April 2024 Toronto Real Estate Market Update

The April 2024 Toronto real estate market stats are in and as always, I’ve taken a deep dive into what they really mean so I can share these insights with my clients.

Real Estate is a hot topic today and there are plenty of misleading headlines out there – especially around the market stats. I’ve been catching up on social media as well, and I’ve seen every interpretation of the numbers possible, from one end of the spectrum to the other.

So, I’m here to give you some context about what the facts really mean.

Interest Rates & Inflation

First, let’s start with Interest Rates. May is an off month for Rate announcements from the Bank of Canada, and the next scheduled meeting is for Wednesday, June 5th. So, what do you think will happen?

I feel like the industry is pretty split right now – half think we’ll see our first cut and half are predicting another hold. I’m going to place my bet on another hold announcement, and here’s why.

June is still too early in my opinion. If the current market is any prediction of what’s to come when they cut rates, things are going to get pretty wild. Some market segments are already there – more on that later…

During June, many are still in the city and not focused on the Summer holidays. The important reason is I feel like the Bank of Canada is going to pick a traditionally slow month for real estate to test their first rate cut. It’s going to be July or August as many are away for school holidays and it’s not that busy of a season for buying and selling.

But let’s see what June brings and what the language will be around the Bank of Canada’s thinking. Either way, June will be a busy month – just how busy is what we’ll have to wait and find out.

Now regarding Inflation – that’s the one piece of news I was waiting on in order to do my analysis. I wanted to put some details around the inflation numbers and what that means.

Canada’s annual inflation rate slowed to a three-year low of 2.7 percent in April, matching expectations, and core measures continued to ease, likely boosting chances of an interest rate cut early this summer.

The cooling inflation rate should be an indicator to buyers in the real estate market that the power position they are currently in is soon coming to an end.

Toronto Real Estate Market

If you’re looking for market stat highlights, I want to start with that before getting into my own experience with buyers and sellers right now in the market.

Key April Takeaways – Pricing in each segment is nearly flat (-1% / +1%) – We’re seeing two different types of market – the condo segment is behaving in one way, while the semi and detached markets are behaving oppositely. This is pretty unique, and I’ll dive into that in a moment. – A staggering stat that I found today – there are 1000 MORE condo listings in April 2024 than in April 2023. I’ll look at what’s driving that below.

Toronto Condos

Let’s get right into the Condo segment because that stat above made me look twice.

New listings are up year-over-year by 66%

New listings are up year-over-year by 66%

Quantity sold is down year-over-year by 8.7%

Pricing is up 1% year-over-year AND month-over-month

Days on the market are up from 17 days to 25 days year-over-year

Days on the market are up from 21 days to 25 days month-over-month

I’m working with several buyers at the moment and I can attest to the fact that they are indeed in the driver’s seat. There are so many options to choose from and there is no pressure to jump to an offer within a day or two of listing.

So why are there so many listings within this segment? I’ll get to the semi and detached market in a bit, but what I’m seeing from many sellers is they want to take advantage of this buyer’s market and move from a condo into a semi or a detached home. So, to do so, they need to sell their condo first. A major influx of listings is correlated to this fact.

So, what’s actually selling? The stand-out condos that are priced well – those are the ones that are moving.

I had a listing at 125 Western Battery Road that was a beautiful 1-bedroom + den, 2-bathroom condo with parking, locker and great views. It was listed for $749,900.00. We had 17 showings, and within 13 days we had negotiated a solid offer that my client accepted.

125 Western Battery Road Listing

This proves our strategy right – fresh paint, exceptional staging and a targeted marketing campaign can get the job done, and less than half the average condo sale time.

But back to the stats – with the quantity sold down, new listings up, and days on the market up, one would expect to see pricing going down. But what we’re actually seeing in the condo segment, is that there has been little to no change in the average pricing thus far in 2024, over 2023.

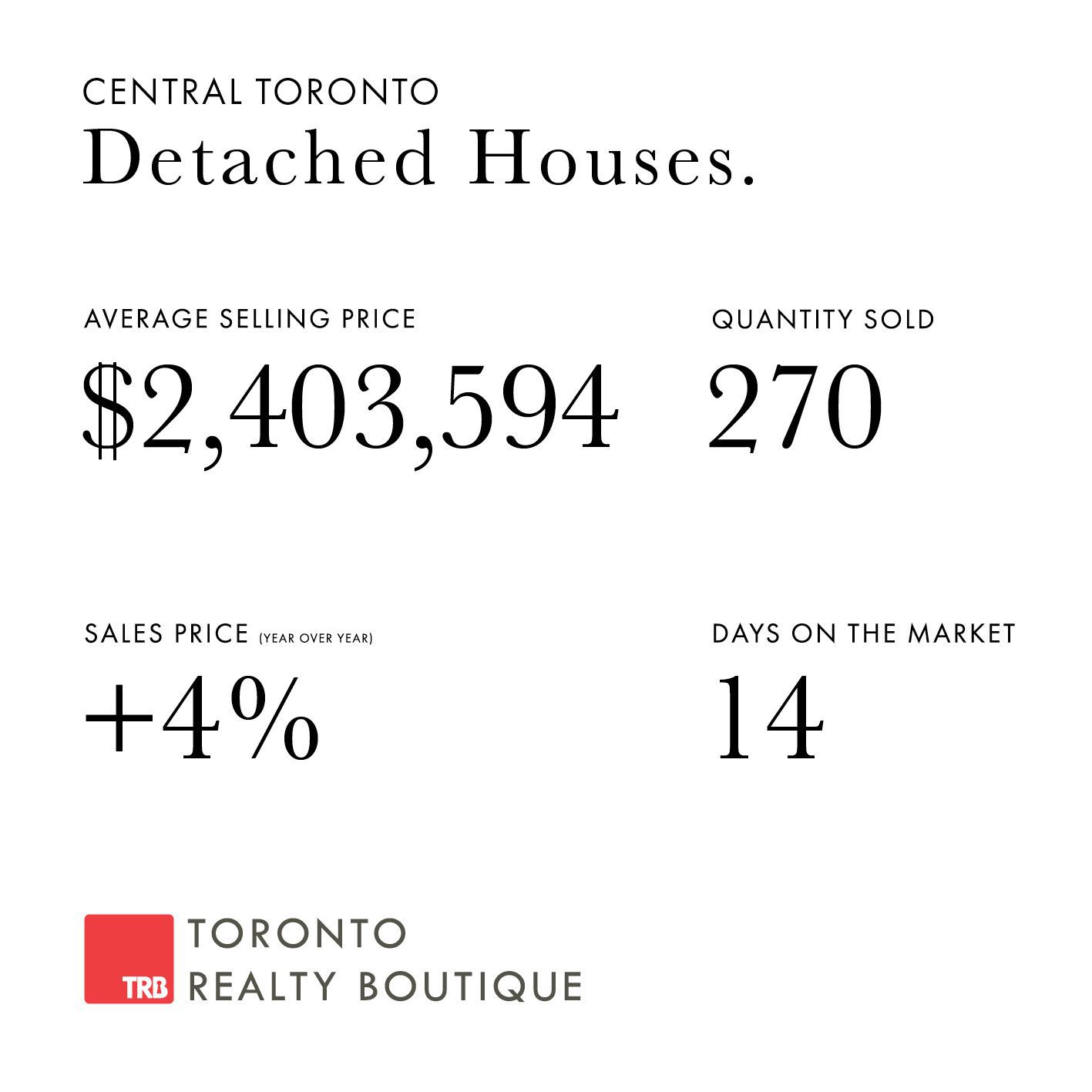

Detached Homes

New listings are up year-over-year by 31.5%

New listings are up year-over-year by 31.5%

Quantity sold is down year-over-year by 0.7%

Pricing is up 4% year-over-year and 10% month-over-month

Days on the market are down from 15 days to 14 days year-over-year

Days on the market are up from 12 days to 14 days month-over-month

The detached homes segment is always a good one to watch to help predict trends in what’s to come in the next few months.

From the numbers above we can see that new listings are up but pricing is also up. This means that although there is an influx of new homes for sale, buyers are seeing that this is their chance to get into the home they want, now.

More proof of this is that home prices are up both year over year and month over month, with the bigger number being 10% higher than last month in this segment.

We have to step back and remember this time last year when inventory numbers so were incredibly low because everyone was in their wait-and-see phase. Those types of moments don’t typically last very long so just one year later we’re in this market where there are SO many listings. But where are the buyers? They are around but they’re not succumbing to any pressure at all and are taking advantage of the buyer’s market that we’re currently in.

Semi-Detached & Row Homes

New listings are up year-over-year by 52.8%

New listings are up year-over-year by 52.8%

Quantity sold is up year-over-year by 16.2%

Pricing is down 1% year-over-year and 3.2% month-over-month

Days on the market are up from 11 days to 12 days year-over-year

Days on the market are down from 16 days to 12 days month-over-month

Let’s start with the highest number mentioned above and that’s the number of new listings year over year, being up over 52%. Several factors come into play for this stat, but again, I’m going to look back at this time last year when no one was selling.

Also, seasonality comes into play here with the Spring market. It’s traditionally the time to list and we’re seeing a good year or two of pent-up waiting that’s coming into play.

But I also think that many semi-owners are seeing the huge opportunity that’s in front of them that’s shortly coming to an end. This is the time – it’s a buyer’s market so why not take advantage?

I have several clients who are in this exact situation – they’ve been considering moving for a little while, but know that if they don’t take advantage of this buyer’s market that we’re currently in, they may miss the boat.

Another item in this trifecta of the current market is the pricing that just keeps pushing upwards at a steady pace month over month. They’re seeing this trend and know that timing is everything when it comes to maximizing both sides of the buy and sell.

I always say this segment is the first to react to any major movements and we’re seeing that yet again here.

Advice for Buyers & Sellers

If I could scream this from the rooftops I would and I’m going to say it again – now is the time to buy. I promise. It’s getting close to a Bank of Canada rate announcement of a cut and the moment that happens, the numbers we’ll see will be unlike anything we’ve seen in quite some time.

Don’t approach this in the wrong way – think about what you’re going to save on the buy because we all know that’s where you make your money.

Take advantage of the negotiating power you have now as a buyer and don’t think about the small amount of money you’ll lose out on with the sell. Think about getting into your dream home in your dream neighbourhood without pressure.

Now the condo market will have some extra time on this, simply due to the nature of the quantity of condos in Toronto that trade. But again, the clock is ticking so don’t have regret later this year – be happy in your new home and sit back and watch your equity build. There is no better situation than that.

Working with TRB

Now besides crunching all of these numbers for my clients – you may or may not know (but hopefully you do) that I help many clients buy and sell real estate daily. I am the Founder and Lead Broker of Toronto Realty Boutique and I specialize in listing homes and condos, representing buyers of all budgets, I also do a lot of work in the Toronto pre-construction market.

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the April 2024 Toronto real estate numbers you have or about the Toronto market in general.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240

TRB Education Hub

Get the real estate resources you need to succeed. Visit our education hub for market insights, guides, podcasts and more.