Wow, do we have some great stuff to discuss this month or what?! I’m sure you’ve seen the real estate headlines, right?

Here are a few that have caught a lot of attention:

Sales and Average Selling Price Increases in October

Toronto’s Housing Market Turns a Corner as Sales Surge

Toronto area Housing Market Ignites with Sales Jumping 44% in October

Toronto Homes Sales Surge 44% in October as Rate Cuts Draw Buyers Back

Whenever I see the media using words like “SURGE” and “IGNITE”, I want to dive into the numbers and see what’s really happening. We’ve got a lot to discuss so let’s jump in.

Interest Rates

I’d be amiss if I didn’t start with the interest rate announcement that took place on Wednesday, October 23rd.

The Bank of Canada lowered its key interest rate to 3.75 percent, making a 50-basis-point cut for the first time since the COVID-19 pandemic.

Before Wednesday, the rate stood at 4.25 percent. Economists were expecting the central bank to go with a larger than usual cut, compared to the 25-basis-point downgrades made in June, July and September.

The last time the bank made a cut this size was on March 27, 2020.

As concerns over inflation have subsided — out-of-control price growth, the catalyst for the central bank’s initial rate-hike campaign, is now back within the target range — the bank has focused on cutting to keep inflation stable and support economic growth, which has been sluggish under the pressure of high rates.

Here’s what the Bank of Canada interest rate announcements have looked like this year so far:

January 24, 2024: Hold

March 6, 2024: Hold

April 10, 2024: Hold

June 5, 2024: Cut – 0.25%

July 24, 2024: Cut – 0.25%

September 4, 2024: Cut – 0.25%

October 23, 2024: Cut – 0.50%

December 11, 2024: TBD

Since the rate announcement was so late in the month, we can credit the influx of activity in the market to the sheer anticipation of one coming. And with another cut of 0.50% expected in December, I have a feeling this simmering pot is going to get boiling faster than we expect.

Toronto Real Estate in October 2024

This is one of the rare times that each market segment shares the same key markers – pricing is up in each segment and quantity sold is up in each segment – way up. Days on the market remain quite high in all segments which shows that buyers are still taking their time, but with the volume of homes and condos sold, we’re slowly approaching that balanced market I talked about last month.

As a reminder, when months of inventory are low (2 or lower), the market is usually in sellers’ territory. When months of inventory are high (4 or higher), the market is generally in buyers’ territory. Months of inventory between 2 and 4 are typically considered “balanced”.

In October, we saw many buyers come off of the sidelines and make strategic buys in each segment. With the almost-guarantee of a major rate cut, and an additional one coming, many buyers made offers with close dates after December 11th (the next rate announcement). By doing this, they’re getting ahead of the pack and securing the home they love, all while taking advantage of a strategic closing date to lock in a lower mortgage rate.

If the anticipation of a rate cut at the end of the month sparked this much activity, I’d be willing to bet that once we see the November numbers, we’ll see the same, if not more in each segment.

I’ve personally experienced this sudden surge in the market with my clients. One who was looking at Mississauga and was interested in a detached home. This home was listed in September for $2.7 Million and sat for six weeks on the market with no interest. The sellers then lowered the price to $2.2 Million, held back offers and ended up selling in multiples for more than the original list price.

And just last week I was out with a client looking at condos, when text after text came in notifying that an offer had been registered on the suite we were looking at. This happened three times, and all three sold at near full-ask pricing.

My condo buyer client said to me “I’ve been watching the market for a while now and I know that inventory isn’t going to get any better. Now is the time to pick a condo I love because pricing is already starting to creep up”.

So needless to say, buyers who were on the sidelines casually looking have been motivated to pull the trigger on homes they love because they’re seeing how quickly things can turn.

October 2024 By The Numbers

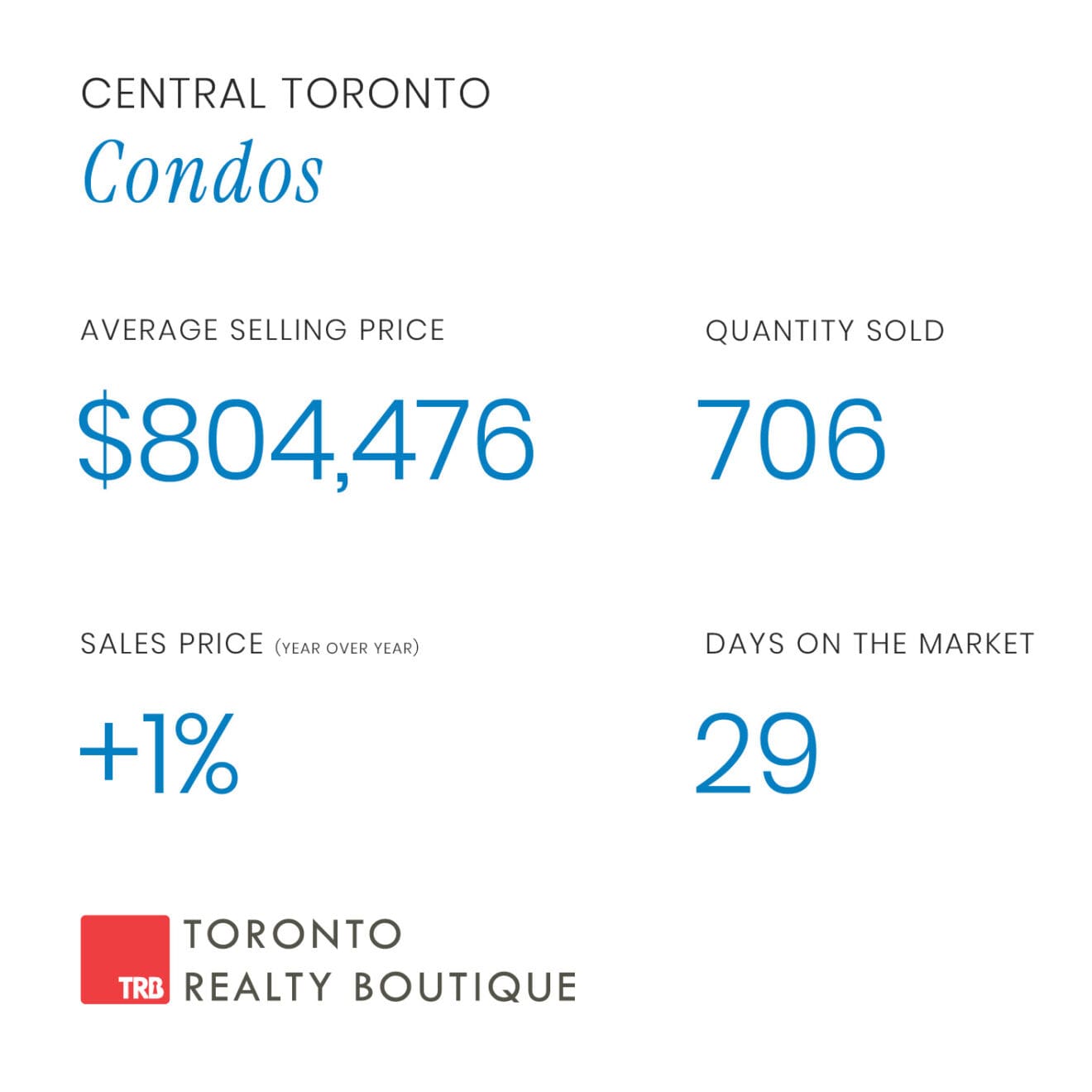

Toronto Condos

Let’s look at some of the important numbers that aren’t typically reported monthly.

New Listings were down year over year in October by 7.9%

The Quantity Sold year over year was up by 34.2%

The average price of a condo year over year was up by 1%

Days on the market, year over year were up from 25 days to 29 days.

Days on the market, month over month were down from 33 to 29 days.

Last month, I mentioned that we were in a very strong buyer’s market as we were sitting on 7.8 months of inventory. But now after the surge of condos sold in October, and how busy the first part of November has been, we’re sitting at 5.3 months of inventory which is a significant drop from September.

So even in the most challenging segment of the market with the most inventory, we’re seeing things pick up and buyers are out in full force.

My advice – if you’re looking to purchase a condo and you’re waiting for the right time, this is it. Inventory levels are coming down, pricing is starting to creep up, and the first condos to get bought up are the most stunning ones. Just like my condo buyer client who’s offer was accepted last night – it’s the best of the best and he’s thrilled we got it for him, for significantly less than the asking price.

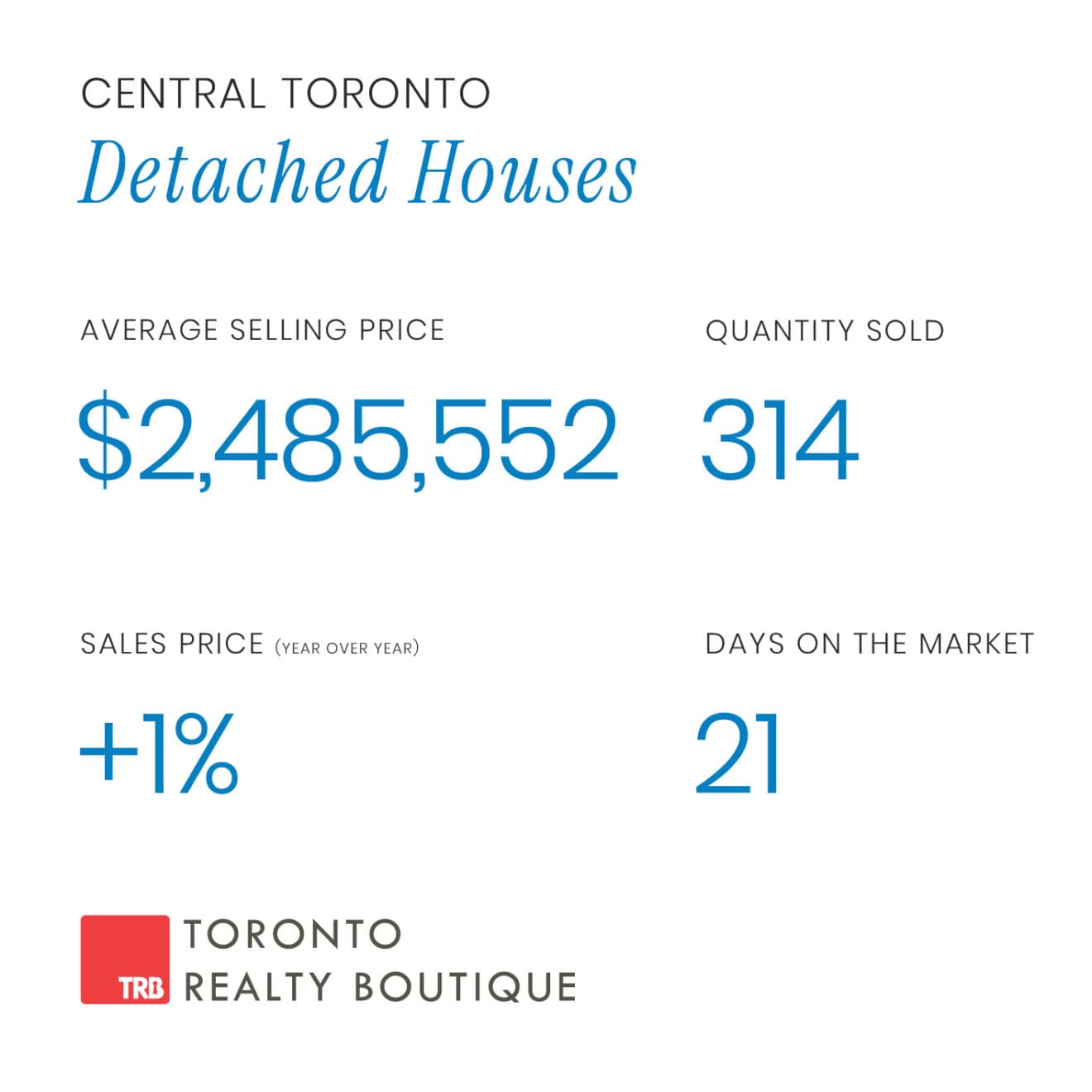

Detached Toronto Homes

New Listings were up year over year in October by 8.5%

The Quantity Sold year over year was up by 58.6%

The average price of a detached home year over year was up by 1%

Days on the market, year over year were up from 18 days to 21 days.

Days on the market, month over month were unchanged at 21 days.

So the big number here that made me look twice was that giant 58.6% increase year over year in quantity sold within this segment.

Traditionally the detached homes segment sees a slowdown come December and January as no one with a family wants to uproot their lives during the holidays. So with timing and interest rate drops matching up, this was the perfect storm for buyers to act within this segment.

More than any other segment, I saw the most casual lookers here. Many were browsing but not ready to make a move. They all saw the inventory on the market was at its prime, and with the latest rate announcement and the looming holidays, buyers were motivated to make a move.

Another interesting point of motivation for buyers here – since January, average pricing in this segment has slowly increased by $300,000.00. So those “waiting it out” realized that they may just be waiting a bit too long.

My advice – anyone that is listed for sale right now as we approach the holidays, is likely motivated to sell. Now is the time, especially with that December 11th rate announcement coming.

If you find a home you love, you’ll be surprised with how flexible sellers will be when it comes to closing date. Why not throw out a January close to see if they’ll work with you? You’ll be home for the holidays (so will they), and you’ll have another 0.50% rate cut upon you before you close.

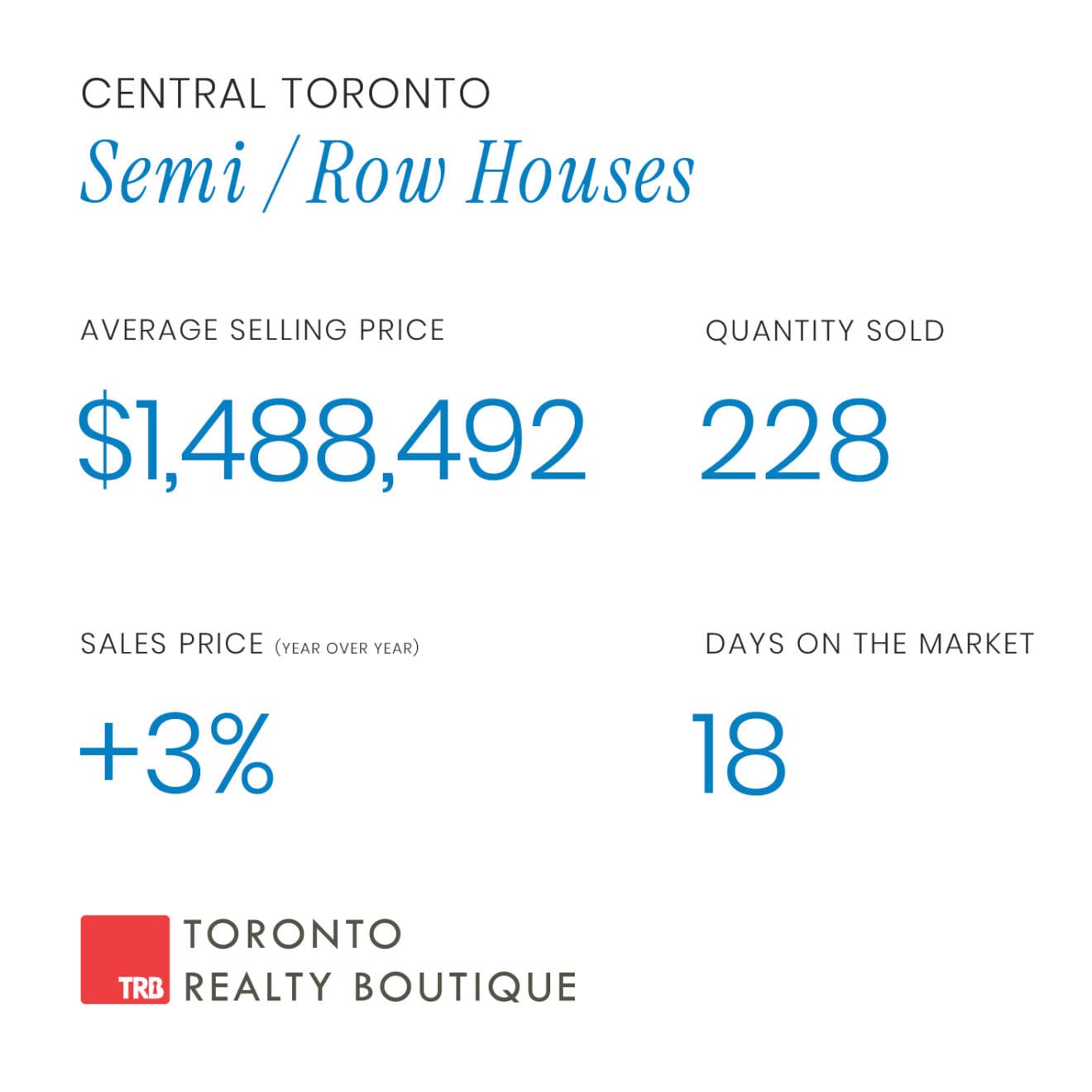

Semi-Detached & Row Homes

New Listings were down year over year in October by 8.9%

The Quantity Sold year over year was up by 32.6%

The average price of a semi/row home year over year was up by 3%

Days on the market, year over year were down from 20 days to 18 days.

Days on the market, month over month were up from 16 to 18.

I predict this segment of the market to really take off over the coming months, and be the first to enter into a seller’s market during the first quarter of 2025.

The perfect storm is brewing and if buyers are out there thinking of getting into the market, they need to be aware of what’s happening. New listings are down, sales are up and rates are coming down. Timing is everything here.

My advice – if you’re a buyer in this segment, I’d get out there sooner than you think. Keep in mind the next rate cut is likely going to happen on December 11th, so my recommendation is to close on your purchase after that time. Get your mortgage broker to work out a couple of scenarios that show you your buying power and what you can afford. This is where you’ll find comfort in making an offer.

Working with TRB

Now besides crunching all of these numbers for my clients – you may or may not know (but hopefully you do) that I help many clients buy and sell real estate daily. I am the Founder and Lead Broker of Toronto Realty Boutique and I specialize in listing homes and condos, representing buyers of all budgets, I also do a lot of work in the Toronto pre-construction market.

You can check out some of my featured listings that are currently active here:

Toronto Realty Boutique Listings – Homes & Condos for Sale

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the October 2024 Toronto real estate numbers you have or about the Toronto market in general.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.