The October 2021 Toronto Real Estate numbers are in! Each month, we examine the numbers and not only report them but do a deep dive into what they really mean.

There are a lot of real estate headlines buzzing around right now, so in order to get a full picture of what is really happening in the market, you need to look past those clickbait tactics. We look at each market segment and compare them to both year over year, but also month over month to help us predict trends accurately. Let’s get into it!

October 2021 Toronto Real Estate Numbers: The Condo Market

The Toronto condo market continues to be stable, healthy, strong – all of the things we look for in this segment of the market. The average price has shown an 8% increase over October 2020, the number of transactions is up to 1,150 from 1050 in September 2021, and the average days on the market is now sitting at 16, versus 17 in September.

The Toronto condo market continues to be stable, healthy, strong – all of the things we look for in this segment of the market. The average price has shown an 8% increase over October 2020, the number of transactions is up to 1,150 from 1050 in September 2021, and the average days on the market is now sitting at 16, versus 17 in September.

This shows that buyers are active, and the condo market is still trading strongly.

One thing that you may look at and question is the average price fell slightly – $848,476 in October from $855,055 in September. The reason why this isn’t something to be concerned about is because the number of transactions is up. The very small drop can be attributed to the likelihood of smaller suites trading rather than the $1.5 Million + condos.

We’ve been looking at the condo market for some time now as we prepare financial analysis for many of our clients looking into pre-construction. It has given us the opportunity to really examine the future of condo pricing and honestly, it’s going nowhere but up.

In most industries, there is no crystal ball to predict the future, but in real estate, as many times as you’ve heard “I have no crystal ball”, we kind of do when it comes to condos – it lies in the current pre-construction selling numbers. It’s as close as you can get to seeing the future value of condos.

Many project launches have clients paying anywhere from $1,300.00 – $1,500.00 per square foot.

These clients purchasing at these prices see the future value of the condo market and are making moves now. They will certainly not be selling for a loss in the coming years or even a breakeven – they’re going to realize the future potential of the market, just like many of my clients who are selling for a healthy profit now and are investing in the right projects for the future.

So, what does this all really mean? It means that the average price per square foot in King West, sitting currently at $1,078.00 per square foot, Liberty Village currently sitting at $1,025.00 per square foot, and The Waterfront Communities currently sitting at $1081.00 per square foot, are low – VERY low.

Our projections have these neighbourhood prices going up quickly, as new pre-construction condos hit the market. Buying now may seem expensive, but you’ll be amiss if you didn’t look at the bigger picture and what the future has to offer.

Real Estate is always hard to predict but imagine being able to turn the clock back 5 years and purchase in Yorkville, King West, Liberty Village – anywhere in the city with a trusted developer. Don’t let the pricing of today scare you away from the potential of what’s to come.

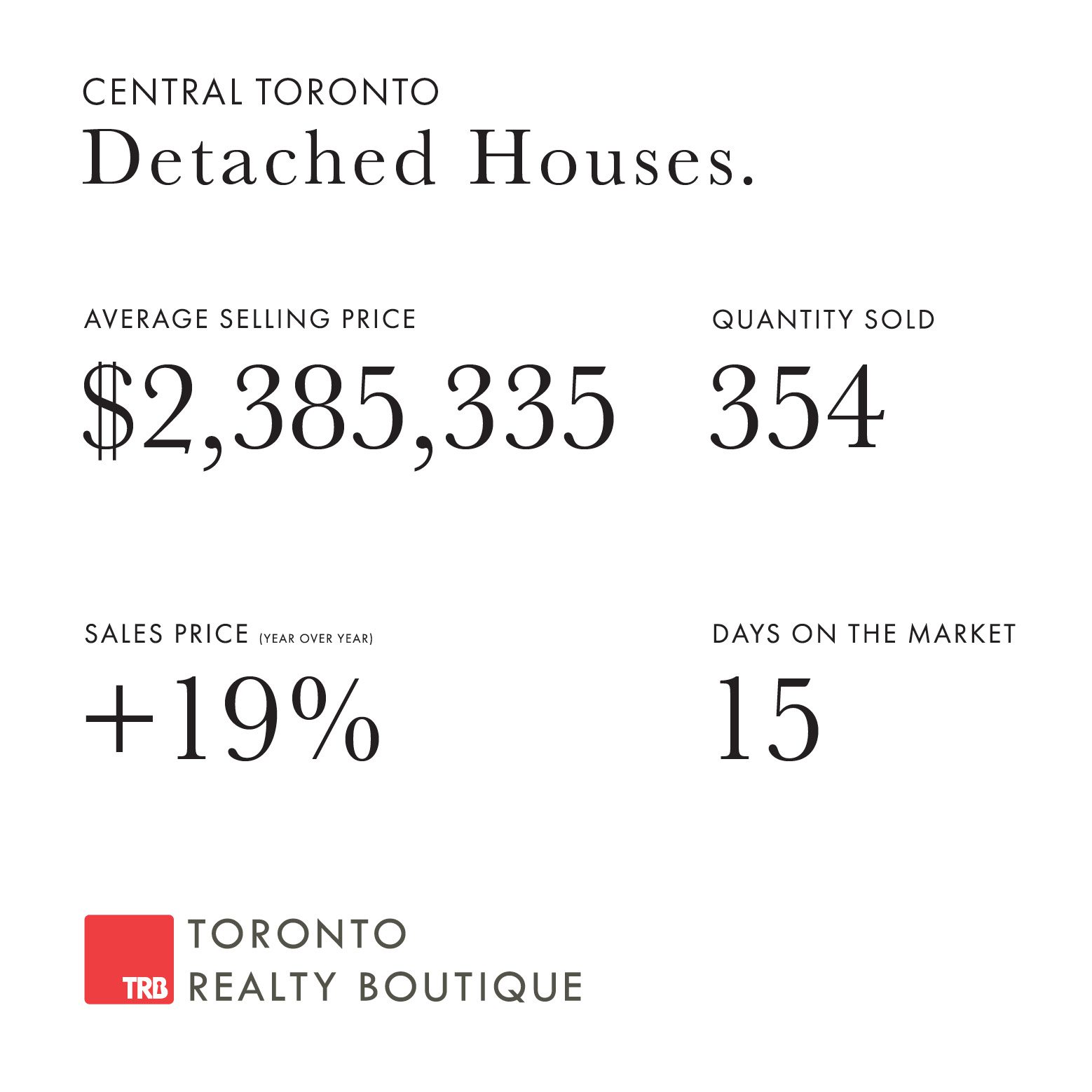

October 2021 Toronto Real Estate Numbers: Detached Homes

The detached home market continues to climb, just as we predicted, with prices up 19% from October 2020. We’re on track to end the year looking at a 20%+ increase over what we saw in 2020.

The detached home market continues to climb, just as we predicted, with prices up 19% from October 2020. We’re on track to end the year looking at a 20%+ increase over what we saw in 2020.

The average days on the market is now sitting at 15 days, which is down from 18 days in September 2021. This may not seem like a lot but in trading detached homes, even a small decrease indicates buyers are hot and ready to buy.

The number of transactions is up from September 2021 – 354 transactions up from 304.

Similar to the condo market, when we looked at the month-to-month trend between September and October, I noted a slight average price drop from $2,439,154 in September, down to $2,385,335 in October.

Many luxury homes sales took place in August and September – we’re talking in the $5 Million + range, and now with the lack of inventory in that market segment, we seeing the lower-priced detached homes trading, and trading more than the previous month – that’s why the number of transactions is up.

Similar to the condo market, and nothing to be alarmed about here. I’m going to keep my eye on this and report back next month when we have three months of fall market data to examine.

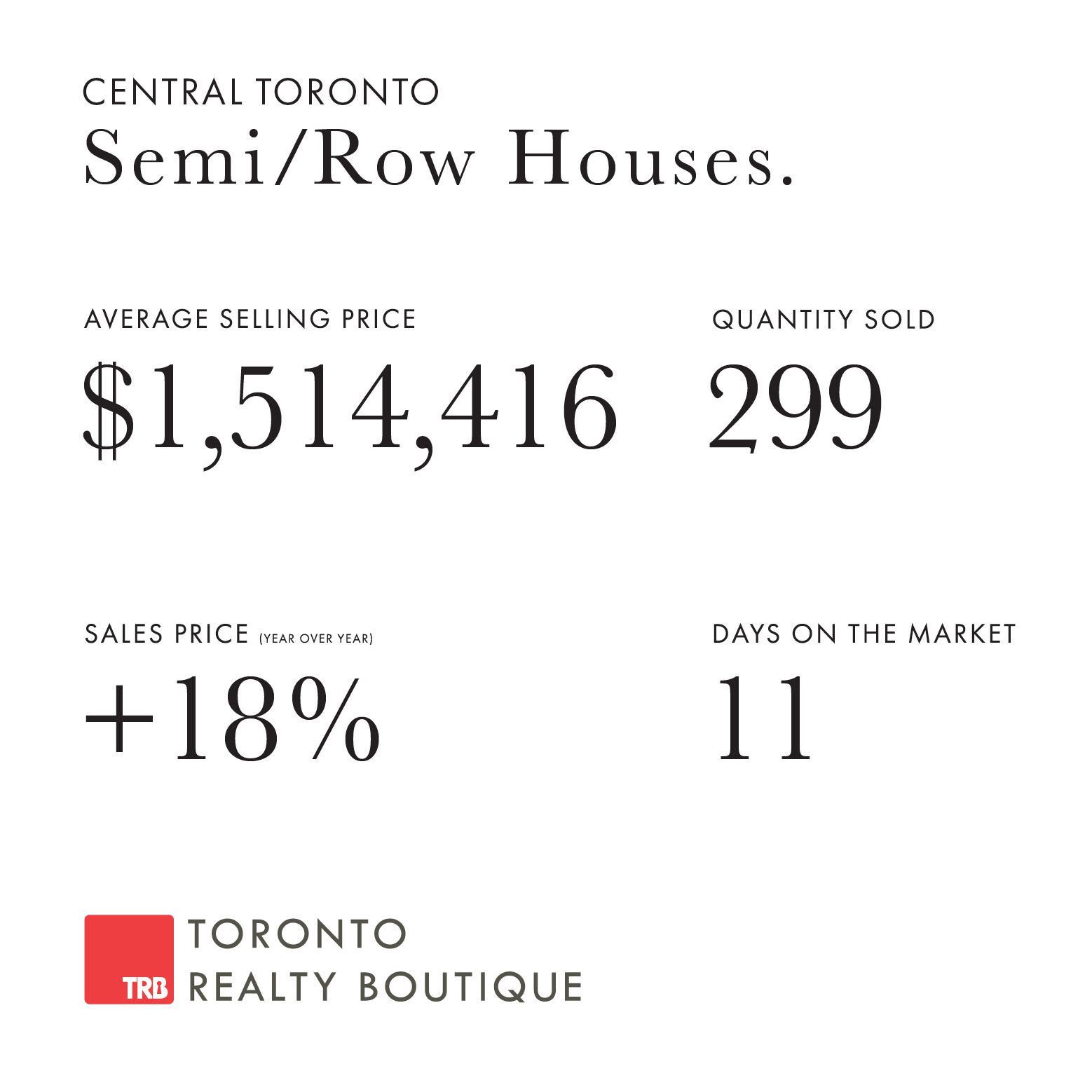

October 2021 Toronto Real Estate Numbers: Semi-Detached & Row Homes

This segment of the market is showing the most growth in year-over-year prices, up 18% over 2020. The month-over-month average price is also up from September 2021, currently sitting at $1,514,416.00. The number of transactions are up over the previous month – 299 from 229) and the days on the market remain stable – at just 11 days.

This segment of the market is showing the most growth in year-over-year prices, up 18% over 2020. The month-over-month average price is also up from September 2021, currently sitting at $1,514,416.00. The number of transactions are up over the previous month – 299 from 229) and the days on the market remain stable – at just 11 days.

This segment of the market more than another is driven by mortgage rates – why you ask? Buyers in this price range are most impacted by any fluctuations in mortgage rates. Their buying power can dramatically change within this segment of the market because traditionally, there is a small range in pricing for semis and row homes.

This is different from the condo market, as there are various sizes of condos, at various price points – the spread is much greater than semis and rowhomes.

This market segment is primed to lead the charge across all markets as the top performer in 2022.

What’s to Come

We’re preparing our 2022 market predictions now so watch for that in the coming weeks. The market is strong for both buyers and sellers and perhaps the best is yet to come.

If you’re thinking about buying and want to know more about specific neighbourhoods and what the numbers really look like, reach out to us. We study the numbers weekly to know exactly what’s going on for our clients who are looking to buy.

Contact Toronto Realty Boutique if you’re interested in learning how our roots in finance can get you exactly what you’re looking for in the Toronto Real Estate market. Simply fill out our form and we’ll be in touch right away.

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.