The September 2022 Toronto real estate numbers are in and the interest among my clients about what’s happening in the market is at an all-time high. The headlines are out of control – a quick Google search this morning showed headlines that went from one end of the spectrum to the other.

From “Experts say Toronto’s housing prices will likely climb even more in 2023” to “Real estate observers see rocky road ahead”. No wonder people are confused.

My goal each month is to give my insights based on my 13 years of experience on the ground working in the Toronto market, and my background in finance that helps me analyze the numbers unlike anyone else. I don’t just report them, like many do. I take a deep dive and give you the facts that others are missing. Let’s take a look at September.

The Overall Toronto Market in September

The biggest takeaway from the September 2022 Toronto real estate numbers is that the market is actually more on the slow side, versus being down the 50% that the headlines say. Read that again – the market is SLOW. Is it down? Yes, absolutely and that’s not something I’m going to deny. It’s down slightly year over year from September 2021 to September 2022. But it’s incredibly slow out there.

The number of sold transactions is down 50% across the board and new listings are down 26% year over year. So, what does that mean? The combination of insane headlines, increased interest rates and a generally fearful public have come into play. Sellers are afraid to list and are holding off, and buyers are pausing to wait and see what happens in the market.

But let’s dive a bit deeper into this. Think about it – all of these sellers are holding off on selling – more and more each week. Buyers are fearful to make a move as the “what ifs” are getting the best of them.

What do you think is going to happen here? Ever taken a bottle of champagne that’s been sitting still for months and give it a really good shake? You know what happens – the top pops and you have a massive explosion. Well – this is what’s coming for the Toronto market.

My warning – BUYERS – buy now. Because pretty soon, you’re going to be back to competing bids and huge prices.

I’ve got a great example of how the market is simmering right now, but the pressure is mounting.

I have clients looking for a home in the Christie Pits area – they found a row home they really liked recently and moved to make an offer. This row home has been on the market since very early this year, so many, many months. It needs A LOT of work, which is what they were looking for.

I prepared the offer, submitted it and within the 12-hour irrevocable period, two additional offers were registered. They didn’t go over their budget which I recommended, and we’re submitting on another home, but WOW – what on earth is happening here?!

Nothing for nearly 10 months and bang, three offers in 12 hours. So this tells me that buyers are absolutely buying – they’re just waiting.

Sellers are holding for their fair market price and with the pause that most buyers are taking, I’m standing behind my prediction that this winter will be one of the best times to buy Toronto real estate in recent history.

The Toronto Condo Market: September 2022

Let’s start with the facts and numbers most typically don’t see in the usual market stat reports.

- Number of sold transactions is down 49% year over year

- Number of new listings is down 27% year over year

- Number of days on the market is up by 6 days, year over year

When we look at pricing, prices year over year are basically flat, sitting at an increase of 1%. This shows that although things are slow, prices are still stable in this segment of the market.

When we look at pricing, prices year over year are basically flat, sitting at an increase of 1%. This shows that although things are slow, prices are still stable in this segment of the market.

The main reason we’re not seeing too much change in pricing within the September 2022 Toronto real estate condo market is due to entry-level buyers and investors. Most people that enter the Toronto real estate market for the first time are likely to purchase a condo. It’s the entry-level price point and the cheapest route to entry.

With that said, these buyers are the ones that are competing with the investor buyers who are VERY active right now. They see the huge demand for rentals and the sky-high rents, so they’re taking advantage of the listings out there – usually the smaller one-bedroom suites and studio condos that are in high demand right now among renters.

My advice for buyers: if you’re looking as an end-user, don’t default to the smallest suites – this is where the investor competition will sit. Look at 1-bed + den suites if you can, or even pair up with a friend and look at combining buying power and purchasing a two-bedroom. I’m seeing this quite a bit lately among first-time buyers – you’d normally rent with a roommate so why not buy with one?

Investors – buy quickly. Rents are going to keep going up. The winter intake of international students is coming quickly, and you want to be ready to go as they start looking for suites to rent.

My advice for sellers: Although the headlines are screaming about falling prices, the condo market right now is incredibly stable. Pricing didn’t fall in September so if you’re thinking about listing, now is in fact a great time. This is especially true if you’re looking to upsize into a semi or row home – sell your condo at market pricing and take advantage of the lower pricing in that segment to secure a new home for you and your family. It really is the perfect storm for condo sellers looking to upsize.

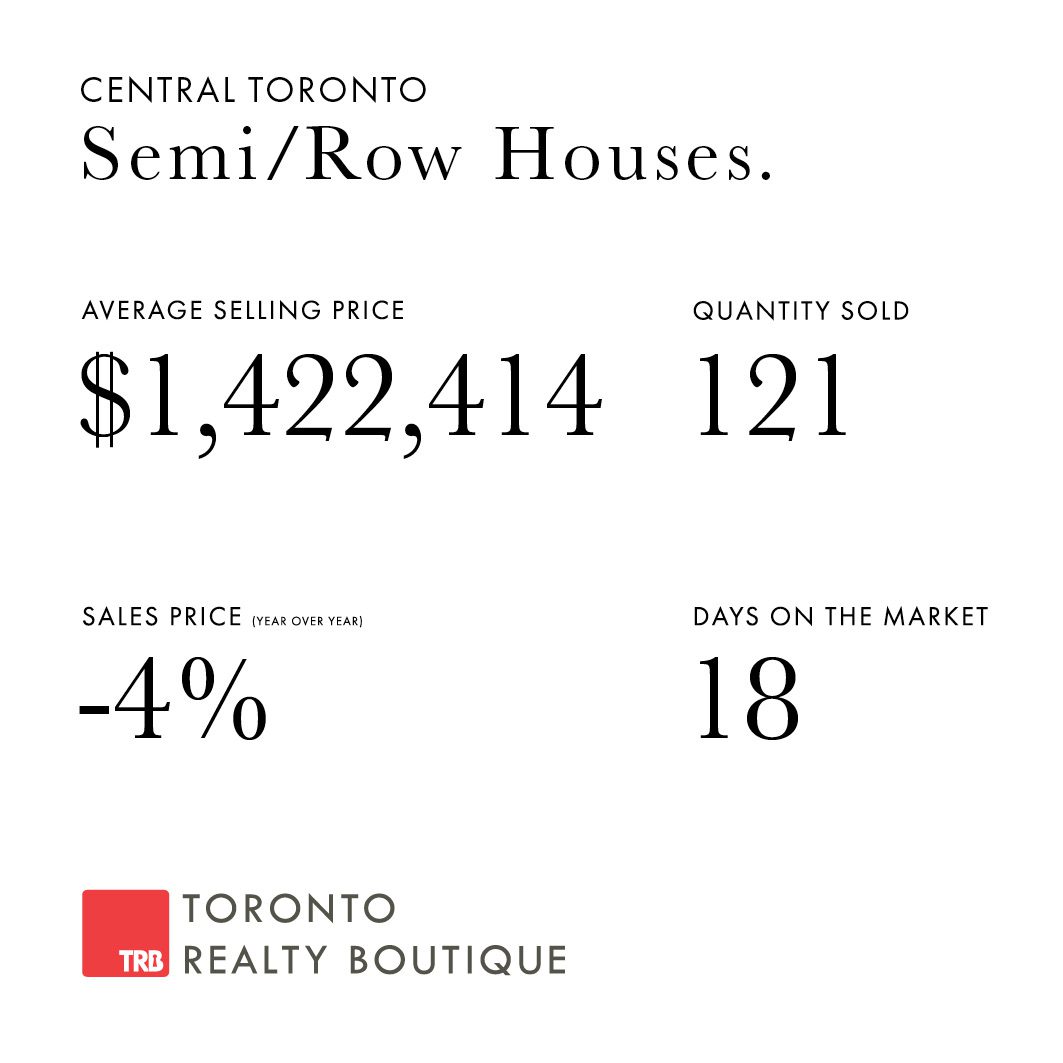

September 2022 Toronto Real Estate Numbers: Semi-Detached & Row Homes

Let’s start with the unseen facts within the semi and row home segment first:

- Number of sold transactions is down 47%

- Number of new listings is down 28%

- Number of days on the market is up 7 days

Looking back at the last few months, we can see that this segment of the market is actually starting to trend upwards. (Note, this is what the month-over-month stats are useful for – examining trends). The semi and row home market is still down but the trend in the numbers is showing some stabilization.

Looking back at the last few months, we can see that this segment of the market is actually starting to trend upwards. (Note, this is what the month-over-month stats are useful for – examining trends). The semi and row home market is still down but the trend in the numbers is showing some stabilization.

I always say, this segment of the market is the first to react to interest rate hikes and changes in the economy, so we tend to see changes here first. Buyers in this segment typically come from the larger condo segment – moving from a condo to a semi is very typical. We’re seeing little movement in the larger condo market – things are taking longer to sell, therefore the buying in the semi market could still be slow because of this.

My advice to buyers: it’s SO important to lock in your pre-approval before the next rate hike because one is most likely coming before the end of the year. I would also say that now is the time to make a move – the month-over-month trends are showing things are picking up (but still down) so over the next few months might just be your best time to buy. Don’t wait until the spring market, whatever you do.

My advice for sellers: Although the semi and row home segment is down, you need to look at the big picture. Don’t get caught up in the what-ifs or what could have been. Look at what you bought for and what you’d sell for today – I’m certain you’re making a very healthy profit, and if you’re upsizing, you’re going to win on the buying side too. Although you’re getting slightly less for your home when you sell than you would have earlier this year, you’re also winning on the buying side by buying for less than what you would have paid earlier this year too.

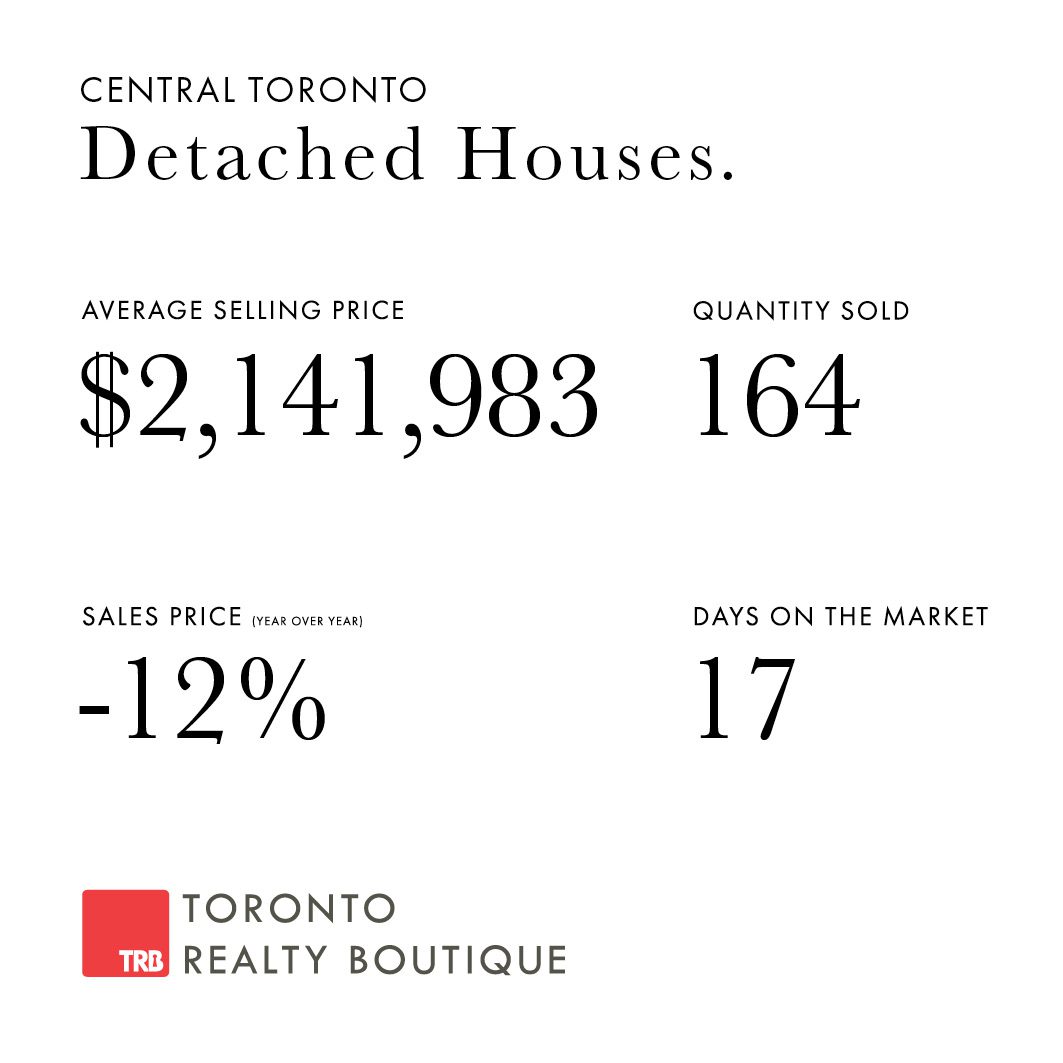

September 2022 Toronto Real Estate Numbers: Detached Homes

Let me start by saying the detached market is always such a roller coaster – mainly due to the wide price range of homes within this market. You have luxury homes priced at $10 Million + but also have detached homes in Toronto sitting at $1.5 Million – that’s a huge range of numbers that tend to skew things one way or the other.

So, with that said, let’s look at the untold story behind the numbers:

- Number of sold transactions is down 46%

- Number of new listings is down 20%

- Days on market is actually down by 1 day

These September 2022 Toronto real estate numbers show that buyers are still very active in this segment and are making moves when they see something they like.

These September 2022 Toronto real estate numbers show that buyers are still very active in this segment and are making moves when they see something they like.

The year-over-year numbers are accurate, but it’s a challenge to digest them at the surface level because of the huge range of prices traded in this segment, as I mentioned above. I prefer to really examine specific neighbourhoods for my clients as opposed to the entire detached market.

One thing I want to point out in this segment is the days on the market for listed homes. That number actually went down in September – this is a good indication that those sellers that are listing their homes are pricing properly, and buyers are noticing that and making moves to purchase.

My advice for buyers: it’s a good market to buy in – look at homes that have been on the market for over the traditional 10-15 day period and look into the history of the listings to see how many times it has been de-listed and re-listed. Also, look at the price changes to check the motivation of the seller before making your offer.

My advice for sellers: Price your home properly, at market value if you’re looking to make a solid sale. This is not the time for lofty sky-high pricing or to price low and hold back offers. This is not the market for that and the buyers that are out there will be turned off by this tactic.

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch with you right away. I’d be happy to answer any questions about the September 2022 Toronto real estate numbers you have or about the Toronto market in general and share my insights on what’s to come later this year.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.