Bank of Canada Rate Hike to 2.5% — Here’s What It Means for You: The Bank of Canada has raised its benchmark interest rate by the largest amount in more than 20 years, sharply increasing the cost of borrowing in an attempt to rein in runaway inflation.

Canada’s central bank raised its benchmark interest rate Wednesday by a full percentage point to 2.5 percent. That’s the biggest one-time increase in the bank’s rate since 1998.

The bank’s rate impacts the rate that Canadians get from their lenders on things like mortgages and lines of credit.

All things being equal, a central bank cuts the lending rate when it wants to stimulate the economy by encouraging people to borrow and invest. It raises rates when it wants to cool down an overheated economy.

After slashing its rate to record lows at the start of the pandemic, the bank has now raised its rate four times since March as part of an aggressive campaign to fight inflation, which has risen to its highest level in 40 years.

Economists had been expecting the bank to raise its rate by three-quarters of a percentage point, but the full percentage point increase was ahead of even those high expectations. And even after this record-setting increase, more hikes are expected, because of how serious the spectre of stubbornly high inflation is.

Bank of Canada governor Tiff Macklem said the bank made the decision to front-load its rate-hiking campaign because Canadians “are getting more worried that high inflation is here to stay. We cannot let that happen.”

Large Rate Hike Warranted Economist Says

Economist Stephen Gordon with the University of Laval says it’s clear the bank has miscalculated the speed with which inflation was going to heat up, and are now trying to course correct on the fly.

“They’re paying a bit of a catch up here, and that’s partly why they’re going up so fast,” he said in an interview.

While the size of the hike was outside the norm, he says it was warranted given the unprecedented challenges facing the economy today.

“We’re in a situation where we have supply chain disruptions, really high oil prices, pent-up demand coming out of the pandemic,” he said.

“We’re in new territory here, so there’s very little to guide us in the way of history. We’re just going to have to feel the way forward.”

Rate Hikes & The Real Estate Market

The impact of higher rates will be felt most directly on the housing market, as variable rate mortgages are closely tied to the central bank’s rate.

Canada’s housing market was red hot for most of the pandemic, as record low rates fuelled demand and pushed prices up to their highest levels ever. But that direction turned in the first part of this year, as the central bank’s signal that higher rates were coming took the wind out of the sails of insatiable demand.

Average prices have fallen since March across the country, the Canadian Real Estate Association says. Wednesday’s rate hike will do nothing to reverse that trend.

Prospective home buyers must have their finances stress tested to ensure that they can withstand higher lending rates, and Wednesday’s rate hike will raise that testing bar to about seven percent for fixed-rate loans, and six percent for variable loans.

If borrowers don’t pass the stress test, lenders are obligated to lower the amount they will lend to them, until they meet the bar.

Anyone who currently has a variable rate loan — and anyone looking to get one in order to buy — will likely notice their mortgage rates go up almost immediately.

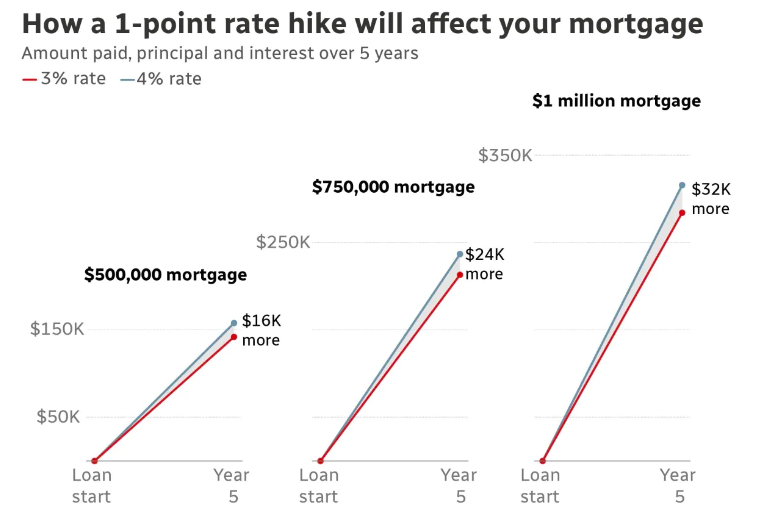

On a $400,000 mortgage amortized for the normal time frame of 25 years, a borrower who signs up for a loan at a three percent rate will pay $1,893 a month. But if their rate jumps by a full percentage point, the way the bank’s rate just did, that monthly payment will go up to $2,104 a month. That’s an extra $211 every month out of their budget.

If the rate goes to five percent, the monthly payment jumps to $2,326, which would be more than 22 percent higher than what they were originally paying.

TRB’s Advice for Buyers

If you’re debating between buying now or waiting, we have some advice for you. Although rates have gone up, now is still the time to buy, especially in the Toronto market. Year over year, the cost of housing continues to rise. That will be the case in this particular market for many years to come. So while you think waiting might be the answer, it’s simply not the right answer.

Get into the market now. Even if your budget is slightly less than it was before, you’ll still get further ahead by buying today. Plain and simple. Get into a home now, and in five years when you want to sell, you’ll see that you’ve made much more money through appreciation than you thought possible.

Real Estate isn’t like the stock market where you buy and sell day after day. It’s a long-term game that you can win just by getting into it now.

If you’re looking for help from an experienced broker, get in touch with Romey today – call or text anytime – 416.999.1240, or complete our form on this page and we’ll be in touch right away.