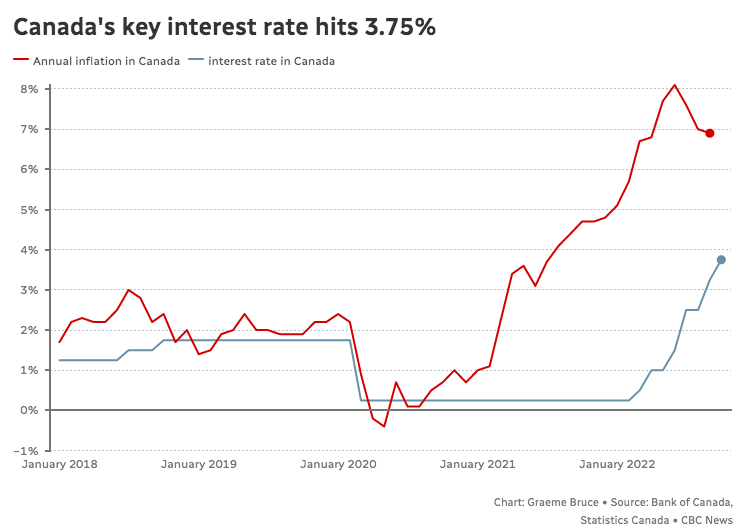

As predicted, the Bank of Canada announced yet another rate hike after their October 2022 meeting, but the pace of hikes may be slowing.

Canada’s central bank continued its campaign to wrestle high inflation into submission on Wednesday, raising its benchmark interest rate by 50 basis points to 3.75 percent.

The Bank of Canada’s rate — officially known as the target for the overnight rate — is the amount that retail banks are charged for short-term loans.

But it filters down into the economy by influencing the rates that Canadians get from their own lenders on things like savings accounts and mortgages.

After slashing its lending rate to near zero early in the COVID-19 pandemic, the bank has raised its benchmark rate six times since March, as it scrambles to rein in inflation, which has run up to its highest level in decades.

While the move will likely help bring down the cost of living in the long run by compelling Canadians to spend and borrow less, it will only increase the pain for consumers and businesses that are already feeling the pain of inflation and higher borrowing costs.

The bank was widely expected to raise its rate, as the country’s inflation rate is still more than twice as high as the range it likes to see. But the increase of 50 basis points is less than the 75 points that some economists and investors were anticipating.

That could be a sign the central bank is nearing the end of its rate-hiking cycle, but in its statement, the bank made it clear that rates “will need to rise further.”

Karyne Charbonneau, executive director of economics at CIBC Capital Markets, said the bank’s decision to slow the pace of its rate increases means “we are getting closer to the end of the hiking cycle and … steps of 75 basis points are now behind us.”

But she thinks another half percentage point is likely coming, and “rates will have to stay at that level at least through the end of 2023 to help bring inflation back down to target.”

The goal of the bank’s rate hikes is to bring down demand for all kinds of goods and services that have seen a surge in recent months. The most direct impact of the increases so far has been on the mortgage market.

What the Rate Hike Means for You

Generally speaking, a 50-point hike in the bank’s rate, such as the one announced on Wednesday, will add about $30 per month to every variable rate loan, for every $100,000 owed. As an example, a borrower who was paying 4.25 percent on a standard $400,000 mortgage will see their monthly payment go from $2,159 before to $2,270 after, which works out to an extra $1,300 a year.

Bank officials made it clear in a press conference following the decision that they are trying to find a balance between doing too much versus too little to fight inflation. They acknowledged the task will be a difficult and possibly painful one.

“There are no easy outs to restoring price stability,” Bank of Canada governor Tiff Macklem said. “If we don’t do enough, Canadians will continue to endure the hardship of high inflation. And they will come to expect persistently high inflation, which will require much higher interest rates and potentially a severe recession to control inflation,” he said.

“Nobody wants that.”

The next scheduled date for announcing the overnight rate target is December 7, 2022. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR on January 25, 2023.

TRB’s Advice for Buyers

If you’re debating between buying now or waiting, we have some advice for you. Although rates have gone up, now is still the time to buy, especially in the Toronto market. Year over year, the cost of housing continues to rise. That will be the case in this particular market for many years to come. So while you think waiting might be the answer, it’s simply not the right answer.

Get into the market now. Even if your budget is slightly less than it was before, you’ll still get further ahead by buying today. Plain and simple. Get into a home now, and in five years when you want to sell, you’ll see that you’ve made much more money through appreciation than you thought possible.

Real Estate isn’t like the stock market where you buy and sell day after day. It’s a long-term game that you can win just by getting into it now.

If you’re looking for help from an experienced broker, get in touch with Romey today – call or text anytime – 416.999.1240, or complete our form on this page and we’ll be in touch right away.