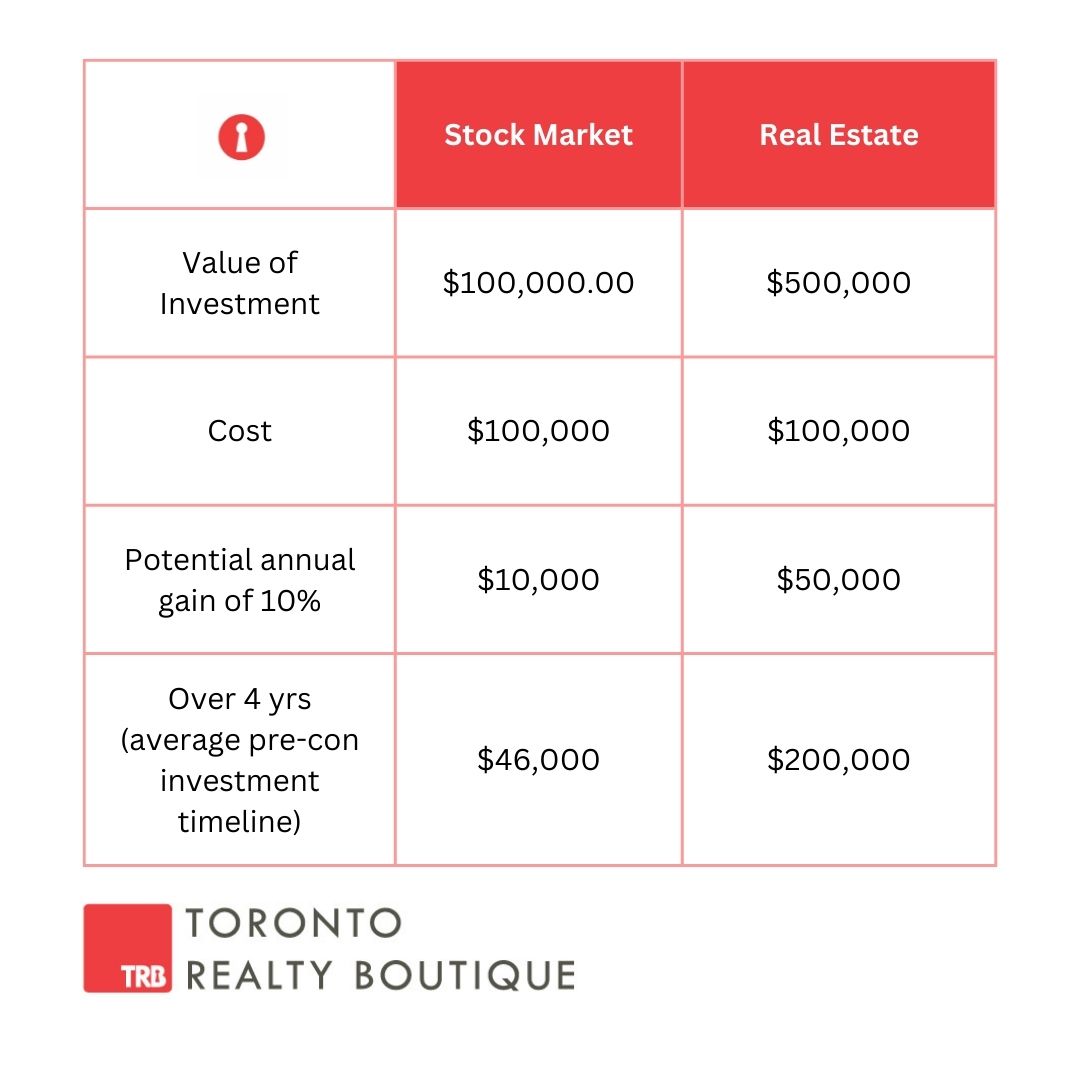

Pre-Construction Condos in Toronto

It’s a very interesting time for pre-construction buying in the Toronto real estate market. Many are taking advantage of the low deposit structures being offered by developers and some of the incredible incentives that are on the table.

The major benefit to buying pre-construction right now is that there is NO mortgage. And some of these deposit structures are spread out by over 600 days. That’s a lot of time for your deposit and your condo to appreciate.

Let’s take a look at some numbers.

Real Estate Vs. The Stock Market

Many smart pre-construction buyers are looking at those immigration numbers and seeing that not only is this going to happen next year, but continue to happen for many, many years to come. Getting into this market with little deposits now, is one of the best moves anyone can make in real estate right now.

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the October 2022 Toronto real estate numbers you have or about the Toronto market in general and share my insights on what’s to come later this year and into 2023.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.