The January 2025 Toronto Real Estate numbers are in so it’s time to take a deep dive into what they really mean.

We are off into 2025 with a bang and I’m getting a lot of questions from my clients about what’s really happening in Toronto Real Estate. There are a lot of confusing headlines out there – no wonder people are hesitant to buy or sell right now.

But I’m here to help. Each month I give my clients a truthful analysis of the numbers, how the market is performing and what they can expect in the coming months.

So if you’re a homeowner, thinking of buying or selling, or are an investor looking at the market, this report is for you.

Interest Rates in 2025

I would be amiss if I didn’t start out with some insights on interest rates as we examine the January 2025 Toronto Real Estate numbers. As predicted, the Bank of Canada cut the overnight rate in January by 0.25%. With this announcement came many insights from analysts who say this trend will continue throughout the first three quarters of the year.

According to Michael Gregory, CFA, Deputy Chief Economist and Managing Director of Economics with the Bank of Montreal (BMO), “Previously, we projected the Bank would cut the policy rate two more times this cycle, by 25 bps in April and July (ending at 2.50%). We now look for the quarter-point pace to continue each meeting until October, thus ending at 1.50%. The net risk is that we get to the endpoint sooner.”

Taking into consideration this news, the current inventory levels of listings and the no-pressure situation buyers are in, I’m recommending to all of my clients that they seriously consider a variable rate mortgage while getting into the market now.

This will allow buyers to purchase a home now while taking advantage of the predicted lowering of rates that are expected this year. There is no better time to chat with a mortgage broker who can walk you through all of your options so you can make the best decision that fits your needs.

The Overall Toronto Market in January

The year kicked off in a very positive way for Toronto real estate. Buyers got back into action after the holidays quickly and the January rate cut from the Bank of Canada helped things along nicely.

I personally had one of my beautiful listings sell at 75 Sloping Sky Mews in the Fort York neighbourhood. Although a higher price point at $1,725,000.00 for a 4-bedroom, 3-level townhouse with an attached garage, it sold to an amazing first-time buyer family who knew this was the time to get into the market.

This winter will be one of the best times to buy in Toronto in recent memory – there’s the combination of inventory of not just a lot of homes, but many beautiful homes, lowering interest rates and no-pressure buying that has many paying attention.

Let’s take a look at each market segment in Toronto to see how January performed when it came to the numbers.

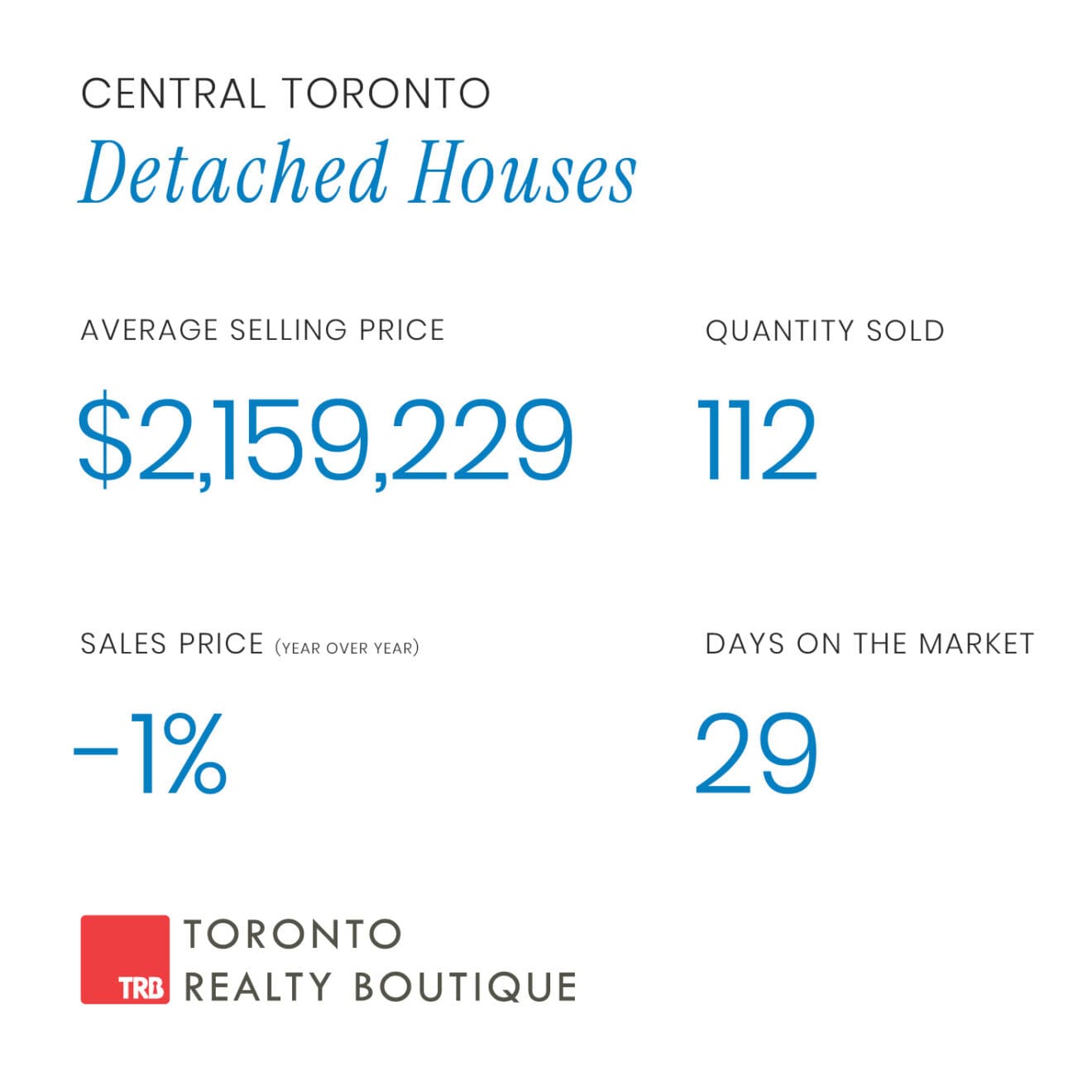

Detached Toronto Homes – January 2025

I’ve also included some stats below that I like to look at in addition to the above.

New Listings were up, year over year in January by 50.9% (!!)

The Quantity Sold year over year was up by 31.8% (!!)

The average price of a detached home year over year was down by 1%

Days on the market, year over year were down from 37 days to 29 days.

To me, this is excellent news for all buyers and sellers. Numbers like this show market stability which is what we’re all looking for right now.

Supply and demand are keeping pace with each other, and the uptick in Quantity Sold year-over-year shows that we’re slowly absorbing the inventory that’s out there and moving out of a buyer’s market and into a balanced market.

- As a reminder, when months of inventory are low (2 or lower), the market is usually in a seller’s territory.

- When months of inventory are high (4 or higher), the market is generally in buyers’ territory.

- Months of inventory between 2 and 4 are typically considered “balanced”.

According to the January 2025 Toronto Real Estate numbers, we currently have five months of detached home inventory, which is steadily getting closer to a balanced market. With the busy spring selling season approaching, it will be interesting to see the pace at which inventory levels continue to sell.

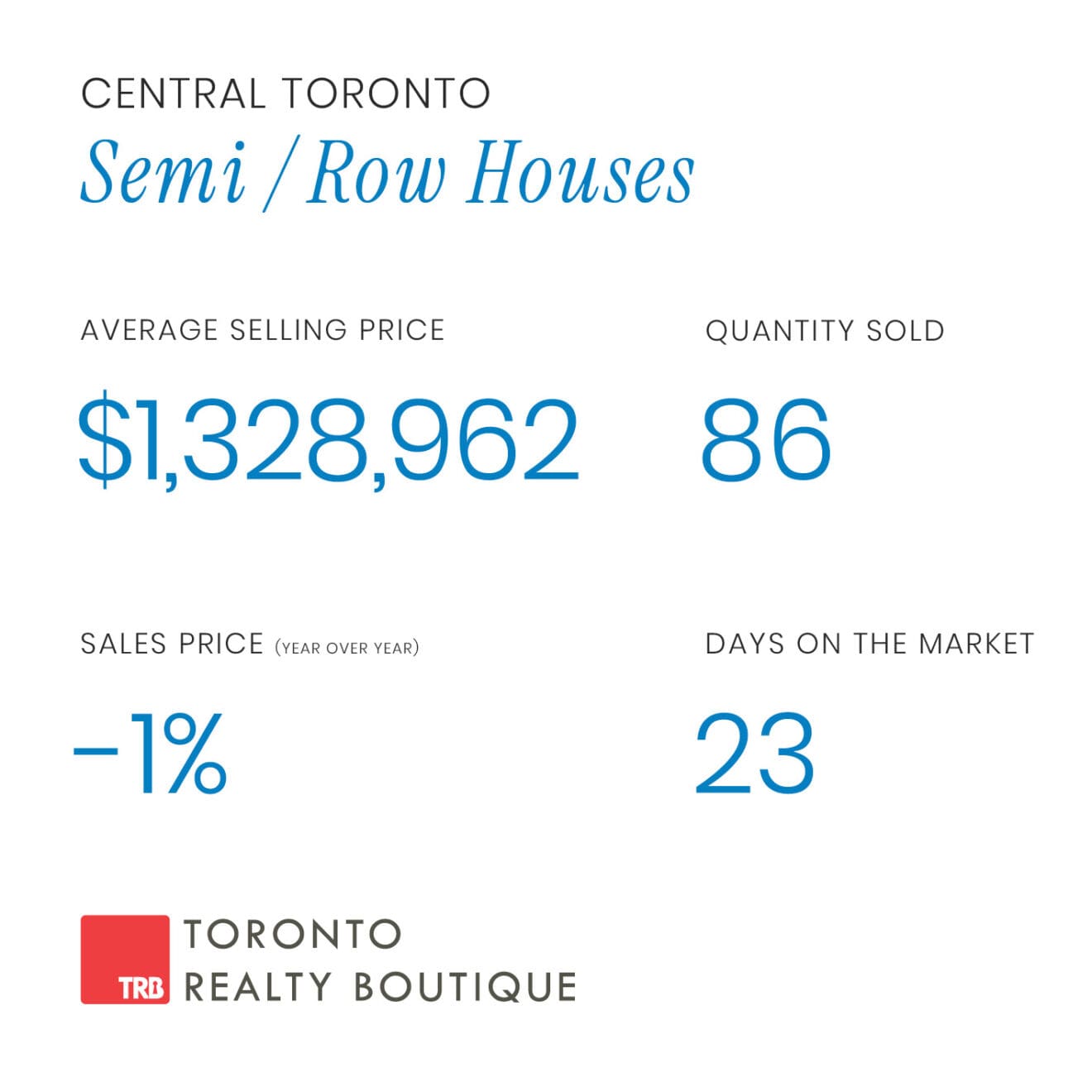

Semi-Detached & Row Homes – January 2025

New Listings were up, year-over-year in January by 41.8%

The Quantity Sold year-over-year was up by 28.4%

The average price of a semi-detached home-year-over year was down by 1%

Days on the market, year-over-year were down from 33 days to 23 days.

I’m keeping my eye on this segment very closely and buyers should be too. New listings are up, transactions are up and days on the market are down by 30%. Why is this important?

With only 2.8 months of inventory available within this segment, we’re approaching a seller’s market faster than most think. This is one of the BIG headlines I’m not seeing anywhere.

The advice I’m giving my buyer clients looking for a semi is to get into action quickly. The Spring market can start at any time and things will heat up fast. And once that happens, we’re going to see a quick uptick in pricing, days on the market fall even lower and the best homes in the best neighbourhoods being bought very quickly.

This segment in particular is the most rate-sensitive, so taking into account a variable mortgage will be a huge asset. Get a mortgage broker working on your pre-approval, and an expected outlook on what will happen over the next several rate cuts. They can paint a pretty accurate picture of what you can afford now, and how to take advantage of lower rates as they come.

But now is the time to buy while you still can, without the pressure that many experience in this busy segment. We’re not there yet, but it’s coming.

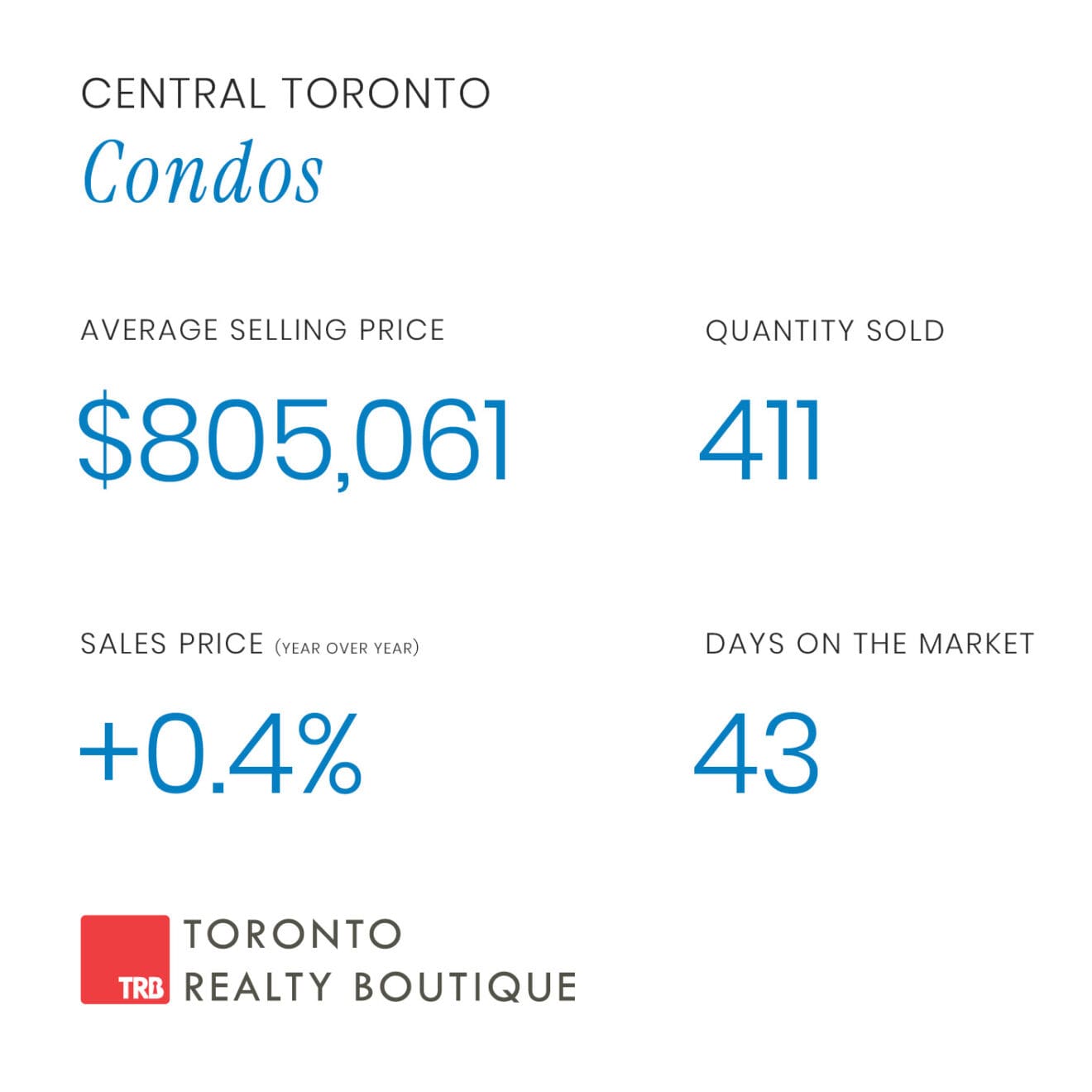

January 2025 Toronto Real Estate – Toronto Condos

New Listings were up, year-over-year in January by 43.4%

The Quantity Sold year-over-year was down by 19.9%

The average price of a condo, year-over-year was up by 0.4%

Days on the market, year-over-year were up from 42 days to 43 days.

Considering where the Toronto condo market has been the past year, the January 2025 Toronto Real Estate numbers are actually positive. Pricing has stabilized, which is the big news here, but we’re still sitting firmly in a buyer’s market with just under 8 months of inventory available.

So where is the sunshine and rainbows in this segment? It’s all about first-time buyers when it comes to Toronto condos. There has never been a better time to get into homeownership than right now.

In fact, all of my most recent clients who are buying in Toronto have been first-time buyers. They were or are currently renting, and have no condo to sell in order to buy – this is what puts them at a huge advantage in the market.

And with so much inventory to look at in every building and every neighbourhood, they’ll be spoiled for choice. There are some incredible suites out there with large floor plans at amazing prices. Sellers are looking to sell, and are willing to negotiate so don’t be afraid to get out there and look.

And don’t forget about the incentives the government is offering to first-time buyers. Those, along with falling rates, stunning condos and being firmly in the driver’s seat make the perfect storm that we haven’t seen in a very long time.

Working with TRB

Now besides crunching all of these numbers for my clients – you may or may not know (but hopefully you do) that I help many clients buy and sell real estate daily. I am the Founder and Lead Broker of Toronto Realty Boutique and I specialize in listing homes and condos, representing buyers of all budgets, I also do a lot of work in the Toronto pre-construction market.

You can check out some of my featured listings that are currently active here:

Toronto Realty Boutique Listings – Homes & Condos for Sale

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the January 2025 Toronto real estate numbers you have or about the Toronto market in general.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.