We’ve got the first three months of the year behind us, and confusion about the market is still brewing among buyers and sellers. I have clients on both sides right now – many active buyers out in the market and sellers ready to list. But questions about what’s happening are asked each day. It’s time for my monthly deep dive into what’s really behind the headlines.

First, I have to say that, if I’m honest, what’s happening in the market is truly all over the place. My colleagues and I discussed this at length—some have listings that have been sitting for months, and some are in multiple offers.

Some buyers act fast and make decisions, while others are still browsing and in no hurry. So what’s the trend here? What’s the tipping point that makes buyers submit an offer, and what makes sellers negotiable right now?

The answer is stability. Sellers are looking for a sign that the market is stable so they can confidently list and get fair market value for their home in a reasonable amount of time.

Buyers are looking for stability, that the price they are paying is a fair market value, as every buyer would love to time the bottom of the market to get the absolute lowest price possible.

But I’m sorry to say this tactic is actually impossible, as we only know it’s the bottom of the market when we look back, not when we look into the future.

My advice to my clients is to look for stability in your own buying or selling situation, as you can’t control anything but that.

If you’re selling, look at what the market will offer you for your current home and what opportunity the market is giving you for your next home.

If you’re buying, examine interest rate stability, current inventory levels, and your finances – the combination of these factors will inform both your buying power and the timing around your purchase to maximize what best suits your individual situation.

April 16th Bank of Canada Interest Rate Announcement

On April 16th, the Bank of Canada announced a rate hold, which was expected.

Historically, over the past eight federal elections, going back to the year 2000, the Bank of Canada has only cut rates twice during an election time. While independent from political influence, the Bank of Canada does seem to step back from the spotlight during election time, and this time is no different.

Detached Toronto Homes – March 2025

I’ve also included some stats below that I like to look at in addition to the above.

New Listings were up, year over year in March by 41.6%

The Quantity Sold year over year was down by 9.3%

The average price of a detached home year over year was up by 5%

Days on the market, year over year, were up from 22 days to 12 days

As of the end of March, there was just under 2.8 months of inventory on the market, down from 3.5 months at the end of February.

The increase in new listings, although high, is not surprising. Many sellers have been sitting on the fence, waiting to see stability in pricing, with most hoping for a big jump in the Spring market. They are now realizing that the market we are in is the market we will be in for some time.

Buyers in this segment continue to be very picky – I am personally seeing move-in-ready homes sell fairly quickly, and those that need work sit. Buyers know what they want, and they will not settle for less when they have so much to choose from.

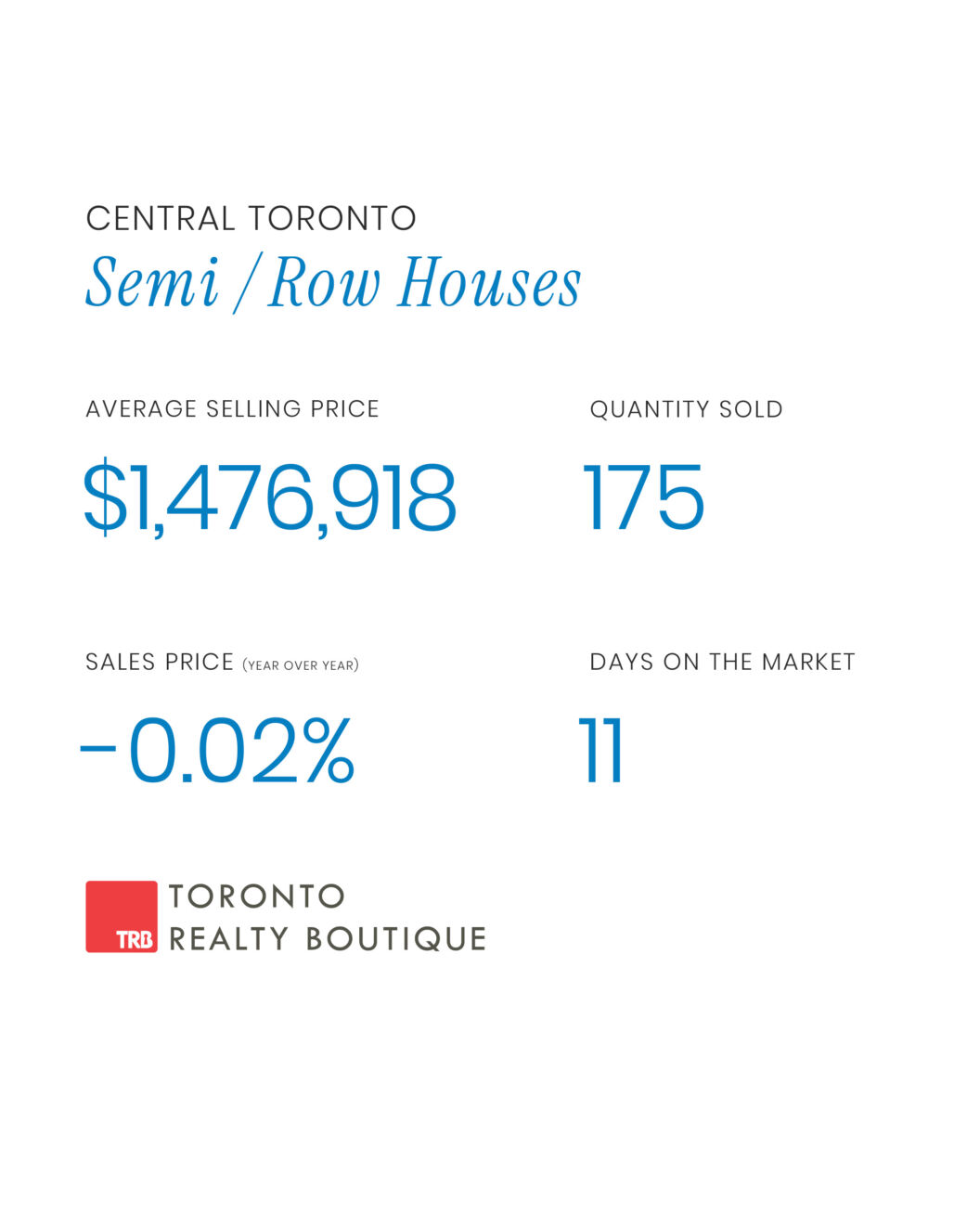

Semi-Detached & Row Homes – March 2025

New Listings were up, year over year in March by 40.6%

The Quantity Sold year over year was up by 2.9%

The average price of a semi/row home year over year was down by 0.02%

Days on the market, year over year, were down from 16 days to 11 days

As of the end of March, there was just under 1.25 months of inventory on the market, down from 1.5 months at the end of February.

Again, there is no surprise here with the number of new listings up by 40%. I still believe many sellers are waiting to list, and we’ll see high new listing numbers once again, come the April results.

With only 1.25 months of inventory available, I feel that pricing stability will end by May (at the latest) in this segment. Buyers are already acting in this segment in particular, as is shown in the year-over-year Quantity Sold numbers. Things seem to be moving in the semi-detached market, so this will be one to keep a close eye on.

I always say this segment is the first to be impacted by any news, so with the latest rate announcement of a hold, it will be interesting to see how buyers and sellers react.

March 2025 Toronto Real Estate – Toronto Condos

New Listings were up, year over year in March by 24.6%

The Quantity Sold year over year was down by 24%

The average price of a condo year over year was down by 0.2%

Days on the market, year over year, were up from 21 days to 27 days

As of the end of March, there was just under 5.75 months of inventory on the market, up from 5 months at the end of February.

This is the segment that I am personally seeing the most activity in, as I have already helped several first-time buyers this year get into their first home, which were all condos.

We continue to see price stability in this segment that we’ve been seeing for well over a year, with prices fluctuating up and down by no more than 2%, with most months under a 1% change.

For those waiting for a price jump to list, don’t.

Technically, we are in a balanced market here in this segment, but it’s definitely leaning more towards a buyer’s market with current inventory levels.

This means pricing will hold because buyers have a lot to choose from, and are not in a mindset to jump into anything that doesn’t fit perfectly into their wish list.

For those buyers waiting for a price drop, don’t.

Pricing has been stable for well over a year and will continue to hold, which has been demonstrated month after month with the condo numbers.

A preview into April is showing the Condo market picking up nicely. I have a new listing in Liberty Village that had several showings over a busy holiday weekend.

If you’d like to take a look at this beautiful condo in Liberty Village, you can see all of the details here:

100 Western Battery Road – Suite 1106

Working with TRB

Now besides crunching all of these numbers for my clients – you may or may not know (but hopefully you do) that I help many clients buy and sell real estate daily. I am the Founder and Lead Broker of Toronto Realty Boutique and I specialize in listing homes and condos, representing buyers of all budgets, I also do a lot of work in the Toronto pre-construction market.

You can check out some of my featured listings that are currently active here:

Toronto Realty Boutique Listings – Homes & Condos for Sale

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the March 2025 Toronto real estate numbers you have or about the Toronto market in general.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.