The September 2023 Toronto real estate market stats are in! And you might have been wondering why it has taken me so long to post my analysis. And I admit I’m late for two big reasons.

First, things are BUSY in the market. The pre-construction condo market is crazy right now and that added on top of my amazing buyers in the resale market and some incredible listings, I’m thankful to say things are definitely moving.

You can check out my latest listing in Toronto’s Danforth Village here:

483 Milverton Blvd

But I also wanted to wait because of the interest rate announcement that came out just this morning. So, let’s jump into that first.

October Interest Rate Announcement

It was announced this morning that the Bank of Canada has held rates this month – no increase, which shouldn’t come as a surprise to anyone. This has been predicted by all of the major banks, so today’s news was a confirmation of what many suspected.

All of the measures that the government is putting into place are working, and that’s essentially the reason behind the hold. Inflation numbers were down this month to 3.8%, and although last month there was a slight increase, once we all saw the latest report, I think the collective sigh of relief was heard.

This past month, I’ve been attending several pre-construction project presentations that included some very interesting information from the top banks in the nation. And there is one slide from all of these meetings that stuck out to me, and I wanted to share it with you.

If you look at the chart below from TD Bank, they are projecting interest rates to be sitting around 2.25% by 2025.

TD Bank’s Long-Term Economic Forecast states:

“The BoC is expected to hike again in Q3-2023 and keep the policy rate at 5% through Q1-2024. At that point, we believe the deceleration in economic growth and downward path of inflation will allow the central bank to start to cut its policy rate, reaching 2.25% by 2025.”

I’ve had countless conversations about the buying strategy as it pertains to interest rates, and I stand behind the fact that buying in the coming months is the better of the two choices, versus waiting until rates come down. And here’s why…

My advice to buyers right now is to get into the market. Focus on your monthly payment and not the rate. There is so much inventory available in the market and the homes out there are amazing and in the top neighbourhoods in the city. Also remember, right now there is very little competition out there – no bidding wars driving prices unnecessarily high. These types of opportunities don’t come around too often.

Rather than following the heard saying rates are too high right now to buy, look at your individual situation and assess what you can afford monthly. A good financial deep dive will help you immensely.

Now let’s get into each of the market segments to review what was happening in September.

The Overall September Market

The traditional September market is known as the start of the fall selling season, which is usually just as busy as the Spring market. When we look at what’s happening in each segment, we see that listings are at near historic levels.

The quantity of homes for sale is through the roof and let me tell you, there are some pretty incredible homes in the absolute best Toronto neighbourhoods for sale. Days on the market are holding steady or in some cases actually dropping, so there is definitely activity – people are buying and taking advantage of the inventory out there.

So, the market hasn’t stalled and there definitely are not fire sales. People are starting to act rather than wait and see, so it will be interesting to see what happens with the October numbers, after the rate announcement today.

September 2023 Toronto Real Estate: Detached Homes

Let’s start with some of the key numbers I look at in my monthly analysis.

Year over year New listings: up 43.7%

Year over year Sold Quantity: up 6.1%

Year over year Pricing: up 10%

Days on the market: down to 15 days from 17 days

Month-over-month prices are up 5.7%

The first thing to note is obvious – this segment has seen historical levels of new listings, but prices are holding and actually going up both year over year and month over month.

Although supply is clearly outpacing demand, sellers are still getting their price and buyers are making moves, as the quantity sold is up and days on the market are down.

This is a great opportunity for buyers for many reasons. – Plenty of inventory to look at – Pricing stability, showing their purchase is secure – Homes are appraising for correct market value, showing less risk than in a crazed bidding war market.

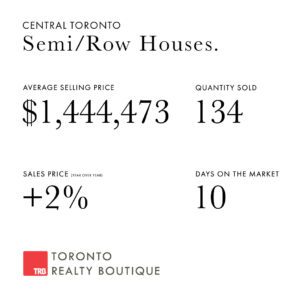

September 2023 Toronto Real Estate: Semi-Detached and Row Homes

Year over year New Listings: up 47%

Year over year Sold quantity: up 10.7%

Year over year Pricing: up 2%

Days on the market: down to 10 days from 18 days

Month-over-month prices are up 1.9%

This segment is showing stability in its pricing as they are up 2% year over year and also up month over month by 1.9%.

This segment is showing stability in its pricing as they are up 2% year over year and also up month over month by 1.9%.

As I’ve said in the past, this segment is the most rate sensitive and rates holding again this month will not necessarily give this segment a huge jump, but it will build further confidence in the market and continue to show stability.

Buyers who are looking in this segment and know that this short-term pain of high rates is almost over are those who are going to see the biggest returns.

When all signs indicate that rates will start to come down, prices and activity within this segment are going to jump up very quickly.

Buyers sitting on the fence here with the let’s wait to see attitude will be caught off guard as bidding wars suddenly come back and prices start to move and move quickly.

Toronto Condos

Year over year New listings: up 52.3%

Year over year Sold quantity: down 6.5%

Year over year Price change: down 7%

Days on the market: unchanged at 23 days

Month-over-month prices are up 0.6%

The condo market is quite an interesting one this month. With the giant spike in new listings, it would be a challenge to think the quantity sold would match.

The condo market is quite an interesting one this month. With the giant spike in new listings, it would be a challenge to think the quantity sold would match.

There is a huge number of condos on the market and the reason could be twofold. From the conversations I’ve had with colleagues, brokers and condo owners, many of them are looking to sell so they can get into a bigger condo, a semi or even a detached home.

Several of the sellers need to sell in order to make that move so they have listed with the sole intention to sell and not to just test the market.

This is an amazing opportunity for buyers (especially first-time buyers) as not only has the number of options increased but sellers are motivated. Sellers see the huge opportunity in front of them to move up and buy for a lot less than they will in a year from now.

Pre-Construction Market

I wanted to touch on the pre-construction market for a moment as it’s been a very busy one over the past month.

Two projects I’ve been working on have launched, and both were an absolutely incredible success. I’ve had many clients purchase at Q Tower, the new condo development by Lifetime and Diamond Corp in the Harbourfront neighbourhood. This building is perfect for both end users and investors as it’s the final piece of property to be developed in this hugely popular neighbourhood.

You can check out the project brochure, renderings, floor plans and pricing here in my client portal: Q Tower VIP Client Portal

Bellwoods House by Republic Developments is another pre-construction project that launched recently with major success. I also had many clients purchase here as the appeal of a boutique building in the Trinity-Bellwoods neighbourhood made this a very high-demand buy.

You can check out the project details, including pricing, floor plans and brochure here in my client portal: Bellwoods House VIP Client Portal

Many shy away from pre-construction, but right now is the absolute best time to be looking into this option. Deposit structures are spread out by years, not months, and by locking in a suite now, you’ll be able to take advantage of low interest rates when it comes time to close.

If you’re considering pre-construction, my advice would be to work with an expert who has deep knowledge of the backers behind the project, the neighbourhood and the financial projections – these are the three key pillars that I base all of my pre-construction recommendations on for my clients.

If you’re thinking about buying, selling, or investing and want to discuss strategies, pricing, timing, or anything else, simply complete my form on this page so I can get in touch right away. I’d be happy to answer any questions about the September 2023 Toronto real estate numbers you have or about the Toronto market in general.

~Romey Halabi

Founder & Lead Broker, Toronto Realty Boutique

416-999-1240