The March 2024 Toronto Real Estate market stats are in!

A lot is happening in the Toronto Real Estate Market right now, and if you’re a buyer, seller, investor or owner, you’re going to want to read this update. There are so many misleading headlines in the news right now, so hopefully this will give you some honest clarity about what’s really happening.

April Interest Rate Announcement

This morning, the Bank of Canada made their latest announcement on Interest Rates. Many were conflicted about what would happen – would we see our first rate cut, or would we continue this holding pattern for the next couple of months? (June 5th is the next scheduled meeting)

But as I predicted, we saw a hold announcement at 5%. Now, you may hear many analysts focus on the language that comes along with the announcement. This is the indicator of what’s to come.

The language that was used with this announcement indicated a few things:

- The BoC will look for signs of sustained slowing inflation before moving on rate cuts

- Inflation is still too high but noted they that core inflation measures — which strip out volatile sectors like food and energy — have trended downward in recent months

- The further decline they’ve seen in core inflation is very recent. They need to be assured this is not just a temporary dip.

- A rate cut in June is within the realm of possibilities.

The Bank of Canada is moving slowly and cautiously as they don’t want to jump and cut rates, even slightly, and then be forced to raise them again. This is why the language around a temporary dip is included.

With a break in meetings for a month, I’m willing to bet that we’ll see a slight cut in June.

March 2024 Toronto Real Estate Market Stats

When I started to examine the Toronto market stats for March, two metrics stood out to me the most – Number of Days on the Market, and Quantity Sold.

Many brokers and analysts focus solely on price, which I think is a mistake. The two metrics above are what should be examined to help predict what’s to come in the coming months. This helps buyers and sellers. Yes price matters, but if you’re studying the numbers, it’s likely because you’re getting ready to make a move and need to know what’s trending to make an informed decision.

When we look at Days on the Market and Quantity Sold, we always look month-over-month, not year-over-year. The reason I do this is to predict trends in the market over the upcoming few months.

Across the board in each segment of Toronto real estate, quantity sold was way up, and days on the market had decreased – some by half. This means that activity is starting to pick up, just as I’ve predicted. Spring fever has begun and people are done with waiting around – the numbers prove it.

I still believe now is the best time to buy – rates are not going to go up. They’ll likely start to go down beginning this summer and when that happens, it’s going to quickly return to a seller’s market.

Buyers need to realize that NOW is the time to enjoy one of the best buying seasons we’ve seen in a long time. Plenty of inventory, no bidding wars, and a relaxed market is the perfect storm for anyone looking to move – don’t wait. Trust me.

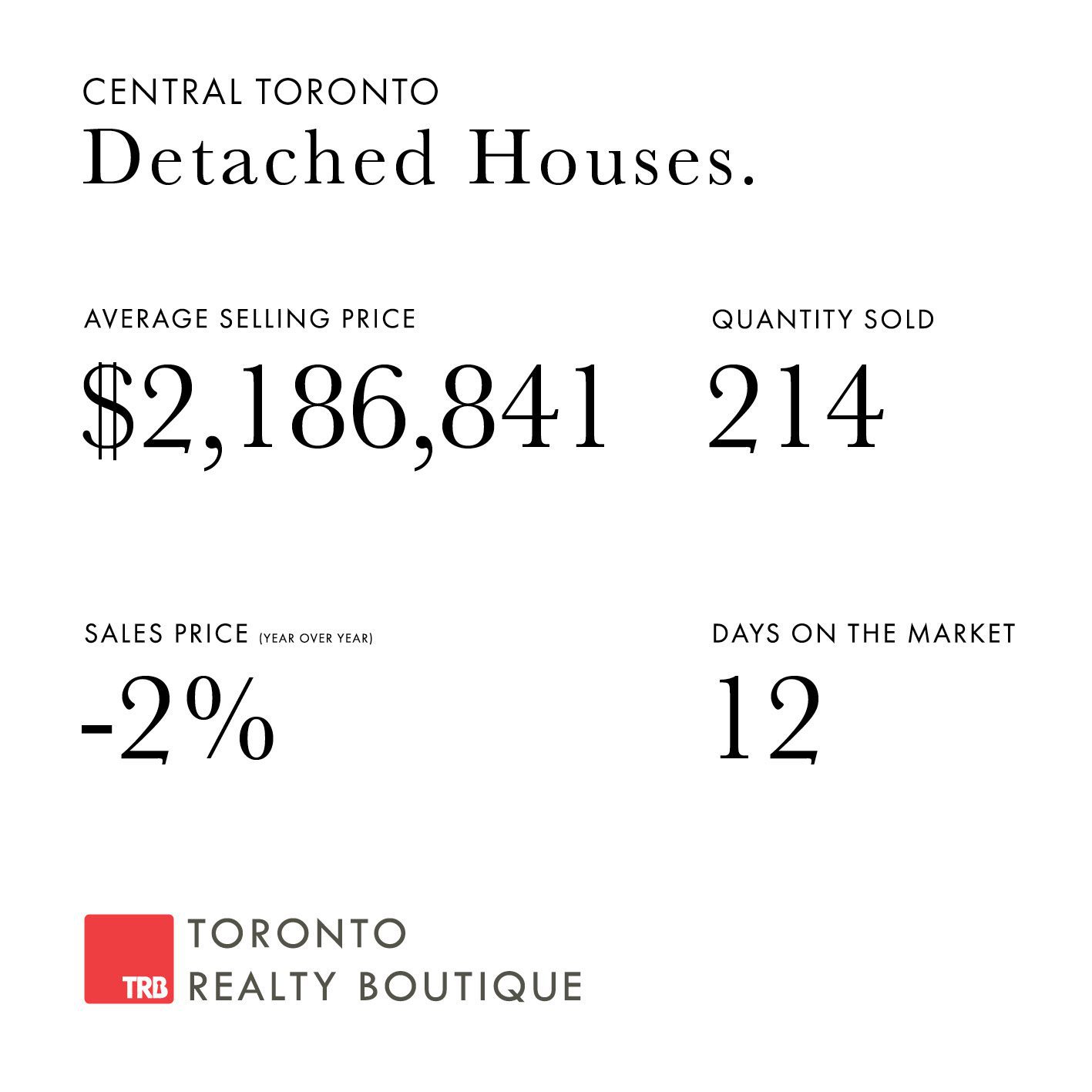

Detached Homes

I wanted to start with this market segment as it has had the biggest variance month-over-month when it comes to Days on the Market.

Quantity Sold: March = 214, February = 158 (Up by 35.4%)

Quantity Sold: March = 214, February = 158 (Up by 35.4%)

New Listings: Down 6%

Days On the Market: March = 12, February = 24 (Down by 50%)

Prices Year-Over-Year: Down 2%

Pricing within the Detached Homes segment has stabilized – over the past few months we’ve seen little movement year-over-year, in either direction.

New listings have slightly dipped, but the intriguing number here is the Days on the Market. Many sellers are waiting to get deeper into the Spring Market to list, but the inventory currently available is starting to really move.

Buyers are getting tired of waiting and with the anticipated rate cuts that are coming, they are getting into homes they love without the competition that’s on the horizon.

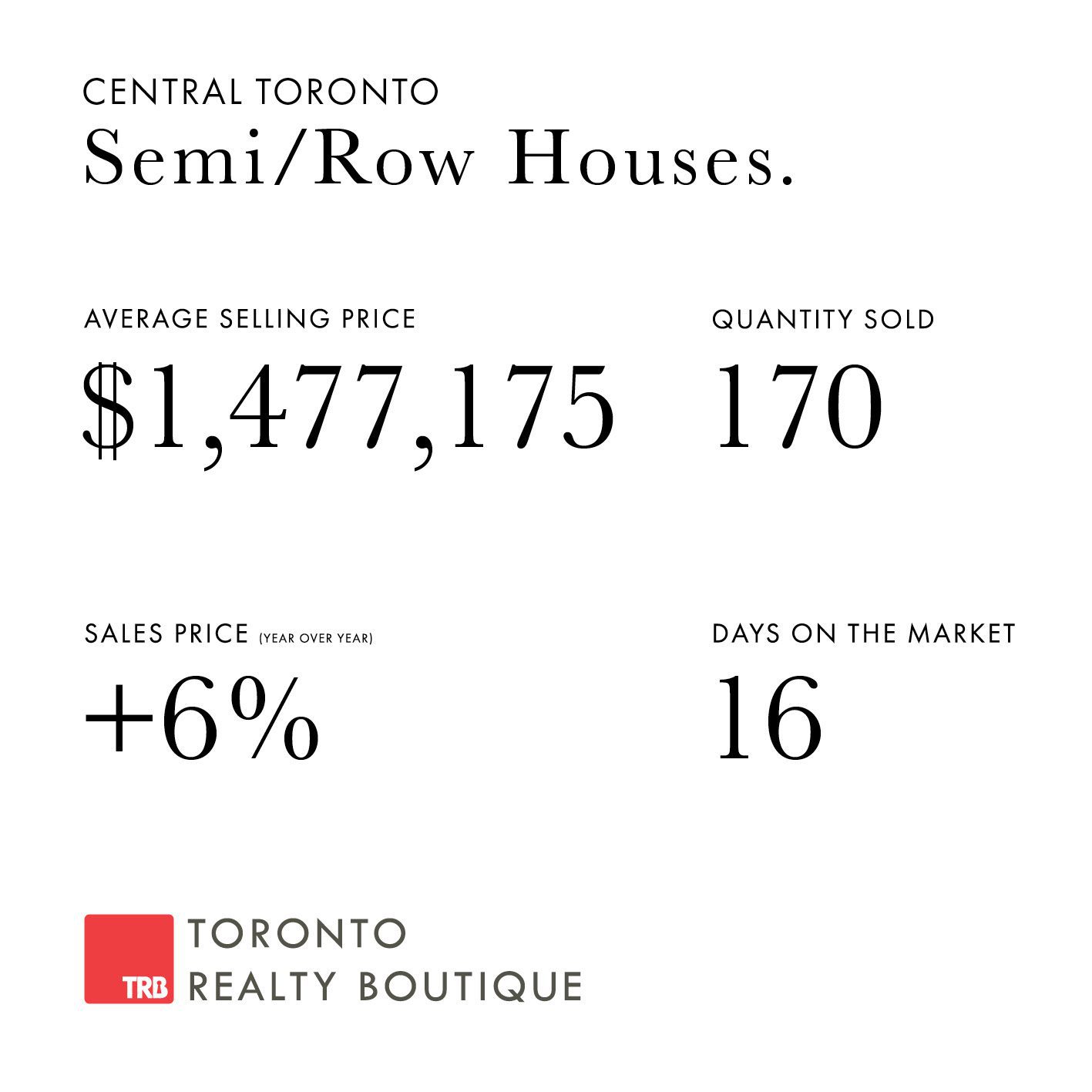

Semi-Detached & Row Homes

Quantity Sold: March = 170, February = 133 (Up by 27.8%)

Quantity Sold: March = 170, February = 133 (Up by 27.8%)

New Listings: Up 19.4%

Days On the Market: March = 16, February = 22 (Down by 27.3%)

Prices Year-Over-Year: Up 6%

Like I always say, the semi-market is the first to react to any market conditions change. And we’re seeing that here in the numbers. Quantity sold is up, new listings are up, days on the market are down, and pricing is up.

This is all an indication of what’s to come.

Sellers are starting to get perhaps a little too overconfident in this segment as I’m starting to see offer dates set with the expectation of bidding wars and multiple offers. But sellers are seeing through that and are not willing to overpay. Yet.

Many sellers are missing offer days, and those that are getting some bids, end up selling at market value. Again, no one is overpaying for homes right now.

Be smart with your listing strategy and you’ll get a good, fair price for your home. If you’re waiting to sell before you buy, do so smartly so you can take advantage of the dream buyer’s market we’re currently in.

Toronto Condos

Quantity Sold: March = 696, February = 608 (Up by 14.5%)

Quantity Sold: March = 696, February = 608 (Up by 14.5%)

New Listings: Up 11.9%

Days On the Market: March = 21, February = 27 (Down by 22.2%)

Prices Year-Over-Year: Down 1%

Similar to the detached homes market, we’re seeing some stability with pricing in the Condo segment. But with that said, I think this will be the slowest segment to react to any interest rate changes. This may come as a surprise to many, but there are a few factors to consider here.

In Q1 2024, there were an incredible amount of pre-construction developments that either took occupancy or closed, meaning many buyers from years ago are moving into their already purchased condos.

It also meant that the renters pool also had an influx of availability, possibly turning some potential buyers back to renters as the desire to live in a brand new suite is very appealing.

But this isn’t necessarily a bad thing. The majority of first-time buyers in Toronto are looking at condos. With stabilized pricing, inventory to choose from and little competition, it’s a dream scenario to get into your first home.

Condos aren’t traded on a month-to-month basis, so getting into your first condo now, and waiting 5 years to sell means a great appreciation to come in equity. I said this would be the slowest segment to react to the interest rates, not that it wouldn’t react.

Working with TRB

Now besides crunching all of these numbers for my clients – you may or may not know (but hopefully you do) that I help many clients buy and sell real estate daily. I am the Founder and Lead Broker of Toronto Realty Boutique and I specialize in listing homes and condos, representing buyers of all budgets, I also do a lot of work in the Toronto pre-construction market.

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the March 2024 Toronto real estate numbers you have or about the Toronto market in general.

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.